From: RegTech Analyst

Cybersecurity company Synack has raised $52m in a Series D funding round to transform security testing through its crowdsourced platform powered by ethical hackers.

New investors B Capital Group and C5 Capital co-led the round, bringing total funding to $112.1m. Previous investors GGV Capital, GV (formerly Google Ventures), Hewlett Packard Enterprise, Icon Ventures, Intel Capital, Kleiner Perkins, Microsoft’s venture fund M12 and Singtel Innov8 also participated in the round.

Founded in 2013, Synack today has more than 1,500 of skilled ethical hackers from 82 countries as active members of the Synack Red Team. Synack augments their talents with continuous security monitoring technology that utilises machine learning and AI to quickly and more efficiently root out vulnerabilities.

Today Synack counts some of the world’s leading banks, retailers and healthcare companies that together represent over $1tn in assets as well as major federal government agencies such as the Department of Defense.

Synack will use the money invest even more in its hacker community, further advance its SmartScan technology that continuously monitors for vulnerabilities and enhance data analytics and research to demonstrate the value of Synack’s hacker-driven approach.

The scaleup will also look towards international expansions and continuous innnovation around AI and machine learning in order to improve its cybersecurity offering. This is something it is certain more companies will need as the coronavirus pandemic has forced many employers to embrace remote working, which has in turn created a whole new attack surface for bad actors.

“For years, remote work has become more and more desirable. Now, it’s essential. Companies of all sizes are leaning on the platforms and services that enable a more nimble, dispersed workforce,” said Jay Kaplan, CEO of Synack.

“The only way to guarantee trust and control in cybersecurity used to be through on-site work. That’s simply no longer the case. Synack can maintain trust and visibility all while giving customers access to an army of the most talented ethical hackers to defend against today’s relentless cyberattacks. Over the past seven years, we’ve proven this model has kept critical organizations safe.”

Premier investors B Capital Group and C5 Capital said they would be supporting the company on the next stage of Synack’s growth.

“Synack offers a market-leading and unique augmented intelligence cybersecurity platform to secure mission-critical applications for some of the world’s largest banks, retailers, technology vendors, and federal agencies,” said Rashmi Gopinath, general partner at B Capital Group. “The remote, crowdsourced model is incredibly vital for organizations to fast track security testing especially in the current environment. Synack’s approach will become the default way for all organizations – regardless of their size – to test vulnerable digital assets. I am really excited to back the Synack team for a second time through B Capital.”

C5 Capital’s leadership added that it had recognised the critical role Synack plays in solving the cybersecurity talent gap, which has become glaringly apparent during the current health crisis by working to secure COVID-19 related apps from key government agencies. The investor highlighted how in March, the Synack Red Team spent 70% more time hunting for vulnerabilities and found 250% more flaws than the same period last year.

“This is a model that can resolve the widening cybersecurity skills gap,” said William Kilmer, managing partner of C5 Capital, “The combination of crowdsourced penetration testing with hackers from more than 80 different countries and insights from artificial intelligence enables sustainable security at scale, giving organisations the ability to take advantage of the world’s best ethical hackers to protect critical information and customer data. We believe this powerful combination has the potential to solve many current and future cybersecurity issues.”

Synack’s emphasis on remote working is nothing new. In fact, several other RegTech industry stakeholders have pointed out that this could be a key driver of the cybersecurity segment of the sector in the future.

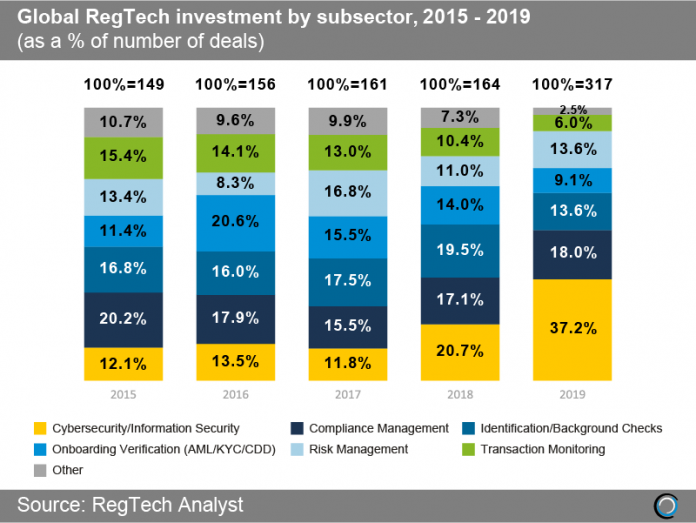

Of course, cybersecurity is already one of the biggest beneficiaries of investment in the industry. In 2018 it attracted 20.7% of all the investment and in 2019 that figure jumped to 37.2%, according to RegTech Analyst’s research. The compliance management and the identity verification sector respectively attracted 18% and 13.6% of the total RegTech funding.