The Monetary Authority of Singapore (MAS) has received 21 applications for digital bank licenses, as the regulator now beings its task of whittling it down to five.

Applications for the license opened last year, with the regulator looking to distribute five new licenses. Of those submitting proposals, seven are seeking the digital full bank license and 14 hope to become a certified digital wholesale bank.

Interest has come from a mixture of players including e-commerce firms, technology and telecommunications companies, FinTechs and financial institutions. A large portion of applicants are consortiums looking to combine their strengths and deepen their value proposition.

Moving forward, the regulator is evaluating the applications on their value propositions including the use of technology to serve customer needs, their ability to manage a banking business and how it would contribute to Singapore’s financial centre.

The successful applicants will be revealed in June 2020 and operations of these businesses are expected to begin by mid-2021.

When the regulator announced it was looking to deploy digital banking licenses it stated they would ensure the country’s banking sector remains “resilient, competitive and vibrant.”

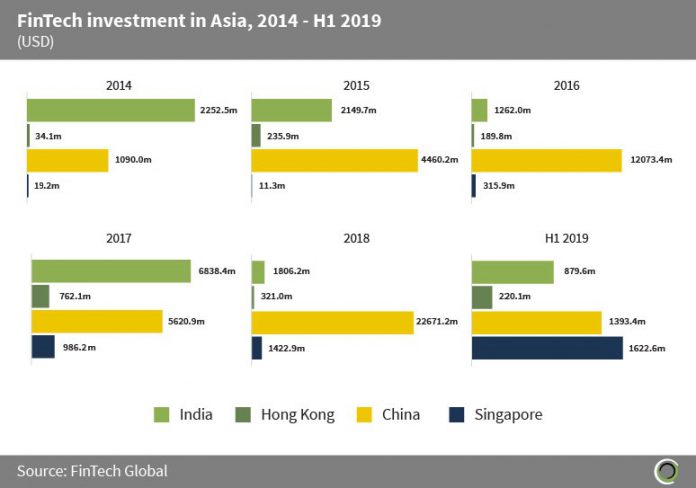

It’s only natural the country is looking to add digital banks after the strong FinTech sector it has established. Since 2014, more than $5.4bn has been invested into startups in the country. Appetite even led to the country seeing more investment than China during 2019.

Singapore is not the only Asian country looking to welcome digital banks into its financial ecosystem. Earlier in the month, the central bank of Malaysia revealed it was updating its licensing framework for digital banks and is looking to issue up to five licenses.

Singapore is not the only Asian country looking to welcome digital banks into its financial ecosystem. Earlier in the month, the central bank of Malaysia revealed it was updating its licensing framework for digital banks and is looking to issue up to five licenses.

Copyright © 2020 FinTech Global