Despite Brexit and concerns about their long-term profitability, UK-based challenger banks seem set to grow their sales in 2019.

That’s according to new research from Accenture, the professional services company, which revealed digital lenders are on track to get 35 million new customers from around the world in the next 12 months. That’s after having snapped up roughly five million new accounts in the first six months of 2019. Today, banks like Revolut, Tandem, Starling and Monzo have claimed 13 million customers around Europe. Most of these customers are in their mid-40s.

On average, digital challenger banks’ cost-to-serve is about £20 to £50 per account. For the bigger incumbent banks, that number was £170. Average deposit balances for these new banks is between £70 and £350 per customer, dwarfed by the £9,000 average big traditional banks had.

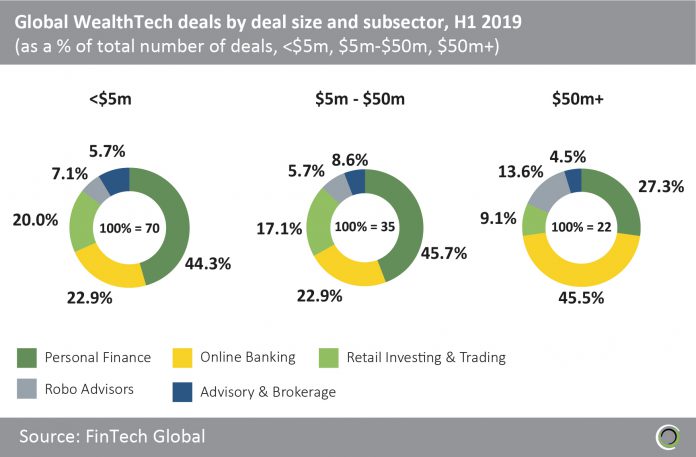

That echoes some of the research made by FinTech Global. Our research about the global WealthTech sector showed that between 2014 and the first six months of 2019, online banks made up of the biggest share of the WealthTech sector. In deals smaller than $5m, they made up 22.9% of the investment. Online bank also attracted 22.9% of the investment rounds worth between $5m and $50m as well as a smashing 45.5% of the rounds worth over $50m.

Nevertheless, that by no means that they have not had their fair share of challenges. The Accenture report also noted that most of these banks are not yet profitable, with them losing roughly £9 on average per customer. Accenture also highlighted that challenger banks are facing increased scrutiny from regulators.

Moreover, Brexit is also threatening to throw a few curveballs into the mix for UK FinTech companies. Most of these have to do with the uncertainty regarding what kind of deal the nation strikes with they EU.

Still, it seems that challenger banks are on the rise around the world, not just in the UK. In Germany, N26 is reportedly gearing up for a US launch. Down Under there has been a slew of neobanks leaping on the opportunity to challenge the incumbents in the Australian banking sector.

Copyright © 2019 FinTech Global