The European savings marketplace Raisin is acquiring fairr, the German retirement savings tech company.

The deal will enable Raisin to tap into the €12tn European pension and retirement savings market and offer its 200,000 customers access to fixed-term and overnight accounts, cost-effective German ETF portfolios and access to specialized pension products.

Commenting on fairr’s journey to become a FinTech leader in the retirement savings sector, Tamaz Georgadze, CEO and co-founder of Raisin, said, “The fairr team has written a remarkable success story, translating and simplifying products like Riester and Rürup for the digital. Through the takeover we will be able to expand our product offering specifically around the important aspects of retirement saving. Together we want to grow and bring new momentum to the sector. Next to bank deposits, retirement savings is the most important asset class for individuals, with a volume of €12tn in Germany alone.”

Jens Jennissen, co-founder of fairr, commented on the deal, saying, “For consumers, retirement savings are still a very opaque, dusty, cost-intensive business. With Raisin’s access to the market we will be able to expand our reach significantly and continue to revamp the retirement savings market. We’re proud of what our team has achieved over the last six years and are very excited about our future together with Raisin.”

This is the second takeover for Raisin this year. It acquired the Frankfurt service bank MHB Bank in March.

However, Raisin’s ambitions are not confined to Germany. For instance, the FinTech company announced in July that it had teamed up with Legal & General, the British financial services group and investor, to provide the latter’s customers with protected cash savings accounts.

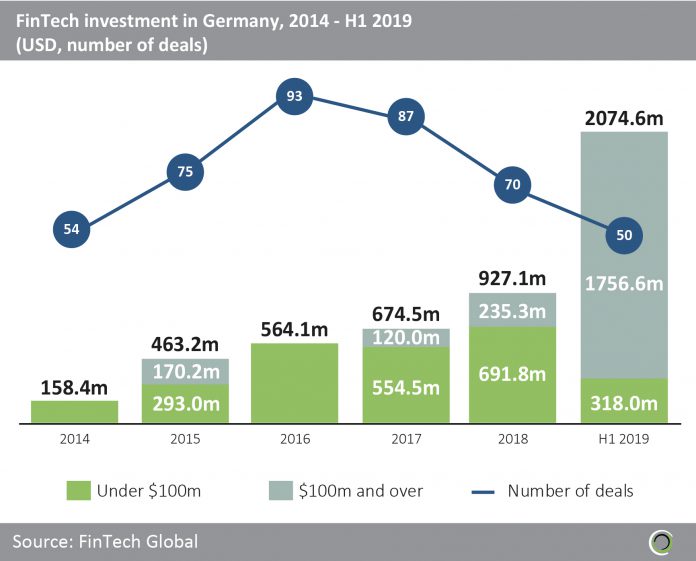

Investors have poured a lot of money into German FinTech companies over the past five years. FinTech Global recently showed that German FinTech investments rose from $158.4m in 2014 to $927.1m in 2018. Moreover, the first six months of 2019 saw that number jump to $2.07bn, representing roughly 74 per cent of the total FinTech investment the country received between 2014 and 2018.

Copyright © 2019 FinTech Global