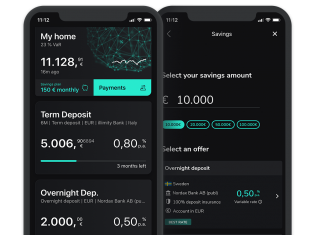

Online savings marketplace Raisin UK has formed a partnership with Starling Bank to improve customer experiences and access to better interest rates.

Through the strategic partnership, Raisin UK will access Starling’s account opening and transaction processing API infrastructure. This will enable the company to build new solutions – access to the services will become available in September.

In the future, Starling customers will be able to take advantage of deals offered by partner banks of Raisin UK, all through Starling’s own marketplace.

Raisin UK is the British division of the Raisin, which was initially established in Berlin in 2013. The UK unit was launched earlier in the year to provide a simplified solution for finding, purchasing and managing an array of saving products offered by its partner banks.

The company has formed partnerships with five banks, and hopes to expand its partner bank network further. Alongside this, it is looking to offer consumers a broader selection of saving products.

Starling Bank CEO Anne Boden said, “Our Banking as a Platform proposition has been designed and built to provide a new way to deliver bank accounts and access to payments. Our first client, Raisin, a disruptor in the European savings market, utilises our service bank accounts and payment processing capabilities.”

Over the past month, Starling has been working actively within the open banking environment. The bank recently partnered with personal finance app Money Dashboard, which will enable users of both platforms to connect their accounts and better manage their finances and saving.

Last month, Starling also partnered with chatbot solution Plum in order to give its own customers access to the robo-advisor service.

Copyright © 2018 FinTech Global