AltFINS, a cryptocurrency trading management platform, has reportedly raised €1m in a seed funding round to improve its technology offering.

Slovakia-based CB Investment Management served as the lead investor to the round, according to a report from EU-startups.

Capital from the round is earmarked for the expansion of the company’s technology capabilities, as well as boosting the scalability to ensure more institutional investors can make more informed decisions, the article said.

AltFINS, which is also based in Slovakia, gives traders with a holistic dashboard for manage their digital asset portfolios. Users can scan cryptocurrency markets for trading opportunities to create and execute their investments.

In the dashboard they can receive real-time data and analytics on the markets, aggregate news from across the web, filter coins based on chart patterns and trade across 20 crypto exchanges.

CB Investment Management partner Dano Gašpar told EU-startups, “altFINS brings an innovative approach to much-needed transparency to the growing digital assets market. A platform that combines trade idea discovery and execution with fundamental analysis is truly unique in the crypto trading space.”

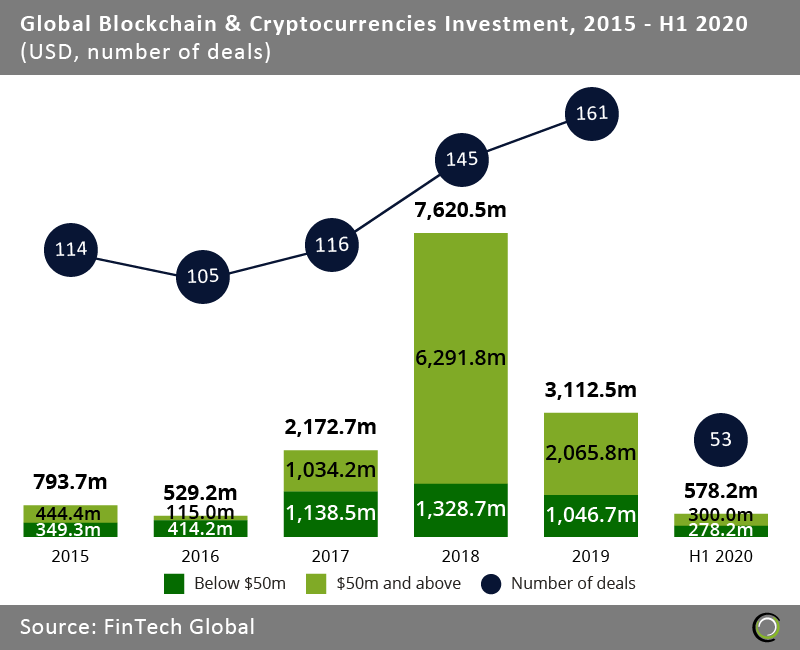

The blockchain and cryptocurrency market has been very unpredictable. The appetite for interests seems to differ each year, rising to the heights of $7.6bn in 2018 down to the lows of $529m in 2016.

The funding levels for cryptocurrency and blockchain companies grew by a CAGR of 279.5% between 2015 and 2018. Despite this huge rise, funding declined in 2019 to $3.1bn, less than half of the capital raised the year before. The funding may have been lower, but there were 16 more deals completed in 2019 than in 2018.

The funding levels for cryptocurrency and blockchain companies grew by a CAGR of 279.5% between 2015 and 2018. Despite this huge rise, funding declined in 2019 to $3.1bn, less than half of the capital raised the year before. The funding may have been lower, but there were 16 more deals completed in 2019 than in 2018.

This Funding spike in 2018 is likely due to the popularity Bitcoin reached in 2017. Bitcoin is the most notorious cryptocurrency and in December 2017 the price of one coin reached a colossal $19,783. The price levels helped bring the currency to the attention of the general public, with many people, previously unaware of cryptocurrency, talking about it and investing. Due to this, more cryptocurrency projects began to crop up and the future of these services were bright.

However, the price of Bitcoin took a massive dip in 2018 and has not recovered to the same heights. Countries around the world have implemented various regulations around digital assets, but many are still cautious of their usage.

Copyright © 2020 FinTech Global