Biometric-enabled payment company Zwipe has raised NOK96m ($10.63m) in a post-IPO round to fuel the further development of its service well into 2021.

The Norwegian company made the raise through a private placement of 6,381,315 new shares at a price of NOK15 per share. The placement took place through an accelerated book building process managed by retained Arctic Securities AS and Erik Penser Bank AB as joint bookrunners.

“After completion of this private placement, Zwipe is funded through commercial launches in 2021 and beyond based on the current business plan and market assumptions,” said André Løvestam, CEO of Zwipe. “We now look forward to taking a leading role in the biometric payment space and embarking on a long journey of value creation for our customers, our shareholders and society at large.”

Jörgen Lantto, chairman of the board of directors of Zwipe, added, “We are humble and proud to receive overwhelming support from high quality international and Nordic institutional investors, considerably strengthening our shareholder base. In particular, the new funding will allow the company to further accelerate our commercial activities to cater for the strong demand from smart card manufacturers and card issuers for Zwipe Pay ONE, our new technology platform for biometric payment cards”.

The payment date for the offer shares will be on or about 10 September 2020, with delivery of the offer shares expected on or about 14 September 2020.

The news comes more than a year after Zwipe raised $14m in January 2019 ahead of it going public a few weeks later.

Since then it has launched a new European tech hub in Germany and teamed up with TAG Systems Group to build a biometric commercial card.

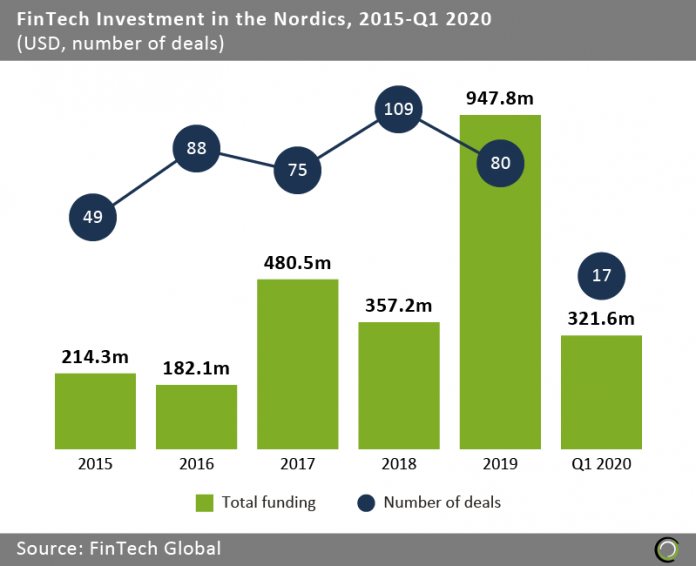

The Nordics have grown tremendously in recent years, often powered by innovation in Sweden. In 2015, the region’s FinTech ventures raised $214.3m across 49 rounds, according to FinTech Global’s data. By 2019, that number had risen to $947.8m across 80 deals. The sector was seemingly on track for another record year in the first quarter of 2020, with the sector raising $321.6m across 17 deals.

Copyright © 2020 FinTech Global