New research estimates that the global challenger bank market will be grow by a compound annual growth rate of 46.5% between 2019 and 2025.

Market Research Inc’s research estimates that the market will grow from $18.6bn in 2018 to $394.64bn in the next six years.

It stated that the industry’s success is due to a combination of factors. One is they have higher interest rate compared to traditional banks, according to the research.

The growing adoption of smartphones in Asia and Australia are also likely to open up more growth opportunities for challenger banks.

Another reason for the predicted growth is that progressive regulators have opened up the space by changing the regulations and being more likely to grant licences and approvals.

An example of this can be seen in Australia where the Australian Prudential Regulation Authority begun to issue restricted authorised deposit-taking institutions in May 2018. These new licences is part of the reason why there is a wave of challenger banks washing over Oz at the moment. Startups like 86 400 and Up are leading the charge Down Under.

The Market Research Inc report also pointed out that challenger banks could still face several hurdles. The biggest obstacles for them to overcome were customer acquisition and profitability.

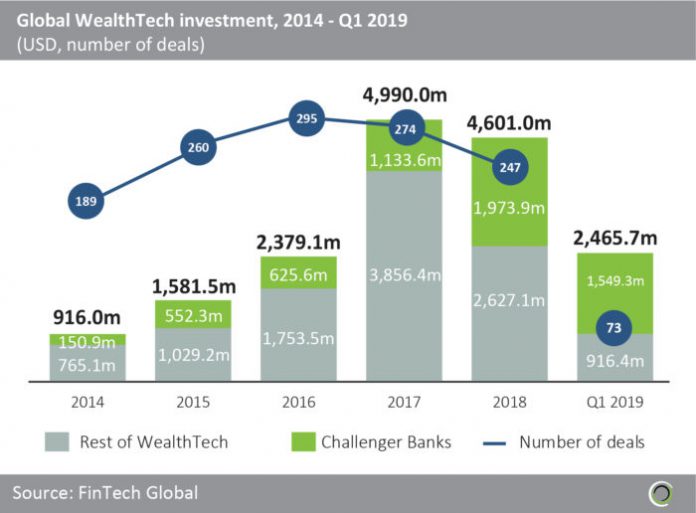

The report comes on the back of FinTech Global’s own research which showed that investment in challenger banks have skyrocketed over the past six years.

In 2014, the market saw $150.9m invested in it. This figure had jumped to $1.97bn by 2018. In the first half of 2019, the industry received investment worth $1.54bn.

Copyright © 2019 FinTech Global