Mexico City is due to welcome Stripe as the payments giant becomes the latest FinTech stakeholder to bet on the opportunities in Latin America.

Stripe is positioning itself to take advantage of the growing e-commerce market in Mexico, which is expected to grow by 35% this year.

The FinTech unicorn, which achieved a $35bn valuation this summer after landing a massive $250m Series F funding round, has tailored its new offering to best suit Mexico’s businesses. Stripe had companies like Cornershop, Homely and Urbvan try the software before the official launch and listened to their feedback.

With this push, Stirpe hopes to make it easier for enterprises in the country to do business online.

“For internet businesses, accepting payments and moving money is still too complicated, cumbersome and slow,” said John Collison (pictured), co-founder and president at Stripe. “At Stripe, our goal is to grow the internet economy by providing the best platform for ambitious businesses to start and scale online.”

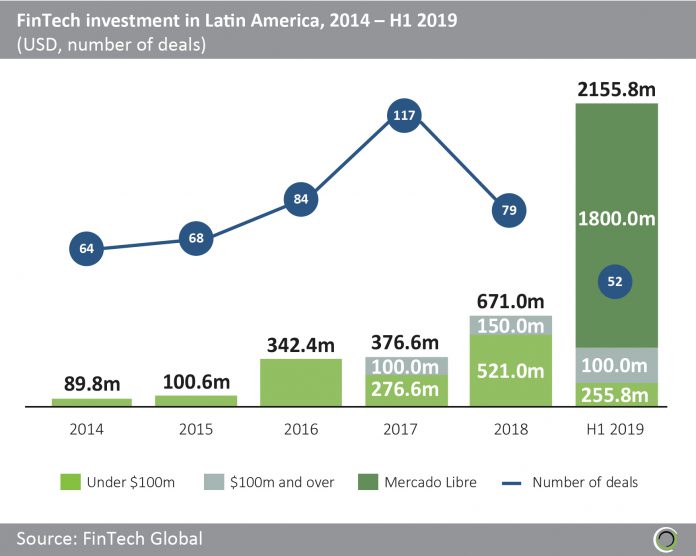

Stripe’s push into Latin America comes as the region is experiencing a massive growth in the FinTech industry. The sector saw over 460 deals completed in it between 2014 and the first half of 2019, according to FinTech Global’s data.

The amount invested into FinTech companies is growing. In 2014, the region’s businesses attracted $89.8m in total. By 2018, that figure had grown to $671m only for that record to be broken within the first six months of 2019. Between January and June this year, the Latin American FinTech industry received over $2.15bn in investment.

The activities in the sector has not slowed down since. For instance, in the past few months, Latin American has found itself with a new unicorn: the payments processing company EBANX after raising an undisclosed among in mid-October.

Moreover, challenger bank Revolut, investment bank Goldman Sachs and Santander have all made moves to tap into the region in the past few months.

Stripe also made the news recently after backing out of Libra, the cryptocurrency project spearheaded by Facebook.

Copyright © 2019 FinTech Global