Despite the hype around big data and data analytics, questions are placed on if it has it even come close to living up to the potential placed upon it.

Last year, the total amount of capital invested into companies building these types of solutions for the financial services industry declined, begging the question of, whether the sector, which offered a lot of promise, might be headed into tough times?

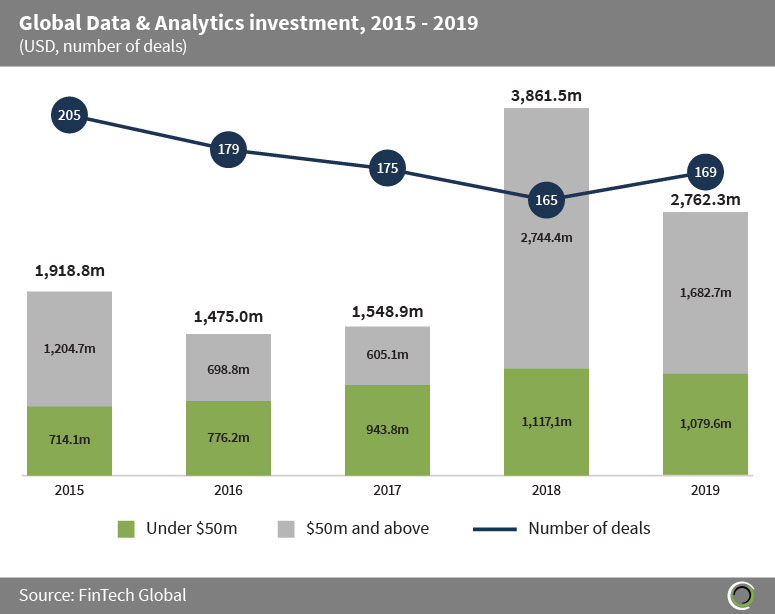

Between 2015 and 2019, around $11.5bn has been into businesses building data analytics solutions for the financial services space. Appetite appeared to peak in 2018, when $3.8bn was invested across 165 transactions; however, 2019 saw total capital deployed drop by 28.5% to just $2.7bn. The cause of this decline can be attributed to the drop in deals valued over $50m. However, FinTech Global data shows investment in deals valued less than $50m has stayed consistent throughout 2015 and 2019, suggesting the subsector’s stability with it consistently experiencing new entrants in the market.

The data suggests that the market is still seeing a steady stream of players entering the market, showing there are still opportunities to capitalise on. Despite funding dropping off for the bigger companies, there still seems to be appetite for the small companies, potentially showing there are still gaps a solution needs to be found for.

Shakti Mohapatra, head of data and analytics at IT advisory company Coeus Consulting, said, “We don’t think big data is losing its appeal. Quite the contrary. There is however, greater understanding around the fact that going shopping doesn’t necessarily generate the big wins that many organisations expect from their data and analytics programmes. The focus is slowly shifting towards a ‘start small and scale fast’ approach, something we have consistently recommended, and more modular sourcing strategies which explains a more diligent approach to funding.”

Organisations are not unaware of the importance of leveraging this data. A recent study from Coeus Consulting claimed that 74% of organisations believe monetising their data should be a key priority. Despite this, only 39% of those questioned in its survey, stated they were using data lakes and warehousing. While there adoption of data analytics is not as high as expected, it is changing. The report claimed that 66% of respondents were in the process of trialling machine learning, artificial intelligence and natural language processing solutions.

One of the issues that has held the use of data analytics and big data back is the complexity of getting it working. The technology needs to have access to as much data as possible, which is easier said than done. This is especially the case for financial institutions which have been around for decades and are heavily reliant on legacy systems and disjointed datasets. A report from Cloud Technology Solutions claimed that 92 of the world’s top 100 were still relying on legacy systems and 80% of budgets were being spent on maintaining them. Due to this and the data siloes it creates, most institutions are only using 0.5% of their data. While hype has been surrounding the data analytics space, these setbacks have failed to let it really take-off.

Maksim Konovalikhin, the chief data scientist at Russian bank VTB Bank, said, “No, it has not [reached its full potential], primarily because of the “fragmentation” of many data sources and the legal difficulties in their integration. Analytical tools are also constantly being improved which takes away more and more routine work from analysts.”

There is a huge opportunity waiting to be realised and can only be done once the issues around data connectivity can be solved. Predictive analytics in banking is believed to be worth around $1.2bn in 2019, according to Allied Market Research, but this will grow at a compound annual growth rate of 20.8% to become a $5.43bn industry by 2026.

