Key Nordic FinTech investment stats in 2023:

• Nordic FinTech companies raised a combined $414m in 2023, a 83% decline from 2022

• Nordic FinTech deal activity totalled at 110 deals in 2023, a 48% drop YoY

• Sweden was the most active Nordic country for FinTech deals with 51 completed funding rounds during 2023

In 2023, Nordic FinTech companies experienced a significant decline in fundraising, with a total of $414m raised, marking an 83% reduction compared to the previous year. This downturn was mirrored in deal activity, with only 110 deals completed in 2023, representing a notable 48% drop YoY.

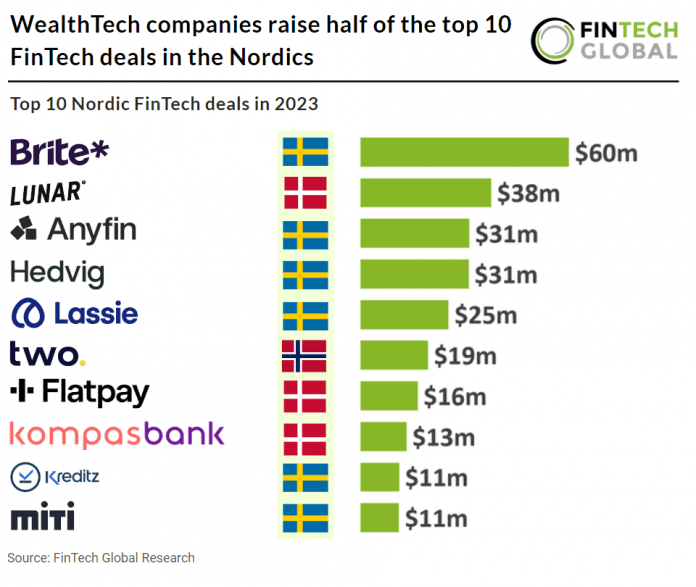

Brite, an instant payment provider, had the largest Nordic FinTech deal in 2023 after raising $60m in their Series A funding round, led by Dawn Capital. Currently, the company boasts connections to 3,800 banks across 25 European countries. In a remarkable feat, Brite Payments reported more than doubling its transaction volume and revenue in 2022, which ultimately led to achieving profitability. This milestone coincided with the appointment of a new Chief Financial Officer (CFO) and Chief Operating Officer (COO) in July this year. A significant focus of this expansion effort is the further development of the Brite Instant Payments Network. This proprietary network is engineered to enable 24/7 “instant” processing throughout the year. Brite Payments claims that this network offers “significant advantages” over conventional open banking payments. It ensures full receipt of funds and enables instant settlement in the currency preferred by the merchant.

Sweden was the most active Nordic country for FinTech deals with 51 in total during 2023, a 46% share of deals. Denmark was second with a 21% share of deals and Norway was third with a 19% share of total deals.