The insurance space has been a hotbed of innovation over the past few years, but pricing might have been left out.

When AI-powered pricing software developer AKUR8 built its services, it was surprised to be the only one looking to automate the pricing process and maintain full transparency, according to Akur8 co-founder and CEO Samuel Falmagne.

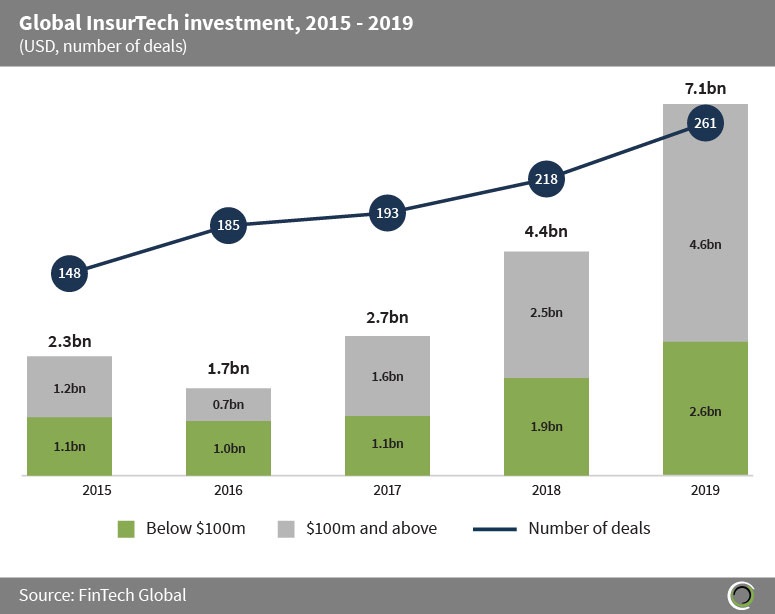

But it’s not like innovation hasn’t happened in the InsurTech space. InsurTech has received a lot of attention from investors over the years. Since 2015, more than $18bn has been invested into companies building technology solutions for the insurance sector.

Interest has only been increasing over the years, with a total of $7.1bn being invested into the InsurTech space during 2019, which is $2.7bn more capital than deployed during 2018. The volume of deals has risen in tandem with the amount of equity invested. Last year, there were 261 InsurTechs to close a funding round.

With the coronavirus forcing the world to indoors, never has there been more of a need for insurance firms to explore digital tools. Companies are seeking ways to maintain their operations during this pandemic. While the world will eventually return back to normal with people allowed to go outside freely, insurance may be changed permanently by the deeper incorporation of digital services. With this rise in demand, companies will be searching for the opportunities and many more InsurTechs could be formed. However, Falmagne believes there is a lack of automated pricing services in the market.

With the coronavirus forcing the world to indoors, never has there been more of a need for insurance firms to explore digital tools. Companies are seeking ways to maintain their operations during this pandemic. While the world will eventually return back to normal with people allowed to go outside freely, insurance may be changed permanently by the deeper incorporation of digital services. With this rise in demand, companies will be searching for the opportunities and many more InsurTechs could be formed. However, Falmagne believes there is a lack of automated pricing services in the market.

“There are so many processes around underwriting, claims management or providing data, but nothing around pricing,” said Falmagne. “That has really surprised me. Of course, I understood this is because the process requires so much transparency and it requires lots of investment into R&D and lots of technical expertise.”

Akur8 claims to have built the world’s only algorithms which are capable of automating the full pricing process, whilst keeping full transparency. The software is designed to give actuaries full control over the models to better understand them and apply their business knowledge. The problem with other services in the market is they are largely black boxes, not giving the actuaries the confidence in the models to control or modify what is being done by the solution. This has resulted in a lot of companies lacking trust in AI, he said.

“They are too much of a black box,” Falmagne said. “So, they create very high risk in terms of compliance with regulation under the term of adverse selection, meaning under estimating some parts of the portfolio and attracting all the bad customers, which means that the cost of mistaken pricing in insurance is huge.”

Realising this problem in the market was the first steps of Akur8’s creation. Pricing is heavily manual and can take months to build risk models and to update prices for insurers. The company was founded in 2018 by Falmagne and Guillaume Béraud Sudreau with the aim to become the market leader for digital insurance pricing, which, in their own words, is a “very specific niche,” Falmagne said.

One of the downsides of being the first to change the pricing process, was no one really expected it to happen. So Akur8 spent six months creating pilots with companies and networking to show that it was possible to automate processing and keep the transparency, and initial reactions were very positive, he said.

In the early days of Akur8, Falmagne had been helping to develop the Akur8 platform in his free time. He was already working at another InsurTech at the time, meaning that he could only spend his evenings and weekends to create Akur8.

“I was quite involved in the other InsurTech, I was managing a team and I didn’t want me to do my job 50%, but at the same time, I was really passionate about building Akur8,” he said. Falmagne was eager to get engrossed with building the new startup, creating the creating the brand and material, as well as raising funds. “It was not an easy moment in terms of time allocation, but it was really fascinating because on one side I had a job that I really loved… and I had the chance to be at the very beginning of the creation of a new a new startup,” he explained.

Akur8 has built an AI-powered pricing solution which can enable insurance carriers to improve their profits and win market share with pricing models that are created and updated within hours, as opposed to months. The technology embeds all of the steps within the pricing process into a single solution, automating the model building while giving clients complete control on the model.

Every company faces challenges, and one of the biggest obstacles which faced Akur8 was changing people stuck in their ways. “you’ve got users that are used to working in a certain way, heavily manually, but now they can see that there is a solution that can automate a significant part of the process,” he added. “It’s a huge impact to, so the users need to learn how to work in a different way.” This is a common issue with companies which have had processes in place for a very long time and it is normally coupled with the fear that the technology will result in the loss of jobs, however, with Akur8 “the objective of the solution is not to replace actuary, but it’s just to allow them to do their job better, faster and with accuracy,” Falmagne said.

The company is only automating the data-driven part of the process so actuaries can have more time leveraging their expertise to create the best models and pricing structures. Falmagne believes there will never be a time where the process is completely taken over by an AI solution, as there will always be a need for human expertise. For example, the AI systems rely on data, but if there is only little available, the technology cannot operate optimally, needing for a human to leverage their expertise and experience to create the model.

Once actuaries see they are not about to lose their jobs to AI, the task is to help them begin to trust the AI solutions. When the automated AI solution comes in, the output is often very different to the models that were created by the actuaries, which is because the solution can assess a wider pool of information quicker and find the best outcome, a human cannot, he said. This even brings up issues of actuaries thinking they could have done better, but “they couldn’t have done better on their side because they cannot spend two years trying all the potential combination of models to find the best one.”

This is why transparency is key for the algorithms. They need to be explainable so actuaries can understand where decisions came from and understand why it is statistically the best option, rather than blindly trusting the technology.

Earlier in the year, the InsurTech closed its Series A round on €8m to help it boost its growth. The funds were supplied by Blackfin Capital Partners and MTech Capital. With the close of the round, the InsurTech is focusing on increasing its international expansion and partnerships with data providers, which will help it to deepen the capabilities of its machine learning technology. Akur8 is planning on forming these data partnerships so it can give its clients access to external data, enabling them to build models with wider data sources which will increase their validity and profitability.

Over the coming year, Akur8 is also looking towards its international growth. It is already opening an office in the US and is also hoping to open one in the UK later in the year.

Copyright © 2020 FinTech Global