French FinTech iBanFirst has successfully raised €21m ($23.8m) in a Series C round, but things could reportedly have gone very differently.

The cross-border transaction company was apparently working on this investment round before Covid-19 became a thing. However, TechCrunch reported that the deal wobbled when the lead investor decided to abandon the deal at the very last minute.

Fortunately for iBanFirst, it managed to find two new investors in Elaia and Bpifrance, which supported the raise through its growth capital fund Large Venture. The two investors injected cash into the startup alongside previous backers Serena and Breega. Both of them had previously supported iBanFirst’s 2018 €15m investment round. The new investors will also find themselves alongside French billionaire Xavier Niel, who acquired stakes in the company in October 2016

Pierre-Antoine Dusoulier, CEO and founder of iBanfirst, was quick to express to his delight for the support from the two new investors and to join their portfolios, saying that they were “two major players in French venture capital and their ability to support the entrepreneurs and companies they invest in is well established.”

“This is a decisive step towards achieving maturity as a company and pursuing our goal of becoming the leading platform for B2B multi-currency financial services,” Dusoulier said. “While continuing to deliver technological solutions that improve user experience, we will keep expanding our SME and mid-tier offering. To support companies in their international growth, we will strive to offer transactions that are increasingly straightforward, secure and transparent, within a network nurturing mutual trust.”

The company stated that the new investment comes at a time of monumental change in the payment industries, particularly for SMEs and mid-tier ventures where the leadership increasingly expect faster, more transparent and secure transactions.

“The digitisation of the traditional economy is not only underway, but it has been drastically accelerated by the current health crisis,” said Xavier Lazarus, managing partner at Elaia. “The FinTech sector, and especially the international payments sector, is on course to becoming one of the clear winners of this crisis period. While the bulk of the market remains in the hands of offline historical players, their quality of service and transaction costs are increasingly challenged.

“This is why we are both proud and delighted to support iBanFirst in its international growth and in the development of a leading pan-European digital platform specialised in B2B payment services and currency exchange. From the determination of the company’s management team, the quality of the tech platform and financial processing on offer, right through to iBanFirst’s already impressive performance – the lockdown period being no exception – the evidence is overwhelming that this is a historic opportunity to be part of the development of a leading tech company here in Paris.”

Over the past few years iBanFirst has grown its European footprint tremendously, having acquired Dutch and German competitors NBWM and Forexfix at the end of 2019. The startup also boasted an increase in the volume of payment transactions that it has processed almost tripled, with an average 180% year-on-year increase, pushing the company to enjoy “three-figure revenue growth as well.” Since 2016, the company has grown from 16 employees to 180 employees in 2020.

Commenting on the investment, Damien Launoy, late-stage investor at Bpifrance Large Venture, said, “Bpifrance collaborates daily with the SMEs and mid-tier companies that iBanFirst caters for, and we are fully confident that such companies have an increasing need for improved services when it comes to international payments and currency exchange. These needs are all the more palpable in such uncertain times, and will be in the months to follow, when these companies will have to resume or intensify trade with the greatest possible ease and flexibility.

“We are therefore delighted to be a part of this new chapter in iBanFirst’s development and we are eager to support the company’s management team in their growth ambitions, as they facilitate the digitalisation of SMEs and mid-tier companies. We are confident that iBanFirst will quickly become a leading international tech company, like many of the companies we invest in via our Large Venture fund.”

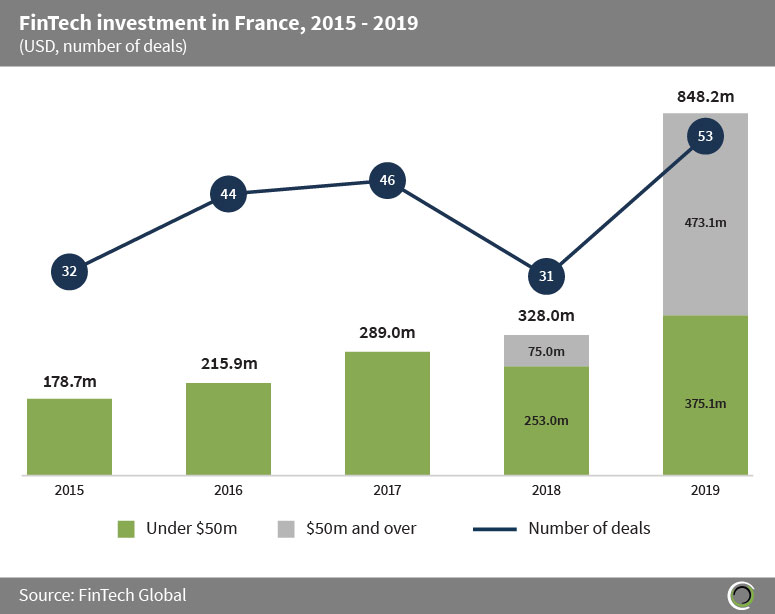

The news comes as the French FinTech sector has gone from strength to strength over the past five years. Back in 2015, the country’s FinTech companies attracted a total of $178.7m in total, according to FinTech Global’s research. That figure jumped to $848.2m in 2019. In total, the country’s FinTech companies raised over $1.8bn in the period.

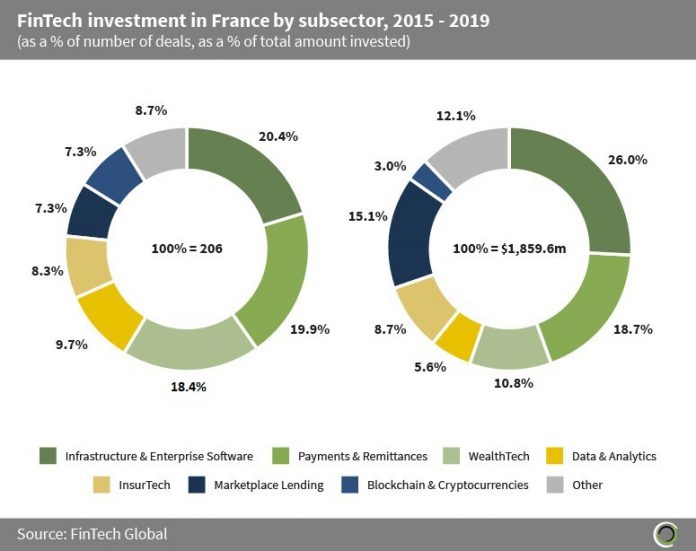

The growth in the nation’s industry has been driven by large infrastructure and enterprise software deals. This segment has accounted for 26% of the total investment seen in the country since 2015. Companies in the subsector were also responsible for the highest deal activity in the country with 42 transactions completed during the period.

Of course, that does not mean that other segments of the FinTech industry has not contributed to the strength of the sector. Payments and remittances ventures made up 19.9% of the total FinTech investment seen in the nation during the period, securing nearly $350m since 2015. In the same time, French WealthTech companies accounted for 18.4% of total deals in the country but only accounted for 10.8% of funding during the period.

Copyright © 2020 FinTech Global

Copyright © 2020 FinTech Global