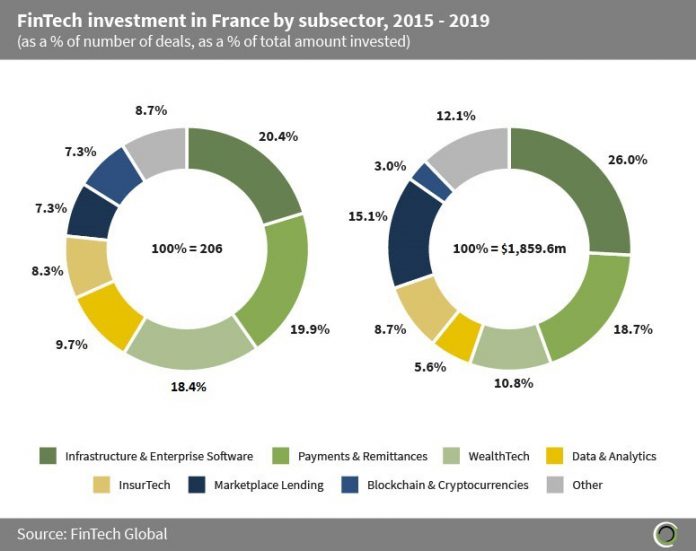

Over a quarter of FinTech funding in France was raised by companies in Infrastructure & Enterprise Software

- Infrastructure & Enterprise Software solution providers have been a significant driver of investment in the French FinTech space accounting for 26% of total investment since 2015. Companies in the subsector were also responsible for the highest deal activity in the country with 42 transactions completed during the period.

- Companies in Payments & Remittances are also driving investment in the country, securing nearly $350m since 2015 and making up nearly one fifth of funding during the period.

- WealthTech companies in France accounted for 18.4% of total deals in the country but only accounted for 10.8% of funding during the period.

- The other category consists of companies in Real Estate, RegTech, Funding Platforms and Institutional Investments & Trading which collectively account for 8.7% of deals and 12.1% of investment raised in the country since 2015. The largest deal in this category came from Vade Secure, an email security solution provider. The company raised a $79.1m Series A round led by General Catalyst in Q2 2019 which was the largest RegTech deal in Europe of the quarter.

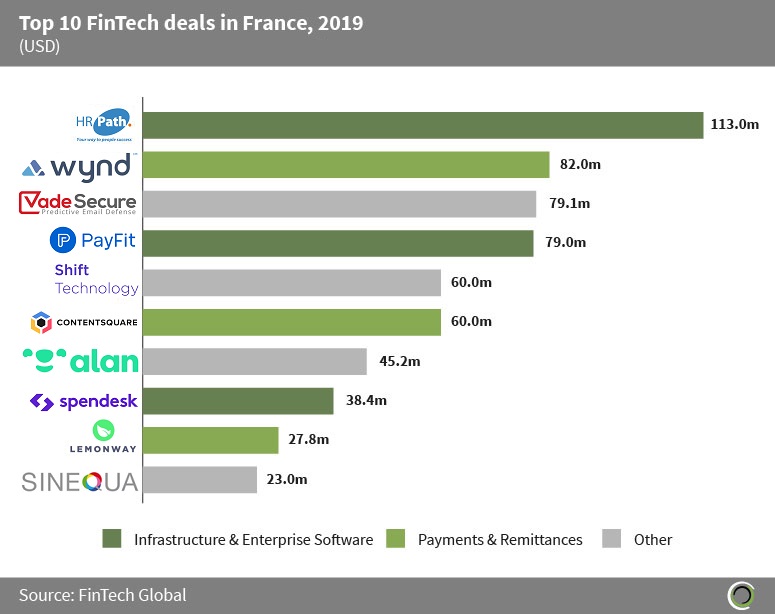

Six of the top 10 FinTech transactions in France since 2015 have been completed by Infrastructure & Enterprise Software or Payments & Remittances companies

- Just over $600m has been raised in the top 10 FinTech transactions in France during 2019 which equates to 71.6% of the total capital raised in the country last year. Of these transactions, seven occurred in H1 2019 with only three being raised in the second half of the year. Infrastructure & Enterprise and Payments & Remittances deals dominated the top 10 with three deals from each subcategory making the list.

- HR Path provides human capital management technology including HR and payroll outsourcing solutions. The company raised $113m in a private equity round in April 2019 and will use the capital to fuel its rapid expansion into international markets, strengthening its status as a key player in the HR field.

- The largest Payments & Remittances deal was raised by Wynd in Q1 2019. The company which offers a point-of-sale solution that unifies and manages sales channels across multiple sites and both online and physical retail locations. Wynd raised $82m in a Series C round in January 2019 to expand operations internationally by hiring staff and opening new offices.

- The other category includes two RegTech companies (Shift Technology and Vade Secure) one Blockchain & Cryptocurrency company (Sinequa) and one InsurTech company (Alan).

