The self-described tech bank Northmill has taken another step towards becoming a banking tour de force.

Having been granted a Swedish banking licence in September, Northmill has not been resting on its laurels to make the most of it.

The challenger bank has unveiled the new Rebilla Card, which gives the user 2% cashback on purchases up to SEK50,000 (£4,008) per year and no fees.

Users will also, once the bank launches its own savings account, be able to link the card to those accounts. The cashback generated will be automatically will then be transferred to the accounts.

Northmill had made no secret of how fundamental the card will be in its efforts to establish itself as a modern banking company.

“Our aim was to introduce the most competitive card on the market with a focus on giving back as much as possible to the users, and I think we pulled it off,” Hikmet Ego, CEO at Northmill.

“We do not believe that it should cost anything to just have a card and we do not necessarily expect the majority of the users to use the credit. However, the launch is a natural next step for us in the journey towards providing a full-scale banking offer with Rebilla.”

Northmill was founded in 2006.

From instalment unicorn Klarna to newcomers like bookkeeping platform Bokio, Sweden is no stranger to innovative FinTech companies.

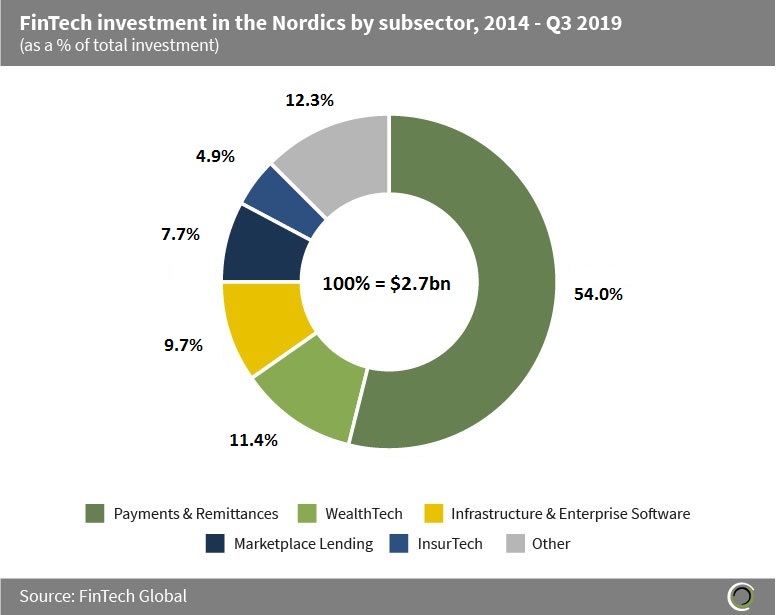

In fact, Sweden has picked up 79.1% of the $2.7bn invested into the Nordics between 2014 and the third quarter of 2019, according to FinTech Global’s data.

Payments and remittance companies have attracted the bulk of the investments going into the Nordics. Of the money injected, 54% went to the sector with 11.4% going into WealthTech, the second most popular sector for investors.

Copyright © 2019 FinTech Global