From: RegTech Analyst

Regulators around the world are working on implementing new standards for data collection and reporting. However, could this be a threat to the RegTech industry?

RegTech used to be so simple because regulations weren’t. Following the credit crunch of 2008, lawmakers around the world rushed to write up and pass new pieces of legislation that would prevent another recession from happening in the same way.

This marked the beginning of the RegTech gold rush. As companies clamoured for solutions to help them make sense of the complexities brought on by the new laws, innovative entrepreneurs seized upon the opportunity to create technological solutions that would help businesses live up to their compliance requirements.

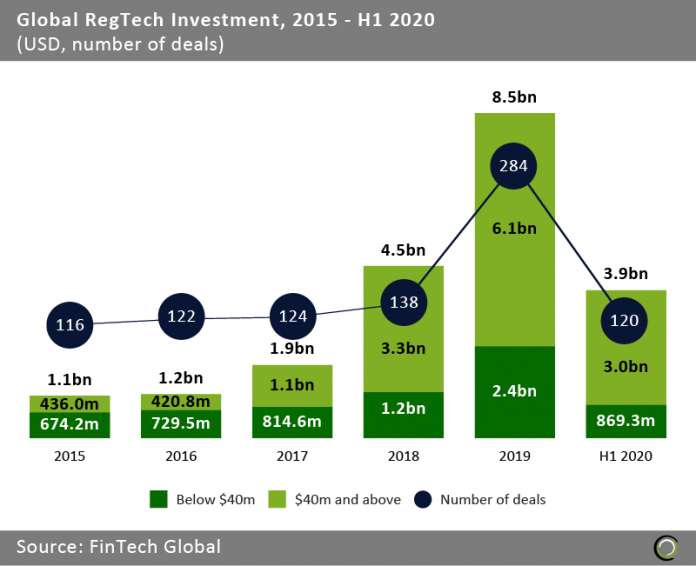

These innovators were able to make more than a few bucks on the back of the chaos. For instance, investment into the sector grew from $1.1bn being collected by the sector in 2015 to $8.5bn being injected into the industry in 2019, according to FinTech Global’s research.

However, now things might be changing because regulators are increasingly moving towards implementing new reporting and data collection standards. The idea is that this will reduce some of the complexities around reporting.

However, now things might be changing because regulators are increasingly moving towards implementing new reporting and data collection standards. The idea is that this will reduce some of the complexities around reporting.

But if RegTech companies have made their money out of the complexities of the industry, does that mean that these new standards could threaten the sector?

That was one of the topics that were up for a discussion on a panel hosted at the Global RegTech Summit.

The panel was moderated by Katherine Wilson, investor at the venture capital fund Illuminate Financial. The panel included heavy hitters like Joanne Horgan, chief innovation officer at RegTech Vizor; Chad Giussani head of transaction reporting, FM compliance at Standard Chartered Bank; and Angus Moir head of the data collection transformation team at the Bank of England.

The segment that began the conversation about the potential threat to the industry kicked off with Moir referencing several projects the Bank of England was currently working on. For instance, he recently participated in a joint innovation research project with the Financial Conduct Authority and financial services firms on how to more easily automate data reporting.

“As part of that project, we showed how we could potentially alternate the regulatory reporting by publishing instructions, not in PDF form as they currently are today, but perhaps in some sort of machine executable format, or regulations code,” Moir said.

The idea is that this would enable companies to more easily automate generate the reporting to regulators.

Moir is also involved in the ongoing Data Collection Review. The review was launched earlier this year in response to recommendations in the Future of Finance report, published in June 2019. The central bank is consulting with market stakeholders – such as banks, insurers and financial service providers – to explore how the next decade of regulatory reporting could be made easier.

“To give you feel about the kind of emerging findings from that review, we’re really excited about a strong sense that can accommodate standards and standardising the way that firms describe and identify their data,” Moir explained. “It’s really a core part and a key part [for] any solution moving forward in terms of complex data collection processes.”

Moir also said that the Bank of England is working on other projects on how to make the future of reporting less reliant on paperwork.

He added that one of the most massive challenges facing the sector right now is to ensure that financial service providers can put the data in the right place and in the right format before it can be analysed by the regulators.

