US-based e-commerce security and website performance company NS8 has closed a $28m funding round which was led by Edison Partners.

Funds from the round will be used to accelerate product development and its go-to-market expansion.

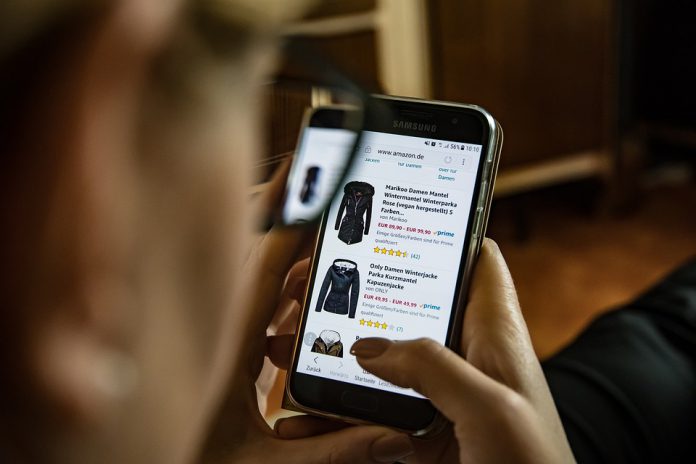

Incidents of e-commerce fraud are reportedly doubling, and merchants lose an average of 7.5 per cent of annual revenues as a result of these attacks, a study from Experian claims. NS8 offers behavioural analytics and real-time scoring to offer companies revenue protection to combat order fraud, advertising fraud, and poor site performance.

NS8 helps merchants to implement abuse, fraud, and experience protection tools. Through behavioural analytics, real-time user scoring and global monitoring, companies can tackle different types of fraud from a single solution.

Its services are used by over 2,400 mid-market and enterprise companies in more than 50 countries. Usage was up by 400 per cent in 2018, and revenues increased five-fold.

The company’s flagship product, NS8 Protect, tracks more than 170 different attributes and enables merchants to establish their own customised order rules to avoid declining real customers. Being an API solution, clients can easily integrate the solution with their existing systems.

NS8 CEO Adam Rogas said, “Simple fraud prevention tools do not always protect merchants from the threats they see on a regular basis, and the genesis of our platform is our low-friction approach that effectively defends merchants against the ‘big three revenue killers’: transaction fraud, advertising fraud, and site reliability issues.

“With their domain expertise in enterprise security and scaling growth, Edison Partners will be an immensely valuable partner to us as we look to bring new abuse, fraud and user experience products to the marketplace.”

Prior to this funding round, NS8 bagged a $7.5m seed round in 2017, from investors including Arbor Ventures, TDF Ventures and Hanna Ventures.

Earlier in the year, Edison Partners led the $7m growth funding round of Bipsync, a research platform aiming to maximize the productivity of professional investors and asset management firms