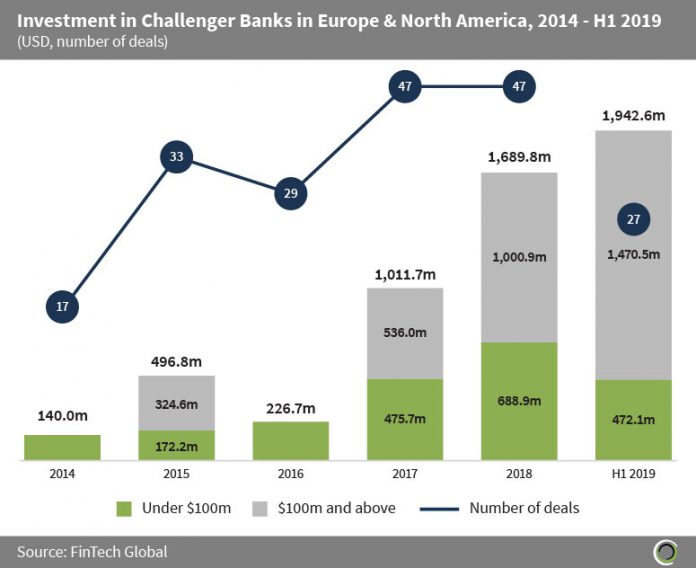

Just under $2bn has been invested in the first six months of the year already

- The WealthTech subsector has witnessed a proliferation of Challenger Banks spring up across Europe and North America over the past five and a half years, with the aims of disrupting traditional banking in pursuit of capturing a growing a millennial customer base.

- Investors poured more than $5.5bn into Challenger Banks in Europe and North America between 2014 and H1 2019, across 188 deals, with investment increasing at a CAGR of 69.2% during the period.

- More than $1.9bn was raised by Challenger Banks in the regions during the first half of 2019, which is equal to 35.3% of the total capital raised by Challenger Banks in Europe and North America since 2014, setting strong expectations for the rest of the year and future investment in the space.

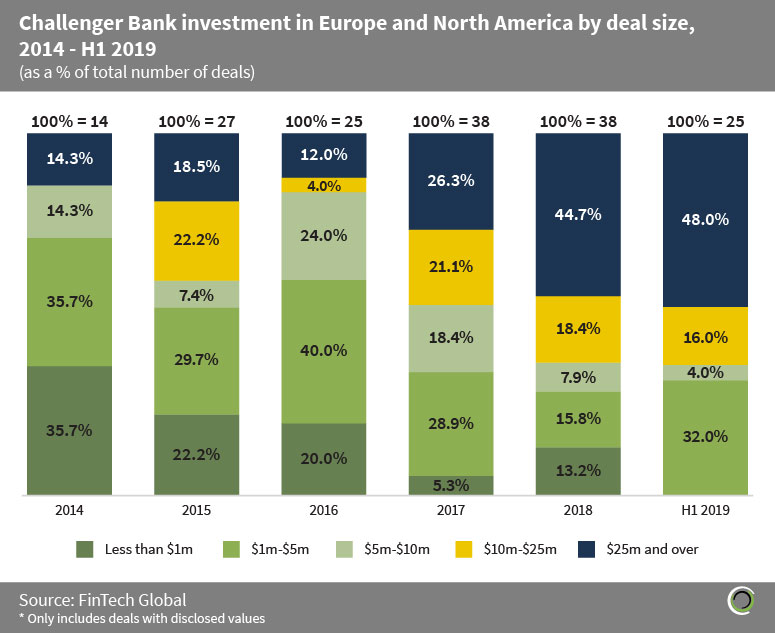

Almost half of the Challenger Bank deals in H1 2019 were valued at $25m and above

- The Challenger Bank segment of WealthTech has shown continued signs of maturity across Europe and North America, with the proportion of deals valued below $5m falling from 71.4% in 2014 to 32.0% in H1 2019, with no deals valued below $1m in the first half of the year.

- Despite continued growth and maturity in the space, digital banks still face challenges including the reluctance of customers to switch from traditional banks and intense competition caused by an increase in the number of challengers.

- Consequently, the average deal size in Europe and North America grew from $8.2m in 2014 to $71.9m in H1 2019, as Challenger Banks require more capital to fund customer acquisition costs and to pursue banking licenses.

- The proportion of deals valued at $25m and above reached 48% in H1 2019, with over three quarters of the capital raised during the period invested in deals valued at $100m and above. N26, a digital only bank based in Berlin that recently launched operations in the UK and US, raised a $300m Series D round led by Insight Partners in Q1 2019. This was the second largest WealthTech deal in the first half of the year and is the largest Challenger Bank deal in Germany to date.