“[That] is actually a pretty tough task,” Moir said. “And currently pretty expensive, inefficient. And so if we really want to unlock some of these analytical techniques, and get to a place where I think people basically want us to get to, [then] I think there’s quite a lot of hard work to be done first.”

Horgan agreed. “I think that’s probably where some of the challenge lies,” she said. “You hear that from banks [that] what a regulator considers [to be] the right format for what they want is so far removed from the operation standards used in banks. I guess that’s why we’re talking about data standards. Right. And there is that challenge for banks.”

Agreeing that this is a problem, Moir still added that one factor that makes the task of standardising data so much harder is that people struggle to agree on what the right standard should look like. Still, he recognised that, fundamentally, whether you’re a firm or a regulator, you’re looking at the same datasets. The trick, Moir argued, is to ensure that the communication between regulator and the industry is as clear as possible.

“We need a better way, a more efficient way of communicating the context or the way that we’re thinking about the world to firms to now enable them to produce the data that we want much more efficiently than is currently the case,” he said.

Giussani welcomed the initiatives from the Bank of England. “For us, it’s beneficial to have things as clearly defined and as easy to understand as possible [and] try and take away any element of human interpretation,” he said. “I think, depending on whichever role you’re in at the bank, just having certainty around sourcing and production of the data to make make the reporting is absolutely essential.”

Horgan echoed that sentiment when she was asked about how RegTech companies like Vizor can create solutions that benefit their clients. “The idea of having a single data model that is applicable across multiple jurisdictions, is very beneficial and it’s just a lot easier,” she said, adding that with Vizor working across 25 different countries, dealing with different regulatory interpretations across this variety of markets is one of the biggest challenge the company faces.

Wilson asked Giussani what the driver is behind companies like Standard Chartered Bank adopting new technology and advancing the record management space, if it was the tech or the processes and the desire for more operational efficiencies.

“I tend to say it is driven by process and efficiency, the striving for better process efficiency and control,” he replied. “There aren’t many times where we go out just looking for new tech to resolve something. We don’t just adopt tech because it’s new.”

He explained that usually, the people in the banks must make their case for what problem a new investment is likely to solve and then get a budget and the task of solving it.

However, Wilson noted that more standardisation might become a problem for RegTechs. Reading a question from the audience, she said, “Isn’t there a paradox here? Not necessarily on reducing ambiguity and reducing differences in interpretation, but an exception accentuating standardisation amongst jurisdictions.

“If the role of RegTech for reporting is to be seen as solving the cost of multiple reporting in diversity, [then] wouldn’t standardisation reduces value? And if the cost of regulatory reporting does decrease, would it make sense for regulators to experiment more on how to collect data? So I guess, is there a bit of a question hidden in there, which is, the more standardisation that kind of comes in, does it mean, that the opportunity for read text does not diminish?”

Horgan nodded. “I’ll be honest about [that] there are a lot of companies [that] make money out of the complexity that’s there,” she replied. “And I’m not trying to take away anybody’s business, but [if] we look at it, it is a little bit ridiculous what happens today. So, you have a regulator who decides [or] defines what needs to be collected, for example, and generally, they are defining that in some [way, which may not be] the most efficient way today, or they are defined in some machine readable way or some data model today.

“And [then] when data is released to the industry and with guidance notes, whatever it is in PDF, you have a whole other set of people that have to try and interpret [what the model is] going look like. How am I going to map my data to it? And I just think, yes, the cost of regulatory reporting should come down.”

Even though the complexities and costs of compliance may come down due to the introduction of these standards, Horgan believed that this would not spell out the end of the sector. “I still think there’s opportunity there for RegTech firms to help solve that problem,” she said.

Having spoken with both financial firms and RegTech startups, Moir agreed that more standards doesn’t necessarily mean worse business opportunities. “I think there’s a general understanding that the standards to a certain extent should be enablers of the RegTech industry,” he said.”It should be about creating an ecosystem, which is, which is more competitive, more dynamic, with more opportunities for firms to exploit opportunities.”

As an example, he said that the complexities might actually hold the industry back, arguing that they made it much harder to switch between two firms. This would, in turn, mean that the costs of switching are unnecessary high. “So I think there’s a lot of firms out there frustrated that they feel like they’ve got a better product than some of their competitors, but are unable to compete, because the cost of the changes is too high,” Moir said.

Copyright © 2020 FinTech Global