UK challenger bank Revolut has launched a bank in Lithuania after having achieved a European banking licence in the tail end of 2018, but says it might just be the beginning of further expansion across the continent.

The new bank will be offering customer deposits that are insured in the same way as other banks by the state deposit insurance. The bank already has over 300,000 customers in the country who are now able to upgrade from their e-money accounts to bank deposit accounts through the app. Revolut claims that the process will only take a few moments.

In the next few months, Revolut Bank is planning to roll out consumer lending services, including consumer loans and credit cards. It is also looking to launch its Revolut Junior accounts for children and young people between the ages of seven and 17 in Lithuania. This last tool was first unveiled in March 2020 and is designed to teach children to manage their own budgets while giving parents control and oversight of their children’s spending.

“Revolut has become a trusted household name in Lithuania,” said Virgilijus Mirkės, CEO for Revolut Bank. “We have achieved this by solving our customers’ problems, treating them fairly and being at the forefront of financial innovation. We are incredibly excited to take the next step in our mission to build a world-class bank for our customers in Lithuania.”

Revolut intends to passport its Lithuanian banking license to other Central and Eastern European countries later in the year, with Lithuania acting as a hub for the region.

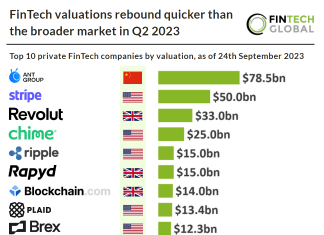

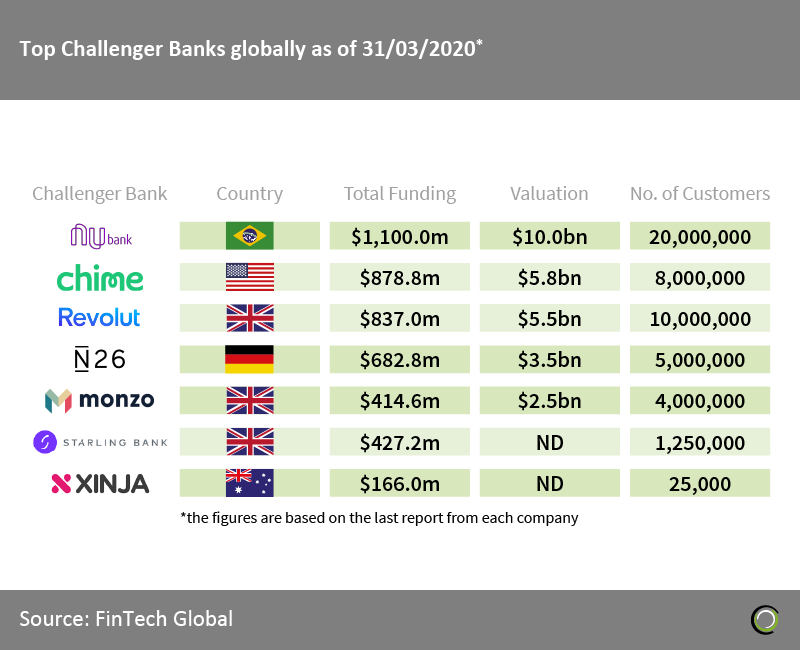

The challenger bank has not been resting on its laurels since it tapped into the deep pockets of its investors to raise $500m at the beginning of the year, making it arguably one of Europe’s most valuable private FinTech startups with a $5.5bn valuation. Swedish unicorn Klarna achieved the same valuation in the summer of 2019.

Since then, Revolut has launched a digital banking service in the US, launched a gold investment service for its premium and Metal users, had a Twitter spat with rival digital bank Monzo, and had to tackle the spread of the coronavirus and its impact on its services, which some believe could actually benefit the neobank as it could make more customers embrace electronic payments.

Today, Revolut claims to have over ten million users around the world, making it one of the leading challenger banks in the world, second only in terms of users to Brazilian rival Nubank that has a whooping 20 million customers.

Copyright © 2020 FinTech Global

Copyright © 2020 FinTech Global