QuasarDB, a real-time data platform for the financial markets, secured a $2.5m Seed round led by Partech Ventures.

The company is an online database that helps analysts interact with financial market data. The platform empowers back testing, fraud detection, predictive maintenance projects and compliance for CVA, MiFID II/MIFIR, FRTB.

Last year, major Wall Street firms started beta-testing the Quasar platform, according to the company.

Capital from the round will be used to expand its commercial footprint and marketing across the US.

This new round brings the company total funding efforts to $3.5m, having previously received an investment led by NewFund Capital.

QuasarDB CEO and founder Edouard Alligand said, “Because QuasarDB’s database technology is optimized both for mass and speed, our financial customers can increase the depth of their analyses thus their accuracies without compromising on speed.

“In addition to the launch of ‘Prisma Compliance’ a QuasarDB-powered product offered by Orolia to address the MiFID II data reporting regulation, I believe we are in a great position to penetrate the US market.”

Late last year, Partech Ventures took part in the ?10m Series A funding round of TheGuarantors, which helps renters to get accommodation by serving as their guarantor. The firm also led the $16m Series A in to data privacy platform Privitar. The company software makes sensitive data available for analytics and machine learning.

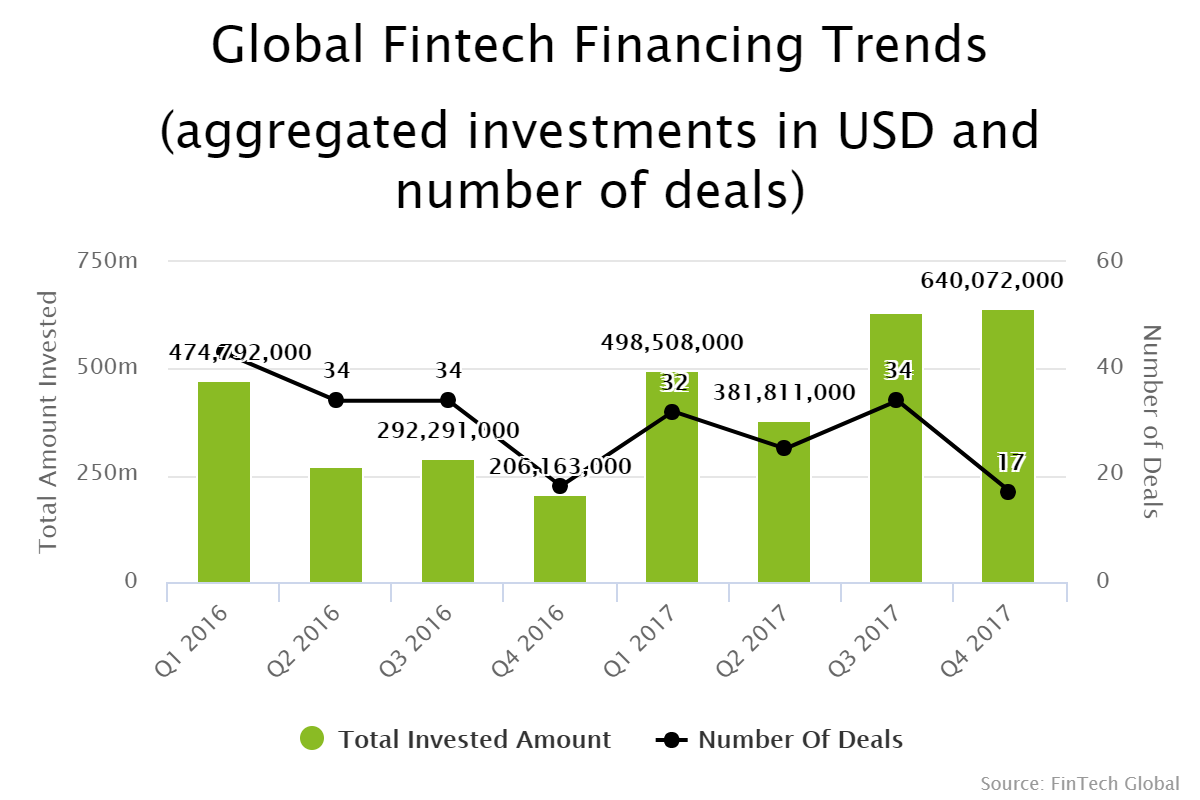

The data and analytics sector saw almost $1bn more deployed to startups last year, compared to 2016. Across 2017, there was $2.1bn invested into the data and analytics space, while 2016 saw just $1.2bn deployed.

Copyright ? 2018 FinTech Global

Copyright ? 2018 FinTech Global