Ever since the UK voted to leave Europe in 2016, there has been a cloud of uncertainty on the FinTech market. Most discussions painted it as doom and gloom, but the amount of capital still being deployed to the country’s FinTechs, suggests things might be fine.

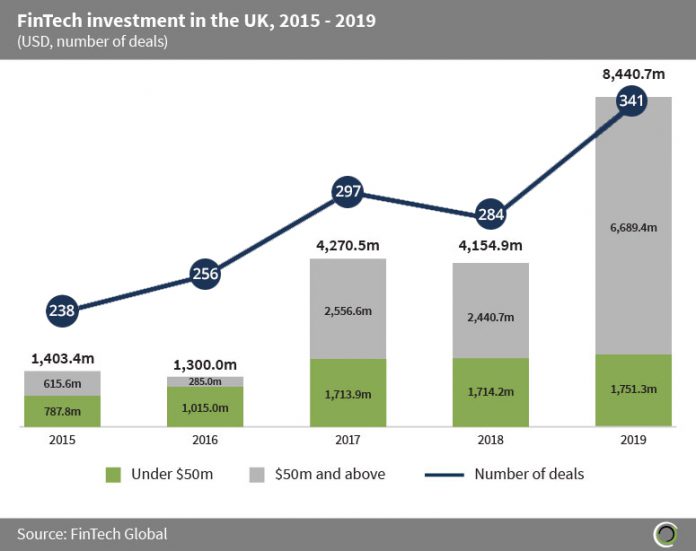

FinTech investment in the UK reached a record level in 2019, culminating in a total of $8.4bn being deployed across 341 deals, FinTech Global data shows. This has increased from the levels back pre-Brexit vote in 2015 when just $1.4bn was invested through 238 transactions. The average deal size has also increased over this period, rising from $7m in 2015 to $30.6m in 2019. Brexit might have concerned investors back in 2016, when funding only reached $1.3bn, but the following year, funding rocketed up to $4.2bn.

The UK officially left the European Union in January this year and while investment has been booming in the country, now will be the time to see if the UK really does keep its position as the leading European market for FinTech.

The UK officially left the European Union in January this year and while investment has been booming in the country, now will be the time to see if the UK really does keep its position as the leading European market for FinTech.

There has always been a strong financial system in the UK, which is only natural seeing as it is one of the biggest economies in the world and this has helped created a strong talent pool across the whole region. Steve Tigar, the CEO at personal finance app Money Dashboard, said the UK has been appealing for FinTechs due to the level of talent in London, Edinburgh and other areas of the UK. He said, “Even just a few years ago the top tech talent wouldn’t put financial services at the top of their list of preferred sectors to work in. That’s changed in a very small period of time – it’s a sector where you can make an exciting and positive change.”

Having good talent alone is not enough to account for the UK’s popularity in FinTech. The region’s connections to the rest of the world have also been acknowledged as one of the major appeals. The UK’s “special relationship” with the US has been well documented over the years, but the UK has also got some good ties with working with countries in Asia as well. Elias Ghanem, global head of market intelligence at consulting, technology and digital transformation services provider Capgemini’s Financial Services said, “The UK also is seen as the ‘door to Asia and the US’ with its language and way of thinking.”

The UK’s links with the US and Asia can be seen by the number of its companies launching operations in these regions. Digital bank Revolut recently launched its services in the US market, while payments company Transferwise made the move last year. FinTechs have also been making a move to the Asia-Pacific region, with FinTech service developer Raypd opening in Singapore and API builder Ebury beginning operations in Australia.

Ian Johnson, head of Europe at modern card issuer Marqeta, said, “The UK is also seen as stepping-stone for many FinTechs, providing a connection between Europe and the rest of the world – particularly the US. For example, the ‘FinTech Bridge’, which supports and encourages the global aspirations of UK FinTechs by helping with expansion to Singapore, China, Hong Kong, South Korea and Australia, and encouraging FinTech’s from these regions to do the same in reverse.”

The UK’s Financial Conduct Authority (FCA) has been a key driver to the support of the country’s FinTech sector through its sandbox but also interactions with other countries. It has established numerous partnerships with regulators in other countries and regions to foster growth between them, including South Korea, the US, Hong Kong and others.

