FinTech companies in the Nordics raised $321.6m in the first quarter of the year with Klarna and Tink closing large investments

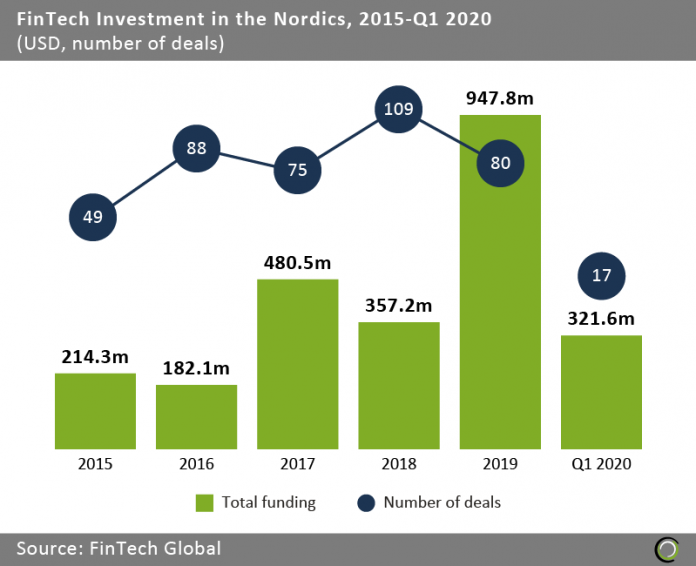

- The FinTech industry in the Nordics recorded strong growth in investment between 2016 and 2019 as investors backed innovative startups in the region developing digital solutions for established financial services firms. Total funding grew at a CAGR of 45% from $214.3m to nearly $1bn at the end of last year.

- Deal activity also increased during the period, peaking at 109 transactions in 2018 before slowing down to 80 in 2019. However, that year FinTech companies in the region raised a record amount of capital, $947.8m, mainly driven by a massive $460m funding round completed by Klarna, the Swedish digital payments and e-commerce giant.

- Investment in the region had a strong start to 2020 with $321.6m capital invested, a growth of 76.4% YoY compared to Q1 2019. That being said, 93% of that funding came from two deals completed by Klarna and Tink, an API provider for open banking, which raised $200m and raised $200m and €90m, respectively.

Swedish companies raised three of the top five FinTech deals in the Nordics in Q1 2020

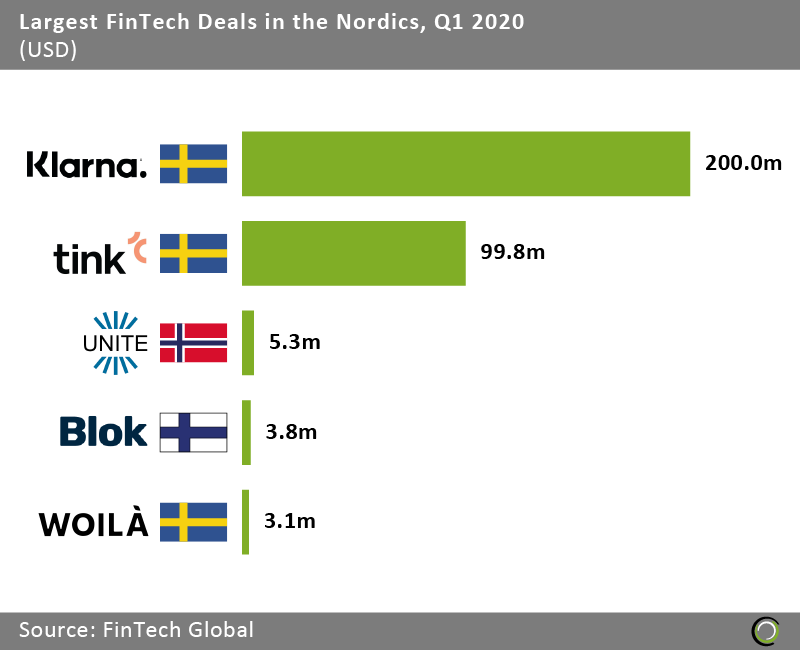

- The top five FinTech deals in the Nordics completed during the opening quarter of 2020 raised in aggregate $311.9m, making up 96.9% of the overall investment in the region during the quarter. The high levels of concentration of capital in large deals is a trend that will be prevalent in 2020 due to the declining number of early-stage deals caused by the economic uncertainty amid the coronavirus pandemic.

- Swedish companies took three spots on the list with Klarna, Tink and Woila, a personal finance app tracking price changes, all raising venture rounds in Q1. Norway and Finland also had representatives in the ranking with Unite Global, a cross-border payments software, and Blok, a digital real estate agent, raising $5.3m and $3.8m, respectively.

- The largest deal of the period was raised by Klarna, which picked up $200m from the Commonwealth Bank of Australia (CBA). The funding round kept Klarna’s valuation at $5.5m and offered CBA additional rights and exposure to Klarna’s international growth as the company rolled out in Australia.

