FinTech is changing banking Down Under and next year might see the sector reach new heights, according to research firm Gartner.

It has released a new report estimating that the banking and securities sector in Australia will spend AUS$18.5bn on technology in 2020, an increase by 5.2% compared to this year.

Gartner estimates that the growth of investment will happen in modern business intelligence, augmented analytics and robotic process automation.

“The banking and securities industry continues to spend in pursuit of digitalization, whether through digital business optimization or transformation,” said Neha Gupta, research director at Gartner. “The introduction of open banking in Australia is also driving new technology investments.”

The research estimated that augmented analytics will increasingly leverage machine learning, creating new user cases in the Australian banking market.

Gartner believed robotic process automation will play a key role in the banking and securities industry, with most large banks adopting it in some way or another by 2023.

“Adoption of RPA will increase as awareness grows among business users,” said Gupta. “We expect almost all new RPA customers will be business buyers that are outside the IT organization. Major growth will come from expansion across silos, often coordinated by or with IT.”

Australia is undergoing a huge FinTech revolution at the moment, with the launch of several challenger banks coming onto the market in the past few years.

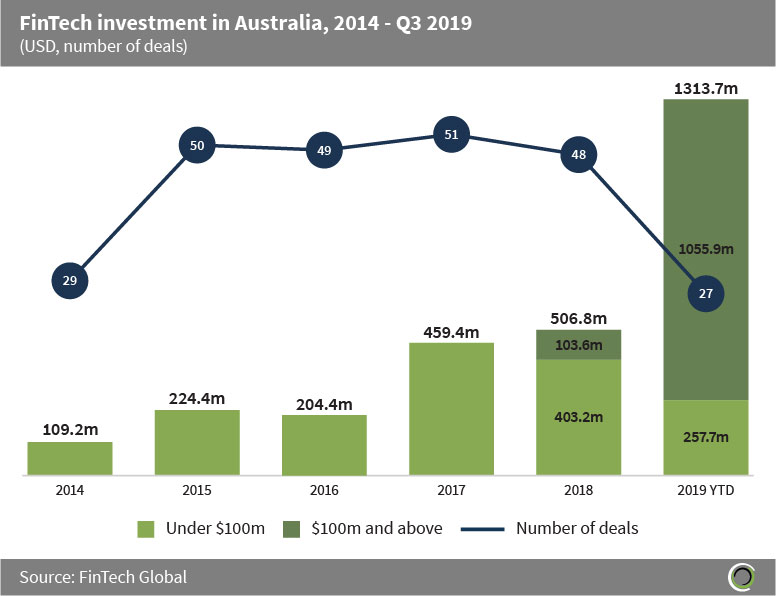

During the same time, the number of deals has increased tremendously over the past six years. In 2014, the Australian FinTech space attracted $109.2m worth of investment, according to FinTech Global’s data. That figure jumped to $505.8m in 2018. In the first nine months of 2019, the sector received $1.31bn worth of funding.

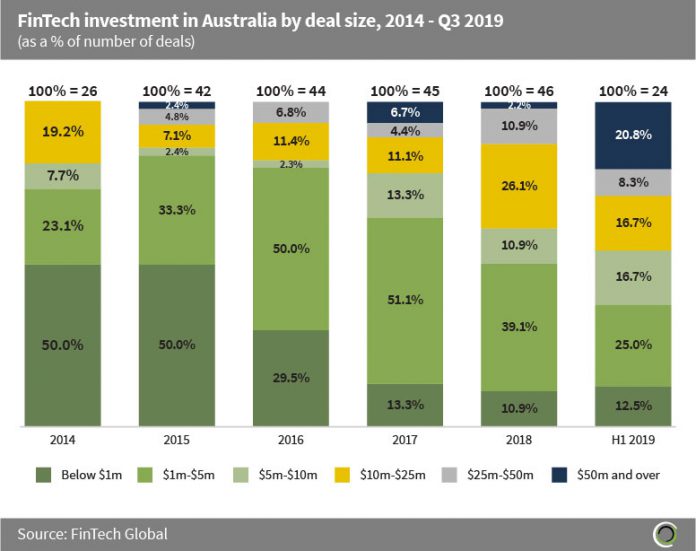

And the deals are getting bigger. Back in 2014, deals valued below $1m accounted for 50.0% of all deals across the region and there were no deals worth over $50m. In the next six years, that has changed dramatically, culminating in the first three quarters of 2019 when 20.8% of deals were worth $50m or more. So far this year, deals worth below $1m represent 12.5% of all deals.

Copyright © 2019 FinTech Global