The open banking initiative has also been one of the big drivers for the regions appealing FinTech scene. Open banking enables consumers to give third-party companies access to their transaction data so they can access more personalised services. While it is still in the beginning stages, several open banking partnerships have taken place to provide deeper services to customers. Countries around the word have also begun implementing similar protocols.

Daumantas Dvilinskas, the CEO of digital remittance service TransferGo, said, “The UK’s Open Banking initiative, for instance, is internationally recognised as a gold standard for banking innovation. By safely and effectively gaining access to customer data, FinTech start-ups and challengers can increase the competition in the market and provide tangible alternative services.”

People could only speculate the impact of Brexit on the UK’s economy but now the UK has officially left we might start seeing the impact. The loss of passporting benefits is expected to be one of the main challenges facing companies. Passporting means a company authorised in one EU member state can trade freely in any other one with only minimal additional authorisation, enabling FinTechs in Europe to easily launch in neighbouring countries. UK companies will lose passporting benefits at the end of the transition period.

Without this benefit, it would mean UK companies would need to get local licenses for other EU countries, adding barriers to expansion. It also means companies in the EU would need to get a full license when wanting to operate in the UK, which could deter them from entering the market. Marqeta’s Ian Johnson said, “Plenty of UK FinTech’s have the ambition to operate in Europe, but the loss of passporting rights means they’ll now need to change their approach to make these plans a reality.”

Depending on how the trade agreement turns out, and whether an alternative to passporting can be worked out, companies wanting to operate in the UK and Europe will need two licenses. Johnson added, The biggest consideration when doing this is weighing up where they can obtain a license vs where the talent is. Countries like Lithuania offer favourable conditions to obtain a licence and have readily available talent to set up a European office. Another alternative is partnering with a third-party to use their existing license.” UK-based challenger bank Revolut is one of the companies to already prepare for this, having established regulatory responsibilities to offices in Ireland and Lithuania.

One of the fears the loss off passporting causes is that European-headquartered FinTechs will choose to leave the country rather than going through the lengthy process of getting a local license. German challenger bank N26 was the first to do just this. Within just a couple of weeks of the UK officially leaving the EU, the challenger bank revealed it would be shutting all UK accounts by April 15. It decided to leave rather than apply for a license because of unstated complexities. As time goes on, this could become a normal instance.

However, Sukhi Jutla co-founder of online marketplace for jewellery, MarketOrders said, “There have been several investigations that revealed N26 had had several run-ins with the Financial Conduct Authority (FCA), low user engagement, and several high profile resignations that led to its exit. Citing this, I don’t think there will be a mass exodus of fintech post Brexit, instead we will see homegrown fintech’s double down on serving domestic markets.”

The UK’s government will likely do whatever it can to ensure its booming FinTech sector does not decline due to Brexit. In March, the UK’s Chancellor of the Exchequer Rishi Sunak revealed a new review of the countries FinTech sector and increased funding for the delivery panel, an initiative designed to identify measures which could support industry growth. Nick Murray-Leslie, CEO at consultancy firm Chatsworth, said, “The aim of this is to further bolster FinTech in the region and ensure it can continue to be a leader in the world. The Brexit process has focused minds on the sheer size and importance of the fintech sector to the city and by proxy the UK economy.”

The funding in the region shows investors have not yet been deterred away from the UK. However, if the UK wants to continue this, it will need to continue supporting its growth and showing the world thre are attractive opportunities for everyone.

Daumantas Dvilinskas, the CEO of digital remittance service TransferGo, said, “In our case – we’ve had to rethink our strategy and plan for a future outside of the European Union. The UK remains the most welcoming country for FinTech businesses in terms of the regulatory framework, so regardless of how Brexit unfolds, it will maintain a certain competitive edge over its European neighbours. It would be unwise to ignore the negativity that may surround this exit, so while preparation is extremely important, UK FinTech firms need to remain diligent and agile, and ready and adapt to the changes that may come.”

Copyright © 2020 FinTech global