Canadian FinTech startups are getting spoilt for choice as another venture capital fund just closed.

Portag3 Ventures has announced that it is has closed a CAD$427m ($320m) fund to support promising new ventures leveraging technology to boost the financial system.

This is the firm’s second fund and it will use it to invest in startups around the world. Although, it will focus especially on Canadian, US, European and some Asia-Pacific regions, according to TechCrunch.

“We’re on a mission to build global champions from a Canadian base,” Adam Felesky, CEO of Portag3, told TechCrunch.

The VC firm used its previous fund to invest in companies like digital banking platform KOHO, buying an equity stake in InsurTech company Hellas Direct and to fund Hong Kong-based challenger bank Neat.

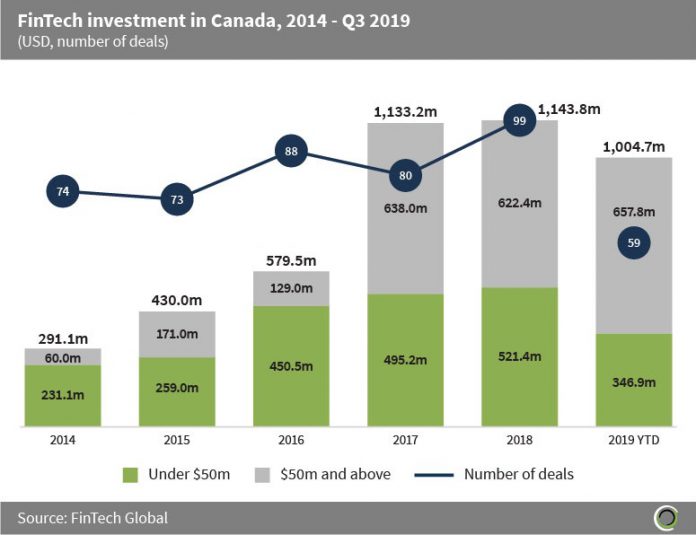

Canada has become a hotbed for FinTech innovation. A clear sign of this is the growing levels of investment the industry has seen injected into it.

The nation’s sector attracted $291.1m of investment in 2014, according to FinTech Global’s data. In 2018, that number had jumped to $1.14bn and over $1bn had already been injected into the industry by the end of the third quarter of 2019. In total, Canada’s FinTech sector has attracted nearly $4.6bn since 2014.

The news comes after Luge Capital, the VC firm, announced it had raised a $85m fund to support Canadian FinTech startups.

Karim Gillani, co-founder of Luge Capital, recently told FinTech Global that Canada’s Fintech ecosystem is going from strength to strength because of several reasons. However, three reasons stood out: more access to funding, increased integration of technology and growing efforts by Canadian policymakers around things like open banking.

Copyright © 2019 FinTech Global