Almost $1bn was raised in the ten largest deals in Q2 2019

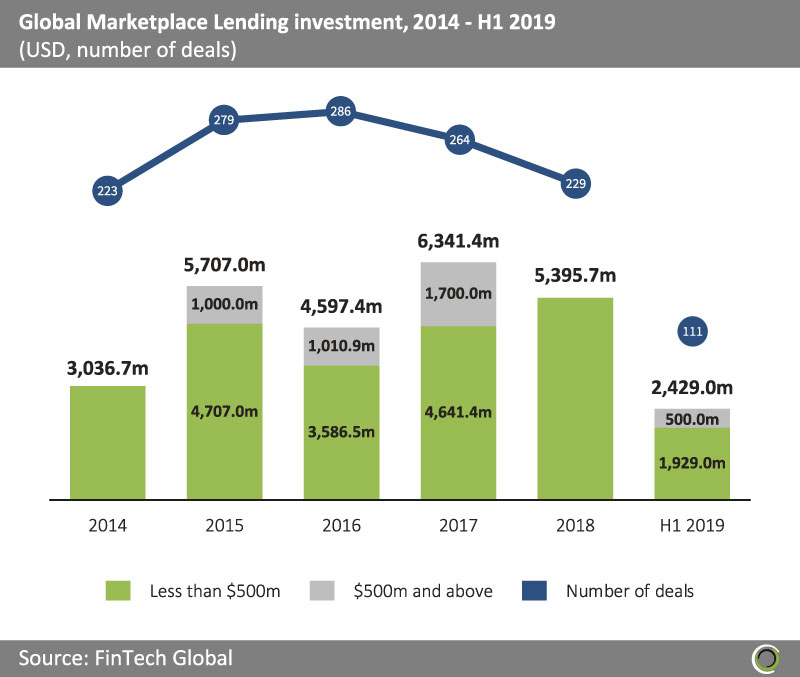

- Investors injected more than $2.4bn into Marketplace Lending companies globally in the first half of the year, with $967.5m raised in the top 10 deals in Q2 2019, equal to 39.8% of the total capital raised in the subsector during the first six months of the year.

- Companies based in North America dominated the top 10 deals in Q2, claiming six spots, with all deals valued at $50m and above, followed by Asia with two deals in the region listed.

- SoFi, an online provider of home loans, personal loans and student loan refinance based in San Francisco raised $500m from the Qatar Investment Authority in May 2019. This was the largest deal in Q2 and valued the company at $4.8bn.

- PeopleFund is a consumer and business loan platform headquartered in Seoul, South Korea. The company raised $30m of debt from Lending Ark Asia Secured Private Debt Fund in June 2019, which was the joint largest Marketplace Lending deal in Asia last quarter alongside the $30m of debt raised by Stashfin, an online consumer lender based in New Delhi.

Total funding between 2014 and H1 2019 reached $27.5bn across almost 1,400 transactions

- Marketplace Lending companies raised over $27.5bn between 2014 and H1 2019 with the return of $500m+ deals in 2019, the previously mentioned $500m raised by SoFi in Q2, following an absence of transactions in this deal size range last year.

- The Marketplace Lending subsector has experienced significant growth since 2009, as non-bank lending companies entered the market, as banks retreat from the space due to tighter regulations around lending standards and capital adequacy ratios.

- Annual funding peaked in 2017 with $1.7bn invested in deals valued at $500m and above. Lufax, an online loans platform based in Shanghai, raised $1.2bn in a Series B round led by China Minsheng Bank in Q4 2017. The company is a subsidiary of China Ping An Group, which is building a FinTech conglomerate covering insurance, money transfers, online loans and financial management.

- More than two fifths of the capital invested between 2014 and H1 2019 was raised by companies in North America and 36.9% captured by Marketplace Lending companies in Asia.

Online lending investment drives rebound in funding in North America in H1 2019

- North American companies have captured 41.6% of the capital invested in the Marketplace Lending subsector since 2014, a larger share than any other region.