Over half of FinTech deals in the Nordics since 2015 have been completed by Swedish companies

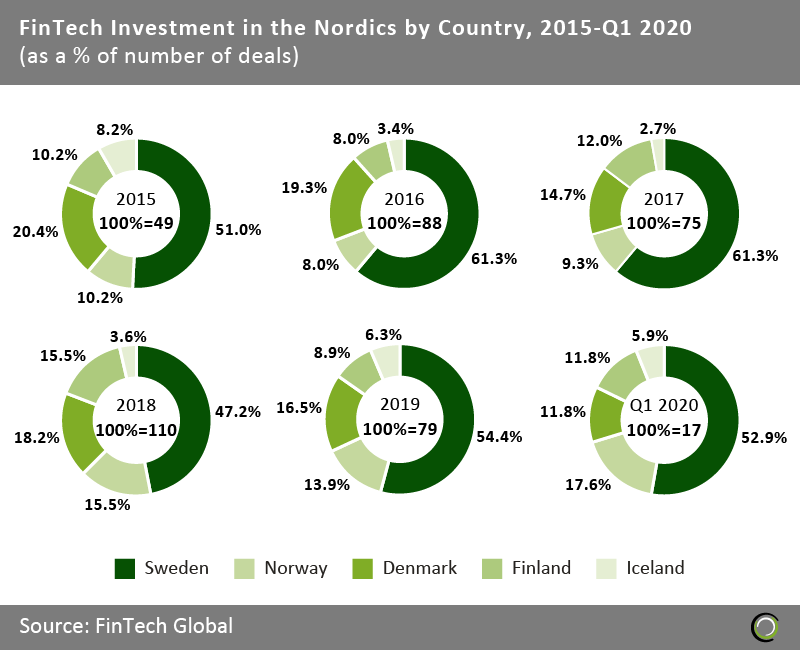

- Companies based in Sweden captured 54.8% of the 418 deals completed by FinTech companies in the Nordics between 2015 and Q1 2020. This is unsurprising given Sweden’s tech-savvy population which is quick to adopt new technologies and the country’s supportive government which invests over 3% of GDP in research and development efforts.

- However, the country’s share of deal activity has declined over recent years as other countries in the region are fostering strong FinTech ecosystem attracting new capital from investors. Sweden’s share of deal activity in the region has steadily declined from its peak of 61.3% in 2017 to 52.9% in the first quarter of 2019.

- The country that saw the biggest growth in deal activity was Norway. Companies in the country completed 17.6% of all FinTech deals in the region during Q1 2020, a growth of 7.4 percentage points. Norway’s progress is spearheaded by banks which made huge commitments towards digital transformation by setting up dedicated investment funds, as well as the government which launched a regulatory Sandbox in 2019 to foster FinTech innovation.

Four sectors drive FinTech investment in Sweden completing 75% of all deals in the country

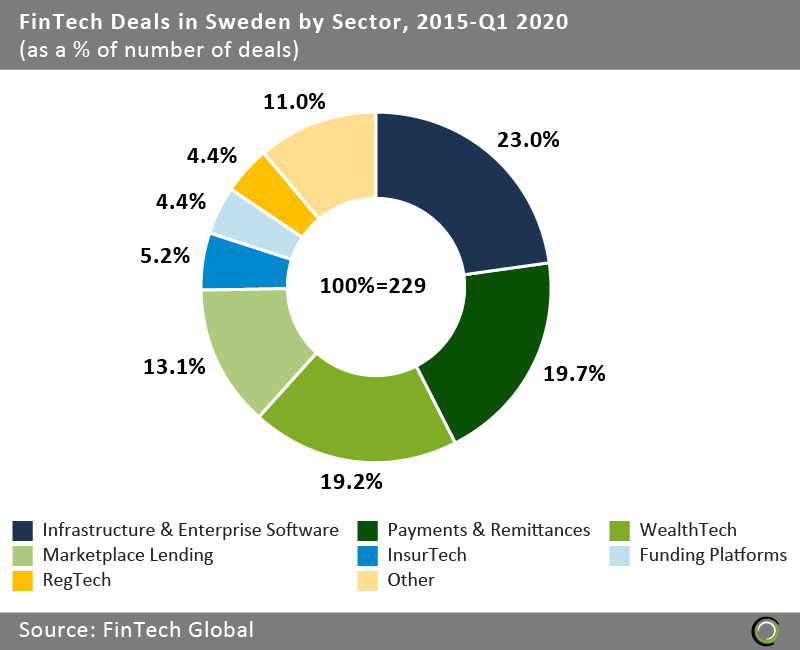

- As the FinTech leader in the Nordics, it is interesting to dive deeper into the Swedish ecosystem and see which sectors have been driving the growth in the industry. Infrastructure & Enterprise Software, Payments & Remittances, WealthTech and Marketplace Lending companies completed 75% of all FinTech deals in the country since 2015.

- Infrastructure & Enterprise software companies attracted the largest share of deals in the country since 2015 taking 23.0% of all FinTech transactions in the country. With population who is considered to be extremely tech savvy and more frequent users of mobile phones than people in other regions, there is a strong need to be fully present in all digital channels and in a way that is engaging to customers. As such there are many startups developing products to move financial services in digital channels.

- Payments & Remittances companies also captured a healthy share of deals, accounting for 19.7% of deals in the country during the period. This is unsurprising considering only 20% of payments in Sweden are made with cash and the central bank is already looking at introducing a national digital currency, the e-krona. As a result, Sweden is home to two unicorns in the sector – iZettle and Klarna.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global.

Copyright © 2020 FinTech Global