Carbon, an FinTech startup based in Nigeria, has posted its financials on its website despite most other African new enterprises would be reluctant to do so.

The financial were audited by KPMG. In 2018, Carbon’s revenues reached $10m and it turned a profit of roughly $500,000. The company has also recently received a pre-IPO venture rating.

According to TechCrunch, few African startups have voluntarily released their financials to the public. But speaking with the publication, Carbon’s co-founder Ngozi Dozi said it had decided to post its audited financials to build trust among clients and potential candidates.

Carbon offer a broad range of mobile-based financial services like payments, investment products, credit reports and business banking services. It is one of the many startups tapping into the potential of the continent’s unbanked population.

Indeed, FinTech Global recently reported that this unbanked populous is one of the main reasons why investments into Africa is on the rise. Nigeria, where Carbon hails from, is one of the three top receivers of this capital. The other two are Kenya and South Africa. Together, these three nations make up of almost three-quarters of all deal activities, according to FinTech Global’s own research.

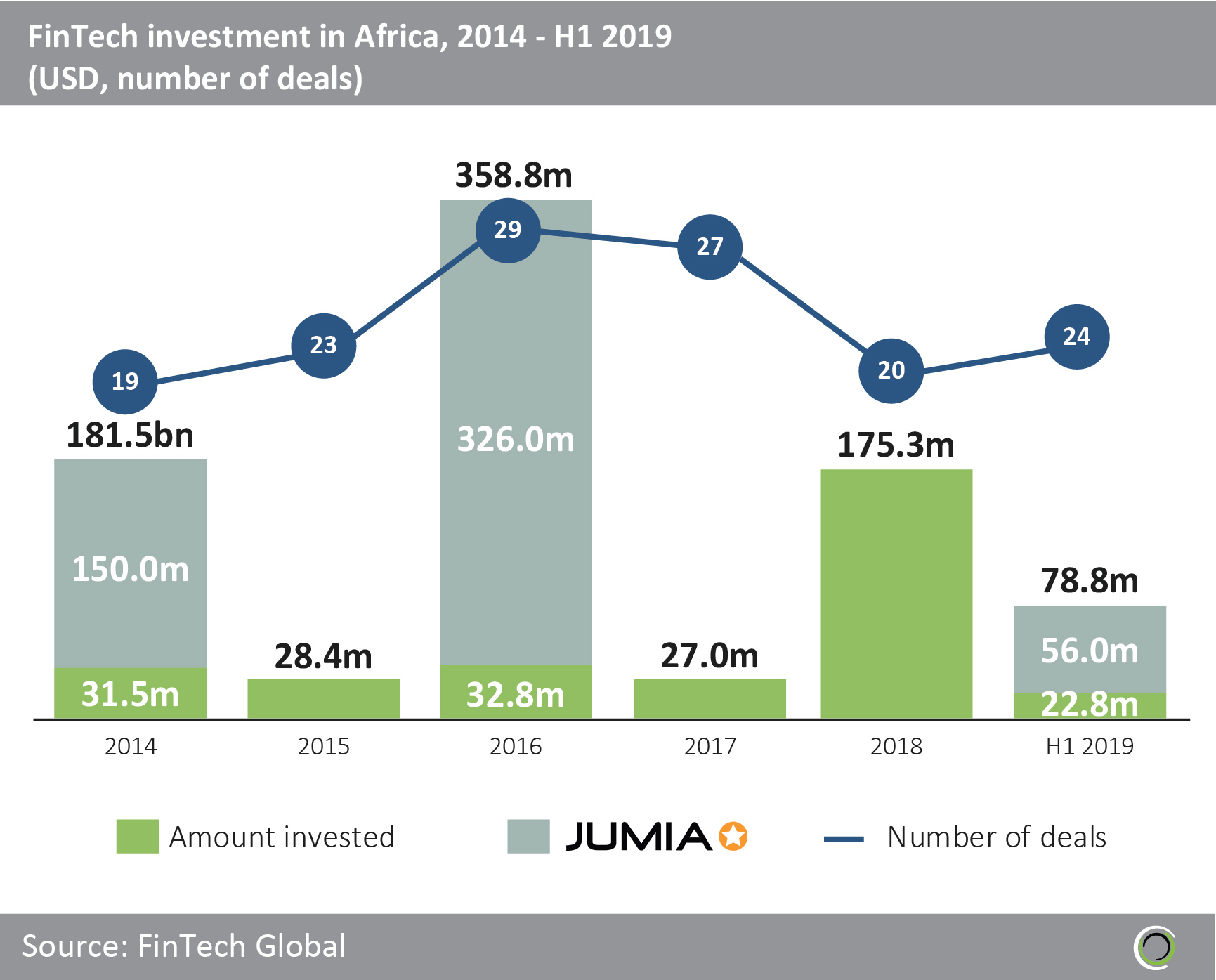

When looking closer at the deals, FinTech Global revealed Jumia, the e-commerce platform, received $554m of the $849.8m total invested into the continent between 2014 and the first six months of 2019.

Interestingly, TechCrunch highlighted that one of the few companies that had released its financials was Rocket Internet, a Jumia shareholder. When the company went public in 2014, it had to include Jumia data in its financial report.