UK FinTech sector hit a new record for deal activity in 2019

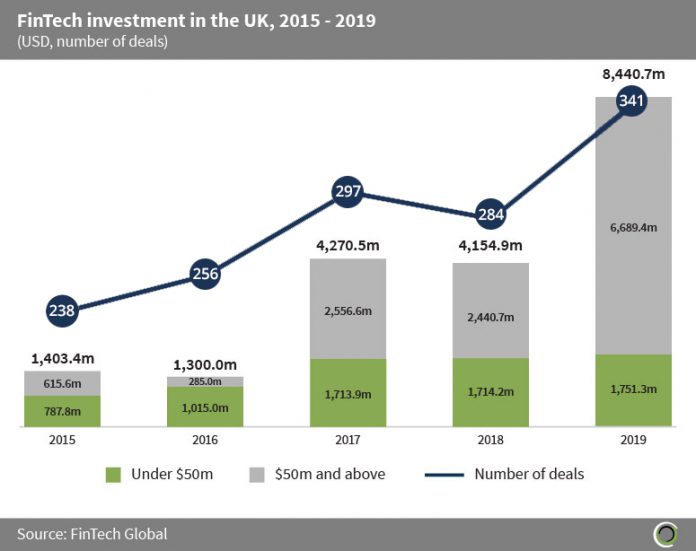

- UK FinTech companies have raised over $19.5bn across 1,171 transactions since 2015, reaching the highest level of deal activity last year with 341 funding rounds completed.

- The UK FinTech sector has experienced strong growth between 2015 and 2019 due to its strong track record for R&D, technology, strong talent pool, access to leading financial institutions, supportive regulatory system, accelerators/incubators, and access to funding.

- The country’s FinTech market has matured since 2015, which is most notably seen in the increased average deal size which upped from $7m in 2015 to $30.6m in 2019. Furthermore, investment in deals valued at $50m and above had a CAGR of 61.2% during the period.

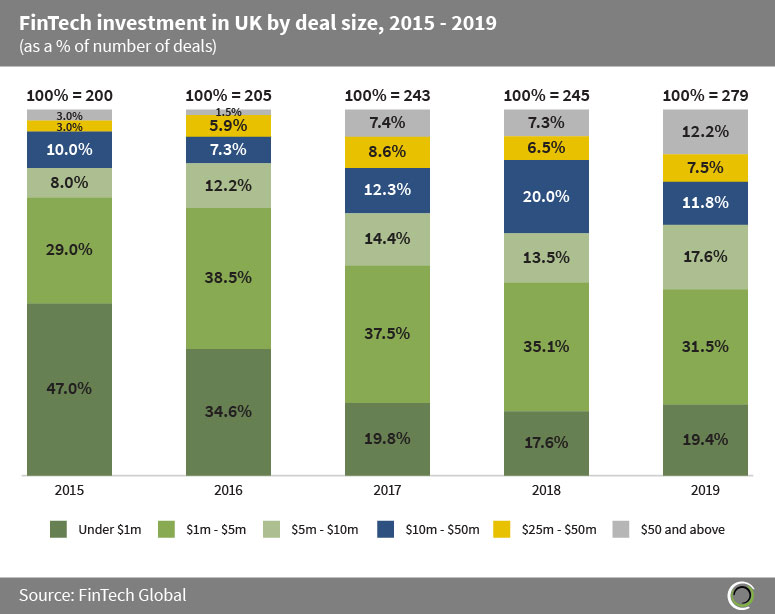

The share of deals valued at $50m and above has grown six times larger since 2015

*Only deals with disclosed values are included in the analysis

- The UK FinTech ecosystem has become more developed since 2015. Evidenced by the increased share of deal activity in transactions valued at $25m and above, which has grown at a CAGR of 26.8% during the period.

- The frequency of early stage funding rounds has dropped since 2015, with a decrease in the share of deals valued at less than $1m by 27.6 percentage points (pp). However, these UK early stage rounds of less than $1m still captured 19.4% of transactions in 2019, which is high compared to EU countries like Germany with 15.2% of deals valued in this size bracket. An explanation for this could be the incentives offered from the SEIS and EIS government schemes allowing investors to claim tax relief on investments worth no more than £100k and £1m, respectively.

- The city of London has accounted for most of the deal activity in the UK, with 86.1% of transactions being raised by companies based in the capital.

