Brazilian challenger bank Nubank has made its first ever acquisition to boost its internal development team as it aims to tackle several obstacles in the new year.

The FinTech decacorn has bought software engineering firm Plataformatec, according to Link Estadao.

The acquihire will see the bank employ the 50 professionals working for Plataformatec as part of its own development team of 500 professionals.

“Our biggest bottleneck today is in the technical area and the Plataformatec team has been consulting for us for some time, with a very good level of talent,” Cristina Junqueira, co-founder at Nubank, told Link Estadao.

Plataformatec had also counted online lending solution FinTech Creditas, which netted a $50m Series C funding round in 2017, as one of its clients.

300 of the Nubank’s development team was hired throughout last year. Nubank has 2,500 employees in total.

The company’s hiring spree is aimed at accelerating the development and launch of new products such as the anticipated personal loans service NuConta.

“It’s something we’ve been testing since 2019 and that can help us generate profitability very quickly,” said Junqueria.

The news comes at a time when Nubank is facing criticism for not being profitable yet, having drummed up losses of $34m in the first half of 2019.

“If we stopped growing today without absorbing new clients, who consume investments until they generate revenue, we would already make a profit,” said Junqueira. “It’s not something that we will pursue blindly. We want to grow at a sustainable pace and with opportunities for efficiency. If this is going to make us profit, great.”

Of course, Nubank is hardly alone in facing that sort of criticism.

When UK challenger bank Monzo scrapped its premium service in September 2019, it raised concerns from investors who were yet to see any return on their investment.

Similarly, British challenger bank Revolut revealed in October that its losses had doubled in 2018 to just under £33m.

Speaking of the UK company, Revolut also highlights another challenge for Nubank: increased competition.

For instance, Revolut announced in September that it would go on a massive hiring spree to employ 3,500 new employees to power its international expansion into Asia, North and Latin America. One of the Latin American markets it was looking at in particular was Brazil. Other international players are also looking for a piece of the pie.

Nubank will also have to look out for domestic competitors like Pride Bank, which caters to the country’s LGBT population.

Moreover, Nubank will also face challenges in its pursuit of expanding beyond the borders of Brazil. In 2019 it opened a new office in Argentina and is currently awaiting regulatory approval to launch in the country.

The FinTech company is also planning to launch in Mexico in the first quarter of 2020.

From a macro perspective, its easy to see that things are heating up in Latin America’s FinTech scene.

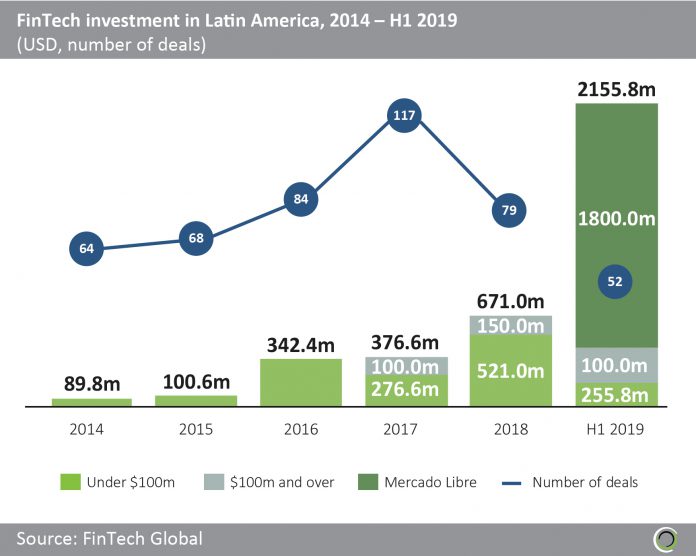

FinTech Global’s research revealed last year that investment into the sector jumped from $89.8m in 2014 to $671m in 2018 before shooting through the roof in the first half of 2019 when $2.15bn was injected into the region as a whole.

Although, $1.8bn in the first six months of last year was raised in a post-IPO equity round from MercadoLibre.

Brazil has been the main receiver of the investment, with 45% of the FinTech investment in the period going into the country. It was followed by the two countries where Nubank is looking to expand to: Mexico and Argentina, which respectively attracted 20% and 13% of the total investment between 2014 and the first half of 2019.

Copyright © 2020 FinTech Global