“The concept of big data was amazing but the reality over the hype is complexity. Big data is available but the constraint is in how to join it together, centralise it and analyse it,” said Andy Lilley, the chief product officer at London-based FinTech Rimilia. “A data warehouse, data lake, data ocean is all very good but the power comes from linking the data together logically to then analyse it. The effort to achieve this causes challenges which are then exaggerated by the timing. The world wants real time data at our fingertips, not two days later when the moment has passed and the world has moved on and it’s too late to turn the insight into action.”

The survey from Coeus Consulting also explored the benefits organisations perceived of implementing data analytics. Improved customer insights was the most popular reason, with 43% of respondents offering the answer. This was followed by 41% stating it was an improved ability to take proactive, predictive decisions. Other reasons stated included improving risk management and regulatory requirement processes (37%), better meeting customer needs (24%) and boosting ability to spot future business opportunities (20%). Surprisingly, the least popular answer was attracting new customers, with only 12% stating this as a motivation.

There are a wide variety of benefits data analytics can and is having for financial services. Companies are now able to offer customers more personalised services, tailoring financial products to their specific needs, whether that is insurance, investing or savings. By making use of the new datasets, they can look more deeply at each of their customers and what they actually need, because at the end of the day, everyone is different and face different challenges. The industry just needs to find a way to overcome the data silo challenges.

Sidharth Mukherjee managing director of knowledge services at digital integrated business services company Teleperformance said, “I think what we will see – and indeed need to see – in the near future is a more consolidated and unified view of data. Data integration is the building block that can make or break an organisation’s ability to remain ahead in today’s disruptive digital age. However, with a strategic data plan that is actionable, relevant and reliable, companies are better positioned to develop and enhance services, manage performance and support their customers’ experiences.”

To ensure analytics can have maximum impact, there still needs to be a human layer involved. Talk around AI is often accompanied by how the technology will see the end of the human worker and how the robots will take over. This is very unlikely to be the case. Instead, it is more likely for the AI to be used to gather the relevant information and build an insight for the human to then use to compliment their own work.

VTB Bank’ Maksim Konovalikhin said, “I think the future will depend on platform solutions that can significantly automate the work of both analysts and ML specialists, particularly when they deal with structured, unstructured or complex structured data. It’s important to have synergy between hardware and software solutions allowing for quick and efficient processing of huge amounts of unstructured data.” Also speaking on the point, Dan Somers, CEO at Warwick Analytics said, “The perfect data analytics solutions comprise high levels of automation and minimal, but still very necessary, human intervention.”

The sheer amount of data being collected on people is staggering. Our daily lives are being overrun with interactions with technology and these are all collecting information on our lives. Whether it’s cookies tracking what websites we go to, Fitbits tracking how much we’re exercising or google tracking the exact places we are visiting, the information available on us is immense and companies are finding even more ways to collect data on us. Sidharth Mukherjee Managing Director at Teleperformance added, “If you consider that 90 per cent of big data has been created since 2016 and that every two years, the amount of data available doubles, the size of this is staggering. An underlying reason for this surge in big data is due to trends such as IoT, mobility, connected devices, social media and so on.”

Thinking about the amount of data companies have on us is quite alarming and highlights the importance of data protection regulations like the General Data Protection Regulation, even though it seemed like a burden to reaffirm cookie rights on websites. But, initiatives like open banking do show it is not all bad. By giving access of data to financial services, customers can begin to be given personal advice with their finances, helping them to take the steps that is right for them.

Shakti Mohapatra, head of data and analytics at Coeus Consulting, said, “We think Open Banking (PSD2) will fundamentally disrupt banking and adjacent sectors in the near to medium term. As modes of big-data exchange become more standardised and secure, a richer ecosystem of partners and service orchestrators will emerge providing superior customer experience, something that consumers have been crying out for in financial services for some time now.

“We are already seeing this take shape with the growing popularity of challenger banks and fully digital and AI driven offerings in the lending, trading and wealth-management space. Incumbents will need to adapt quickly and ensure they are clear about what role they take in these ecosystems – supplier, aggregator or orchestrator.”

Customer demand is changing and people are leaning more towards digital experiences. As companies incorporate more open banking services, customers are likely to realise the appeal of sharing their data. To make full use of this, firms will need to ensure they have the capabilities to process and analyse all of this new information coming in.

“Big-data evolution will be shaped by the need for organisations to pivot to new business models, driven by open banking led ecosystems,” Mohapatra added. “We also expect AI and deep learning to pose new demands on big data infrastructure, requiring higher levels of flexibility and scalability to support increasing levels of model sophistication.”

Copyright © 2020 FinTech Global