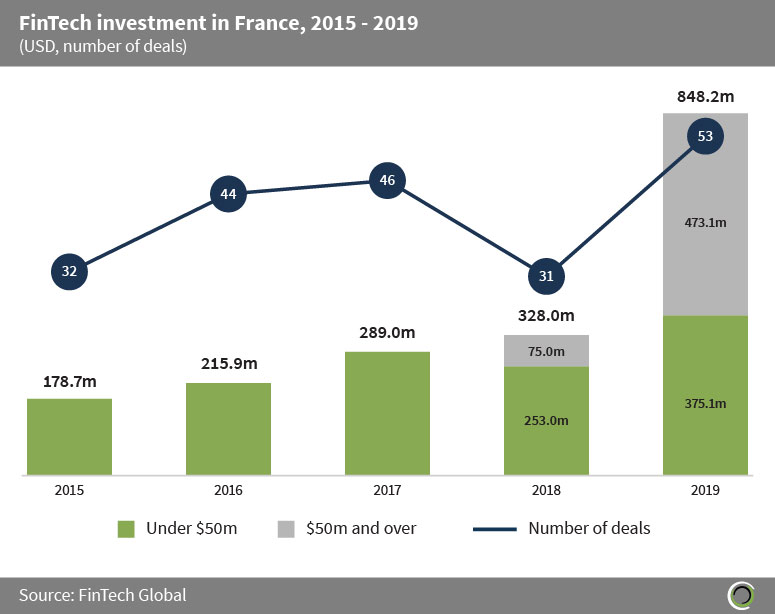

FinTech investment in France reached a record of nearly $850m in 2019

- Over $1.8bn has been raised by FinTech companies in France between 2015 and 2019, with investors participating in 206 transactions during the period. Funding raised in 2019 alone accounts for 45.6% of total funding raised since 2015.

- Investment increased at a CAGR of 47.6% between 2015 and 2019, with investment reaching a new record in 2019 of $848.2m raised across 53 deals. During the period, average deal size increased nearly three-fold from just $5.6m in 2015 to $16.0m in 2019.

- Almost $550m was raised in seven transactions valued at $50m or over, equating to 29.5% of total capital raised during the period. Of these seven transactions, six were raised in 2019.

- France offers an attractive environment for FinTech startups thanks to its continuous flow of innovation and skilled workforce. Additionally, the French government is keen to facilitate innovation and the financing of startups with schemes such as EnterNext, a subsidiary of EuroNext, dedicated to financing and promoting SMEs in financial markets, making France an attractive market for FinTech investment.

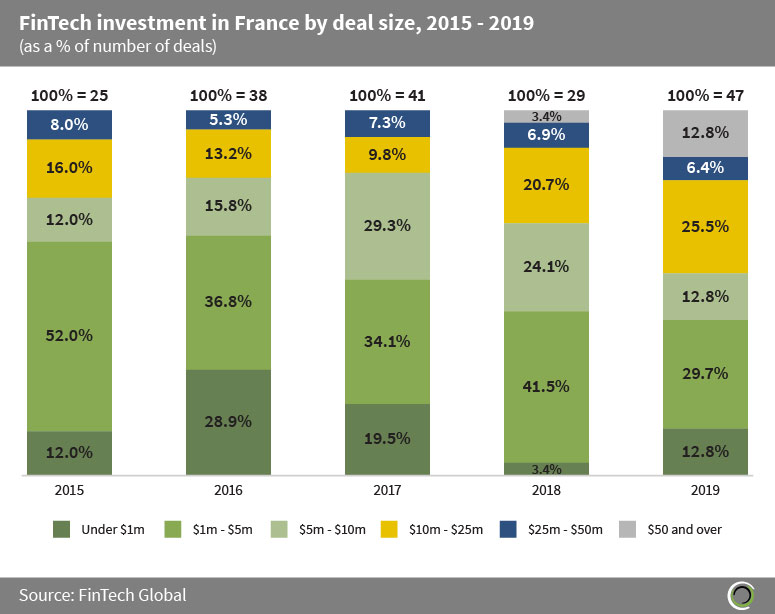

More than one eighth of FinTech deals in France in 2019 were valued at $50m or over

- The French FinTech landscape has witnessed a shift over the last five years from investors predominantly backing smaller deals towards backing more later-stage transactions.

- Back in 2015, all deals in the country were valued below $50m with deals valued below $5m accounting for 64% of deals. This has decreased by 21.5 percentage points (pp) to just 42.5% of deals being in this size range in 2019.

- As the landscape shows continued signs of maturity, investors are willing to invest higher levels of capital in the area, with 2018 seeing the introduction of deals valued over $50m. In 2019, deals in this size bracket accounted for 12.8% of all FinTech deals raised in the country.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ?2020 FinTech Global