- However, there was a shift in funding from North America, which received the largest proportion of capital in 2014 and 2015 (almost 60% respectively), towards Asia between 2016 and 2018, averaging 48.5% of the capital during the three-year period.

- The United Nations has highlighted the large underbanked population in Asia and the subsequent lack of credit history that has precluded many consumers and businesses from receiving loans from traditional financial institutions. Consequently, investors have been looking to capitalise on the opportunity presented by Marketplace Lenders filling this funding gap in Asia.

- However, the drop in the region’s share of investment in H1 2019, can be explained by the introduction of tighter regulations on P2P lending in China at the end of 2018, with the industry expected to continue shrinking and consolidating as a result.

- North American companies share of global investment rebounded to 55.6% in H1 2019, driven by a few large funding rounds in online lending companies, which captured 35.6% of the capital raised in the region in the first six months of the year. Uplift is an online lender that enables consumers to pay for their vacations in monthly instalments. The Silicon Valley-based company raised a $123m Series C round in January 2019 which was the second largest online loan deal in the region in H1 2019, after the $500m raised by SoFi.

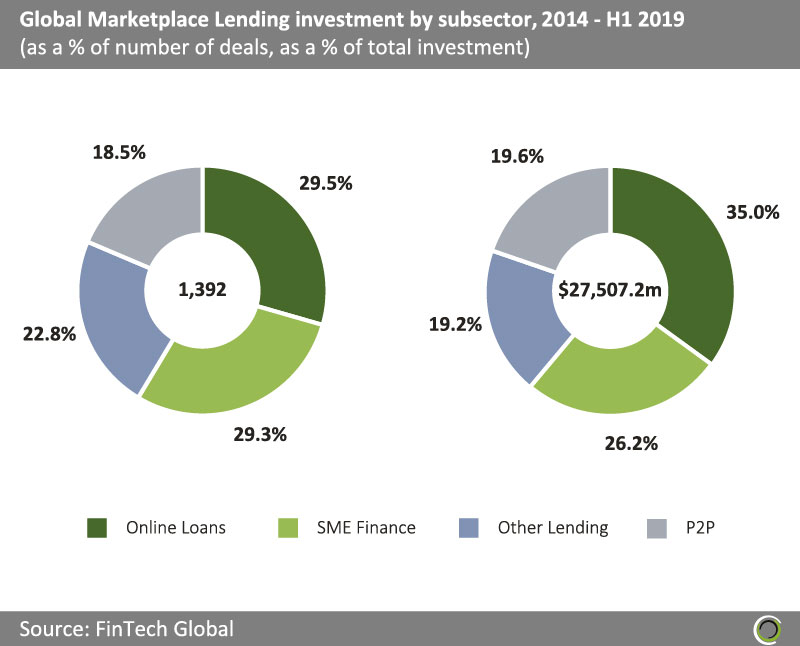

Online Lending companies and SME lenders have captured the largest share of Marketplace Lending investment globally since 2014

- Marketplace Lending companies were involved in 1,392 transactions between 2014 and H1 2019, with more than $27.5bn raised across the deals.

- Online Lending companies and SME Finance providers have captured almost 60% of deal activity in the subsector since 2014 and more than 60% ($16.8bn) of the capital raised by Marketplace Lenders globally.

- The regulatory environment, quantitative easing and the monetary policy adopted by central bankers over the past decade has been particularly problematic for small business lending. The risk weighted regime of Basel III induces banks to favour mortgage lending over loans to SMEs, and the artificially low bond yields caused by QE encourages substitution away from bank lending to bond issuances.

- This dynamic has spawned growth in non-bank SME lenders providing working capital and asset based finance to businesses. Tradeplus24 AG raised $120m in equity and debt, a record for Swiss FinTech startups, in a Series A round led by SIX Fintech Ventures, Berliner Volksbank Ventures (BVBV) and Credit Suisse in Q1 2019. The company provides receivables finance to SMEs and mid-market companies and this deal was the largest SME finance deal globally in H1 2019.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global