Last year set a record for FinTech funding in Germany with more than $800m raised

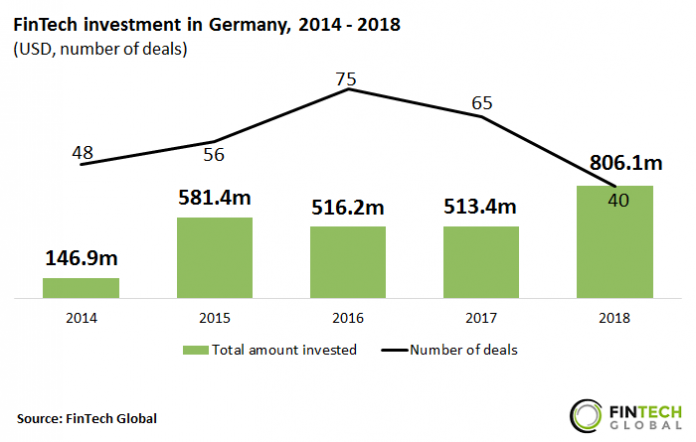

- FinTech companies in Germany raised over $2.5bn between 2014 and 2018, with 284 transactions completed during the period. Investment increased at a CAGR of 53.1% between 2014 and 2018 with the average deal size growing from $3.0m to $20.2m during those five years.

- The German market has become increasingly attractive to international FinTech companies who are establishing branches in Germany in order to serve the large domestic market and with the benefit of EU passporting, can offer services to other EU countries.

- Funding in 2018 set a record with $806.1m raised across 40 deals, of which 13 were valued at $20m and above. Homeday, an online property listing platform, raised a $23m Series B round in Q4 2018 from Project A, Axel Springer, and Purplebricks, which was the largest Real Estate Tech deal in Germany last year. Homeday states that it has brokered more than €1 billion’s worth of real estate deals in Germany and expects to leverage the expertise of Purplebricks, which is active in the UK, US, Canada, and Australia to further develop its product.

Funding in Q1 2018 topped $300m, driven by larger deals

- FinTech deal activity was somewhat flat over the past four quarters, with an average of 10 deals per quarter in 2018 and funding in Q4 2018 was only 8.3% higher than the corresponding quarter in 2017.

- Funding in Q1 2018 reached almost $340m, which is almost treble the amount raised in the previous quarter, with three of the 10 deals in Q1 valued above $50m.

- N26, the Berlin-based challenger bank, raised a $160m Series C round Tencent, Allianz X and Greyhound Capital in March 2018, which was the largest FinTech deal in Germany last year. N26 plans to accelerate international expansion, in particular to the US and UK, invest in the product, to make its services smarter, easier and more personalized for all customers, via artificial intelligence and increase its headcount from currently 400 employees.

FinTech companies in Berlin dominate the list of top 10 deals in 2018

- Berlin is the most important FinTech centre in Germany has been vying with London to become the post-Brexit FinTech capital of Europe. Nine of the top 10 deals in Germany last year involved companies based in Berlin with Hamburg-based Deposit Solutions raising the only funding outside of Berlin.

- More than $590m was raised in the top 10 FinTech deals in Germany last year, which is equal to 73.2% of the total capital raised in the subsector in the country in 2018, with previously mentioned N26 raising a $160m Series C round in Q1.

- Deposit Solutions, an Open Banking platform for deposits connecting banks and depositors across Europe, raised $100m of private equity funding led by Vitruvian Partners in Q3 2018. The company now connects more than 60 banks from 16 countries and reaches 30 million savers.

- There were four InsurTech deals listed in the top 10; Coya, Clark, ELEMENT Insurance and simplesurance, making it the most well represented subsector in the list with incumbent insurers in Germany viewing InsurTechs as partners rather than competitors. Simplesurance raised a $24m Series led by Allianz in May 2018, following up from a strategic partnership that was initiated between the two companies in 2016.

- Coya, a flexible digital home insurance provider, raised a $30m Series A round in Q2 2018 enabling the company to further invest in product development. This funding, led by Valar ventures, was the largest InsurTech deal in Germany last year.

The top FinTech investors in Germany have completed 115 deals between them since 2014

- The 10 most active FinTech investors in Germany, which are made up of venture capital firms and venture builders, were involved in 115 transactions between 2014 and 2018. Venture builders operate similarly to venture capital firms but adopt a more hands on approach to early-stage investing with greater operational involvement, filling in the gap that currently exists between entrepreneurs and venture firms.

- HV Holtzbrinck Ventures was the most active investor in Germany, completing 24 FinTech deals over the past five years. The venture capital firm’s largest investment to date was the $34.2m Series b funding that Spotcap, an SME finance provider, raised in Q1 2016.

- Point Nine Capital and DvH Ventures were joint second, having completed 13 transactions each between 2014 and 2018. DvH Ventures and Tengelmann Ventures both invested in the $14.1m Series B round that COMPEON, a Dusseldorf-based SME finance portal, raised in Q4 2017.

- Rocket Internet is one of the most prolific venture builders, not just in Germany but worldwide. Rocket has made nine FinTech investments in Germany since 2014 with the most recent being a $20m venture investment in Stocard in Q2 2018. Stocard’s app enables consumers to turn their smartphones into digital wallets and this funding, led by Macquarie Capital, was used to launch mobile payment functionality for the app and to open offices in Paris and Toronto.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global