Total funding declined in 2018 due to fewer deals over £50m

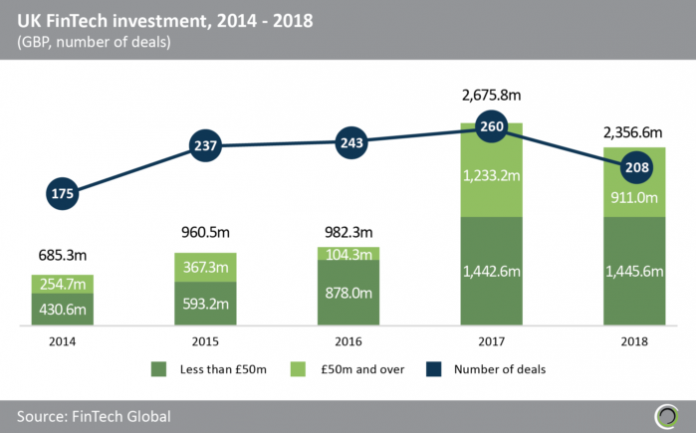

- More than £7.6bn was raised by FinTech companies in the UK between 2014 and 2018, across a total of 1,123 transactions. Investment grew nearly 3.5x from £685.3m in 2014 to almost £2.4bn in 2018, with deal activity increasing from 175 transactions to 208 during the period.

- Just under 46.1% of the funding raised in 2017 was invested in deals valued at £50m and above, which was the largest proportion of any year between 2014 and 2018 in this deal size range. Transferwise raised £212.6m in a Series E round in Q4 2017, funded by investors such as Institutional Venture Partners, Merian Global Investors, Andreessen Horowitz, Virgin Group and Sapphire Ventures. This was the largest UK FinTech deal in 2017 with the remittances specialist using the investment for growth in Asia.

- FinTech investment dipped slightly by 11.9% between 2017 and 2018 with investment in deals valued above £50m falling from £1.2bn to £911m during the period. This drop was possibly precipitated by the uncertainty caused by Britain’s exit from the European Union however, Brexit seems to have had no impact on smaller FinTech transactions with investment in deals valued below £50m little changed between 2017 and 2018.

FinTech investment ended the year stronger with almost £700m raised in Q4 2018

- Investment in FinTech companies in the UK fell by 41.1% from £826.6m in Q4 2017 to £486.7m in Q2 2018, with deal activity sliding from 58 transactions to 42 during the period.

- Funding in Q4 2017 was the strongest of the last five quarters for FinTech investments, mainly driven by larger deals with four transactions valued above £50m compared to just one in Q2 2018. OakNorth bank, CloudSense and Transferwise all raised more than £50m in Q4 2017 with OakNorth raising a £161m Series B round from Toscafund Asset Management, Clermont Group and Coltrane Asset Management.

- Q2 2018 served as an inflection point with FinTech investment growing from £486.7m that quarter to £698.8m in Q4 2018, whilst deal activity increased from 42 transactions to 59 during the period. This recovery in investment at the end of 2018 was also partly due to an increase in larger deals with four transactions valued above £50m that quarter. Monzo raised £85m in a Series E round led by Accel and General Catalyst in December 2018, propelling the challenger bank to unicorn status joining other UK FinTech companies such as Darktrace and Revolut.

London is closing in on Silicon Valley as the top city for FinTech deal activity

- London, New York and Silicon Valley are the most active FinTech hubs in the world, with more than 3,000 deals completed in these cities between 2014 and 2018. Silicon Valley leads the way with 1,271 FinTech deals closed between 2014 and 2018 however, London has been closing in, increasing its share of deal activity from 22.4% to 35.0% during the period.

- London’s share of deal activity surpassed Silicon Valley’s in 2017 and New York’s in 2016. Both London and New York are leading financial centres with strong FinTech ecosystems. London overtaking New York in terms of deal share again points to the resilience of the UK FinTech market to the headwinds of the uncertainty caused by Brexit. Interestingly, total deal activity in the top three cities has declined from 726 in 2015 to 529 in 2018.

- As the FinTech industry matures in Europe and North America, certain companies are emerging as key players within their respective sectors. Investors are making calculated investments into more established companies in these regions, while also looking to emerging markets for new opportunities.

Two thirds of the top investors in UK FinTech companies have their main FinTech focus in the country

- Eight of the top 12 most active UK FinTech investors have made more investments in UK FinTech companies than in FinTech companies in the rest of the world. These eight UK orientated investors have on average completed 84.9% of their FinTech deals with UK companies.

- Two of the four non-UK focused investors are venture capital firms. These include Index Ventures and Anthemis Group both of which have offices in London, the US and Geneva.

- The other two top investors which are non-UK focused have substantial operations all over the globe. London-based accelerator Startupbootcamp operates a global network of over 20 programmes which take place in New York, Dubai, Mumbai, Rome and Cape Town to name a few. Techstars, Barclays’ Accelerator, also run’s accelerator programs internationally. Every year Techstars choses 300 companies, which then receive $120k of investment, hands-on mentorship and lifelong access to the Techstars Network.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2018 FinTech Global