E-commerce giant MercadoLibre’s credit unit Mercado Credito has strengthened its financial muscles thanks to a $125m loan from investment bank Goldman Sachs.

The Argentinian FinTech enterprise aims to use the money to triple its $100m working capital portfolio provided to Latin American SMEs, according to Bloomberg.

Martin de los Santos, senior vice president at Mercado Credito, told Bloomberg the aim of the business was to “democratize financial services” by lending to firms that usually do not have access to financing.

“We wanted not only Goldman’s capital but also the experience the bank has on this type of transactions throughout Latin American,” Santos told Bloomberg. “I hope to work with the bank in the future to finance other portfolios, including consumer operations in Mexico and other markets.”

The deal follows a $2bn raise through a public share offering and direct investments from companies like PayPal and Dragoneer Investment Group in March 2019.

“Over the past 20 years, we have heavily invested in developing the preeminent e-commerce and FinTech ecosystem in Latin America,” said Marcos Galperin, CEO of MercadoLibre, at the time.

“We are excited to welcome these investments which will allow us to significantly accelerate our growth. We look forward to accelerating our leadership in e-commerce and payments and foster financial inclusion in Latin America as a result of our alliance with a global leader in the industry such as PayPal.”

The new Goldman Sachs investment marks another sign that the Latin American FinTech ecosystem is going from strength to strength.

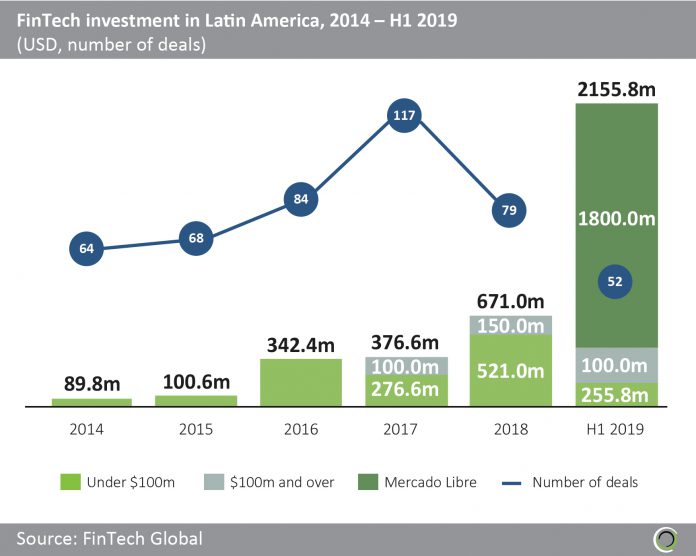

FinTech companies attracted $89.8m in 2014, according to FinTech Global’s data. However, that number grew to $671m in 2018 and a massive $2.15bn in the first six months of 2019.

Goldman Sachs has previously granted Mexican FinTech startup Konfio a credit facility of as much as $100m and loaned Brazilian challenger bank Nubank $49m.

International FinTech companies are also looking for a slice of the pie.

For example, payments unicorn Stripe has opened an office in Mexico City and UK challenger bank Revolut has announced plans to launch its banking services into eight new countries, including Brazil.

Copyright © 2019 FinTech Global