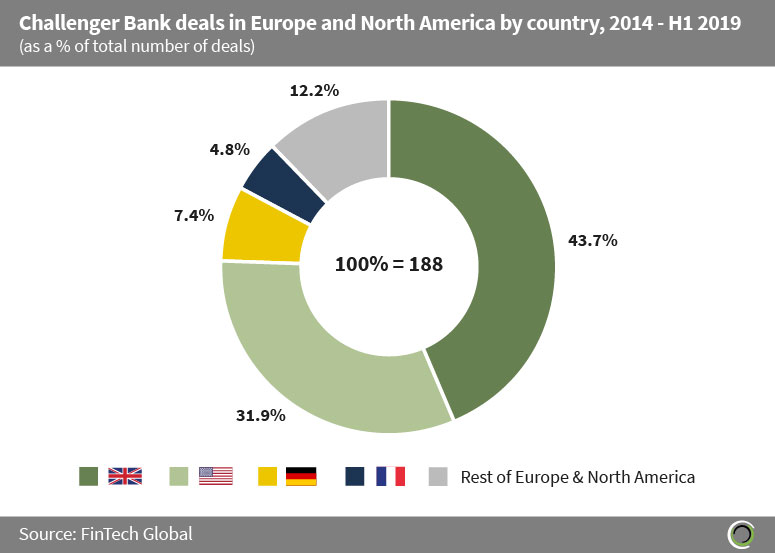

The UK has been the most active country for Challenger Bank deal activity across Europe and North America since 2014

- The UK has captured 43.7% of deals involving Challenger Banks in Europe and North America since 2014 and is home to growing neobanks such as Atom Bank, Monzo and Revolut.

- According to research from KPMG, most digital banks are in the UK because Britain is not as saturated with big banks and their branches as a nation like the US and the UK was also an early adopter of digital banking, dating back to the dotcom era of the late 1990s.

- Germany and France have been the second and third most active countries for Challenger Bank deal activity in Europe, capturing 7.4% and 4.8% of deal activity, respectively, across Europe and North America, between 2014 and H1 2019.

- Qonto is a neobank for SMEs and freelancers and is based in Paris. The challenger bank has raised $36.1m since its founding in 2016, and most recently raised $23m in a Series B round in Q3 2018. This funding, which came from Alven, Valar Ventures and the European Investment Bank is the largest funding round involving a challenger bank in France to date.

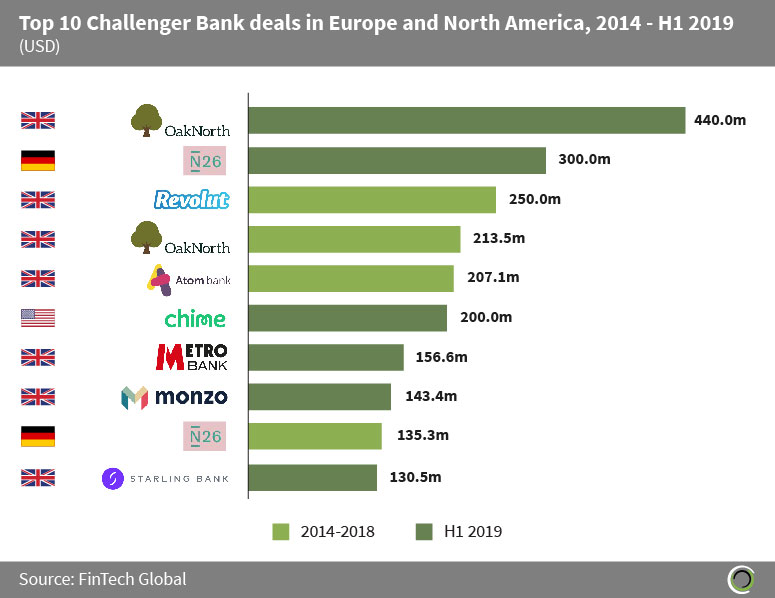

Six of the top 10 Challenger Bank deals in Europe and North America since 2014 occurred in the first half of 2019

- Almost $2.2bn was raised in the ten largest Challenger Bank deals in Europe and North America between 2014 and H1 2019, which is equal to 39.5% of the capital raised by digital banks in the two regions during the period.

- OakNorth, the London-based business only Challenger Bank, raised $440m led by Softbank in February 2019, which is the largest deal involving a challenger bank in Europe and North America to date. This deal was done at a $2.4bn valuation, cementing OakNorth’s status as a FinTech Unicorn.

- Chime is a San Francisco-based digital bank and is the challenger banking segment leader in the US. The company raised $200m in a Series D round led by DST Global in March 2019, valuing the challenger bank at $1.5bn. CEO Chris Britt noted that the company would be profitable if it stopped spending on advertising, and that almost half of Chime’s customers come from referrals and other word-of-mouth channels.

- Metro Bank and Starling Bank all received significant funding in February 2019 ($156.6m and $130.5m respectively) as part of the larger RBS Capability and Innovation Fund, with both challenger banks planning to improve products and services for UK SMEs. This investment from RBS is part of a scheme requiring the bank to boost competition in the sector as a condition of its bailout during the 2008 financial crisis.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global