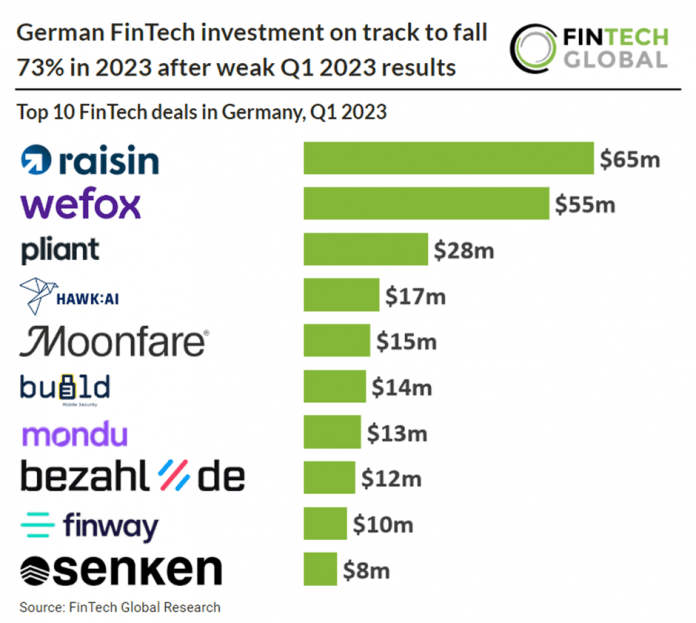

German FinTech investment stats in Q1 2023:

• German companies raised a combined $293m in Q1 2023, a 60% drop from the same period last year

• German FinTech deal activity reached 48 deals in Q1 2023, a 14% reduction YoY

• Berlin was the most active German city with a 41.6% share of deals

In the first quarter of 2023, German companies garnered a total of $293m, indicating a 60% decline compared to the same period in 2022. There were a total of 48 deals in the German FinTech sector during Q1 2023, a 14% decrease compared to Q1 2022.

Raisin, a global savings and investment specialist, was the largest German FinTech deal in Q1 2023, raising $65m (€60m) in their latest Series E funding round, led by M&G Investments. Raisin has been profitable for half a year and currently manages a total of €38bn assets under management for customers globally. In the past 6 months, AuM grew by more than 30%. Raisin is experiencing high demand from consumers looking for competitive savings rates, and banks looking for attractive retail funding sources. Through the new funding, Raisin claims it aims to give more consumers access to simple and convenient products by investing in new features, simpler processes and broader accessibility. Furthermore, the company aims to accelerate growth in the US market.

Berlin was the most active FinTech in Berlin during Q1 2023, with 20 deals, a 43% share of total deals. This represents a fairly low percentage compared to most countries which usually have a dedicated financial hub. Munich was the second most active FinTech city with seven deals, a 14.5% share of total deals. Cologne and Hamburg were the joint third most active FinTech German cities with three deals each.

As of Jan 2023, BaFin, which is a financial supervisory authority in Germany, is trying to streamline the process of registering the appointment of administrative and supervisory board members which is required under the German Investment Code (KAGB). BaFin has made it possible for certain companies under their supervision to submit notifications about people through an online platform called MVP. These notifications relate to the appointment of certain people in administrative and supervisory roles. In the future, this online platform will also be expanded to include notifications of the intention to appoint and the resignation of managing directors. This will make it easier for companies to notify BaFin about personnel changes, which could save time and reduce administrative burdens.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global