Singapore-headquartered small business funding platform Aspire has reportedly netted $9m in new funding.

The capital injection received commitments from Insignia Ventures Partners, Mark 2 Capital, Hummingbird Ventures and Y Combinator, according to a report be Deal Street Asia.

Founded in January 2018, Aspire supports businesses with quick access to cash by approving requested loans in two hours and deploying the funds the next day.

Businesses can take out unsecured, secured and industry-specific loans. These include, business lines of credit, inventory loans, e-commerce seller financing, working capital loans, restaurant loans, merchant cash advance, and factoring, among others.

Loans can be taken out on 12-week or 24-week terms. Aspire currently supports Citi, HSBC, Maybank, DBS, OCBC and UOB.

Earlier in the week, fellow Singapore-based company Anchanto raised $4m for its Series C, which it is still in the process of raising. The company is a SaaS technology developer which connects e-commerce sellers, brands, retailers, and warehousing service providers.

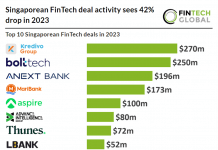

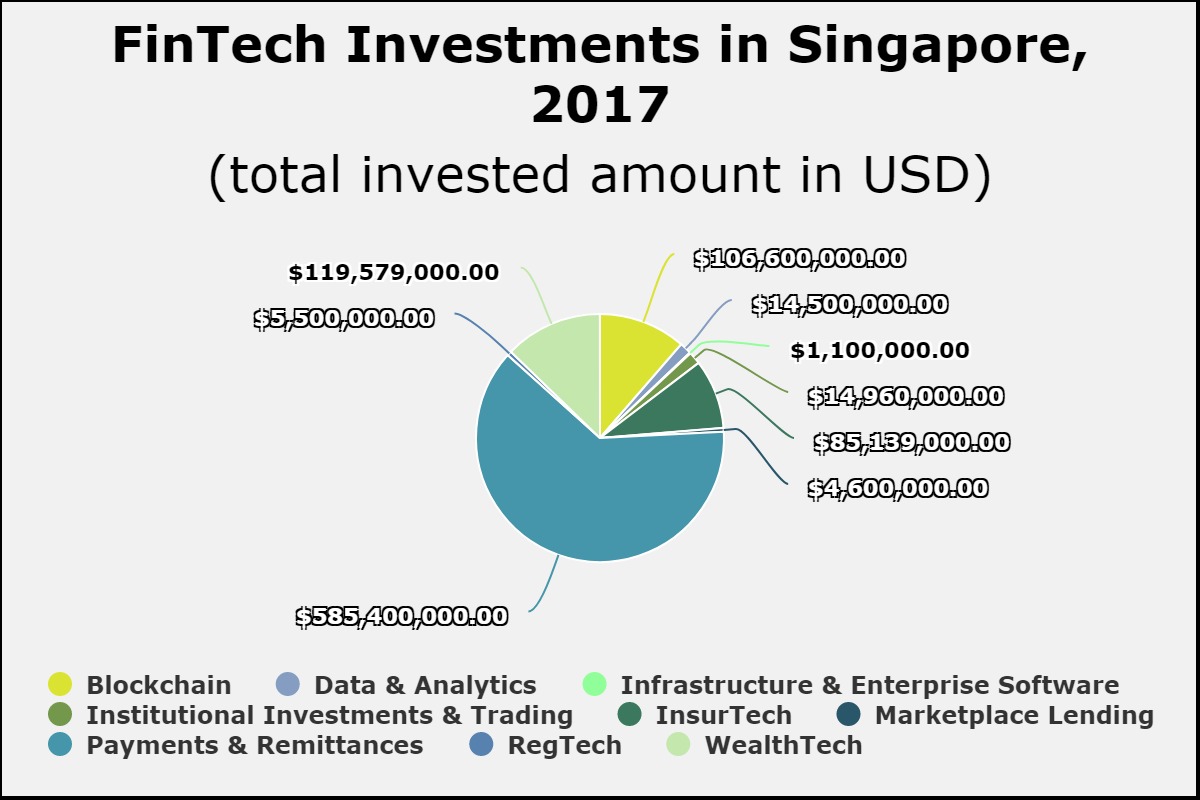

Singapore’s FinTech sector was dominated by the payments and remittances spaces last year. According to data by FinTech Global, of the $933m that was deployed to the country, 63 per cent was invested into companies working in the payments space.

Earlier in the month, Mahindra & Mahindra Financial Services raised $100m in funding from IFC, to support the deployment of more loans. The company supports rural and semi-urban SMEs which have difficulty accessing traditional financing.

Earlier in the month, Mahindra & Mahindra Financial Services raised $100m in funding from IFC, to support the deployment of more loans. The company supports rural and semi-urban SMEs which have difficulty accessing traditional financing.

Copyright © 2018 FinTech Global