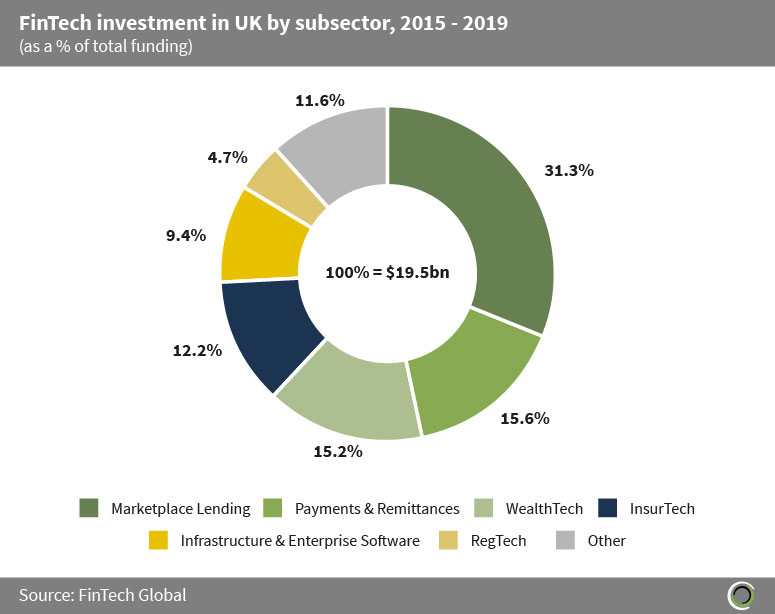

Marketplace Lending companies received almost one third of UK FinTech investment since 2015

- Marketplace Lending companies captured the lion’s share of FinTech investment in the country with 31.3% raised by UK companies operating in the subsector since 2015. The UK FinTech sector has produced world leading Marketplace Lending companies such as Funding Circle, Zopa, and Ratesetter.

- Payments & Remittances and WealthTech are the next most funded subsectors receiving 15.6% and 15.2% of total funding, respectively, between 2015 and 2019. This comes as no surprise given that the UK FinTech ecosystem has also produced world leading challenger banks (Starling Bank, Atom Bank and Monzo) and leading Payments & Remittances companies (Transferwise and WorldRemit).

- The Other category contains Real Estate, Blockchain & Cryptocurrencies, Institutional Investment & Trading, Data & Analytics, and Funding Platforms companies, which collectively raised 11.6% of FinTech investment since 2015.

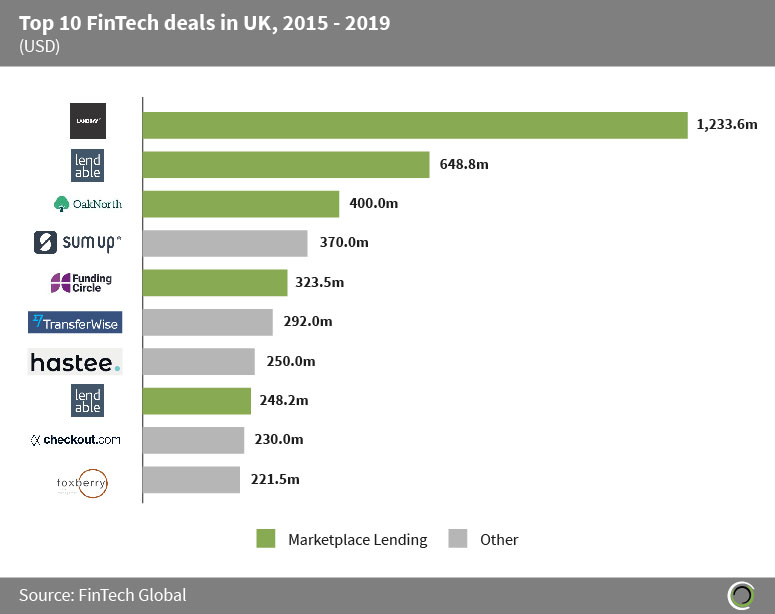

Five of the top 10 FinTech deals last year were raised by Marketplace Lending companies

- Of the top 10 UK FinTech deals five were raised by Marketplace Lending companies, which is unsurprising given the subsector captured the majority of UK investment in 2019.

- Landbay, a UK PropTech platform, raised $1.2bn in a debt financing round in July 2019, the largest UK FinTech transaction that year. The company plans to use the funding to grow their buy-to-let lending in the next couple of years. Since Landbay was founded in 2014 their workforce in London has doubled and the company’s lending volume has increased by 200%.

- SumUp, a UK mobile payments company, raised $370m in a debt financing round led by Bain Capital Credit and Goldman Sachs Private Capital Investing in July 2019. The company will use the funding to grow their product suite organically and through M&A.

- The Other category contains three Payments & Remittances companies (SumUp, TransferWise, and Checkout), an Infrastructure & Enterprise Software company (Hastee), and a Data & Analytics company (Foxberry).

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2020 FinTech Global