Singapore-based Bluzelle has closed a $1m investment round from Chinese blockchain platform NEO Global Capital.

This funding round comes just weeks after it closed an ICO on $19.5m through the sale of 33 per cent of its total token pool. Around 55 per cent of the proceeds from the crowdsale will be put towards research and development efforts.

Singapore-based Bluezelle is a decentralised database that helps software developers get access to cheaper methods for storing data. The platform uses tokens to hire out storage space on an individual’s computer.

Bluezelle is helping developers to build apps on the blockchain, using multiple storage nodes to remove single point failures and increasing performance through dynamic node monitoring. The platform also uses algorithms to store data in a way without the need of data centres, removing scalability limits.

The company has provided blockchain technology products for companies including Microsoft, HSBC, KPMG, BT, ZagBank, OCBC and matchmove, among others.

Bluzelle CEO and co-founder Pavel Bains said, “NEO has a bold vision to accelerate the adoption of blockchain in Asia, and is working closely with both industry and regulatory bodies to make it a commercial reality. We’re thrilled to have the opportunity to work more closely with them to significantly advance the progress of blockchain in Asia.”

Bluezelle has been forming a range of global partnerships to support expansion, including Japanese Global Brain, Korean Hashed, UK-based Kryptonite 1, and Europe-based True Global Ventures.

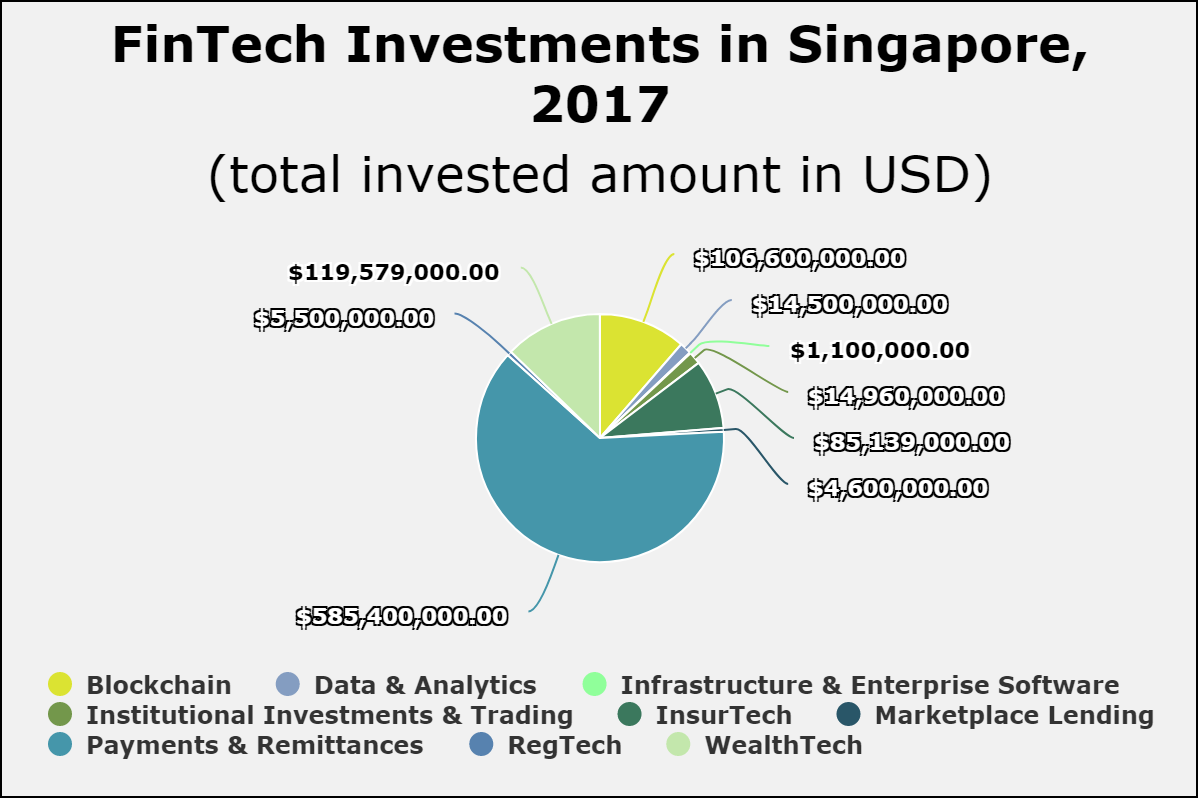

Last year, Singapore’s FinTech sector was dominated by the payments and remittances sector, with it pulling in 57 per cent of the total investment, according to data by FinTech Global.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global