Italy’s digital payment scene could’ve just received a power boost after two native leaders in the sector, Nexi and SIA, inked a memorandum of understanding to merge.

And given the state of the investment into the nation’s FinTech industry, it may need all the help it can get.

CDPE3 and FSIA Investimenti signed the deal on SIA’s behalf and Mercury, a company owned by Bain Capital, Advent International and Clessidra funds, did the same on Nexi’s behalf.

The companies said that the transaction will create a European champion in digital payments, with roughly €1.8bn ($2.1bn) pro-forma aggregated revenues and about €1bn ($1.17bn) EBITDA as of December 31st, 2019.

“The new PayTech company, through its independent role and having CDP as anchor investor, will continue on its growth path as large Italian public company contributing, to an even greater extent, together with its partner banks, to further accelerate the digital payments penetration in Italy and to the digitalisation and modernisation of the country in favour of citizens, enterprises and Public Administration.

“The combination of the best skills in technology and innovation of Nexi and SIA teams is a strength to even further develop more advanced solutions for all partner Banks and customers. I believe that Nexi and SIA people should be proud of this new leading player: a great opportunity for all.”

The new entity rising from the merger will remain listed on the MTA and is said to cover the entire value chain of digital payments serving all market segments with an innovative set of solutions. These include digital payments acceptance services for small and large merchants, to more sophisticated omni-channel and e-commerce solutions, from issuing and management of all type of cards to mobile payments apps, from B2B digital payments solutions to open banking, from local public transportation solutions to banking networks as well as clearing and trading services for the main Italian and international institutions.

“This transaction will create a large Italian PayTech company leader in Europe, a great technological and digital excellence with scale and capabilities to play an increasingly leading role in Italy and at an international level in a market, like the European one, that sees strong consolidation trends,” said Paolo Bertoluzzo, CEO of Nexi.

Nicola Cordone, CEO of SIA, added, “The integration of important hi-tech groups such as SIA and Nexi, thanks to the fundamental role and support of CDP, will create one, large, Italian digital payments player, leader in Europe and boasting the highest levels of excellence for its know-how, people and capabilities of on a global level.

“This operation will contribute to accelerate our country on the path of digitalisation towards a cashless society. This is in line with the mission we have worked on with pride, commitment and dedication for the past 40 years, putting citizens, enterprises, financial institutions, central banks, and [public] administration at the centre of the payment systems revolution.

“Today, bringing together the strengths of two realities of excellence such as SIA and Nexi, we want to continue leading on innovation, with an even greater emphasis, offering infrastructures and forward-looking technological services, and affirm our leadership in Europe in a sector like e-payments that continues consolidating.”

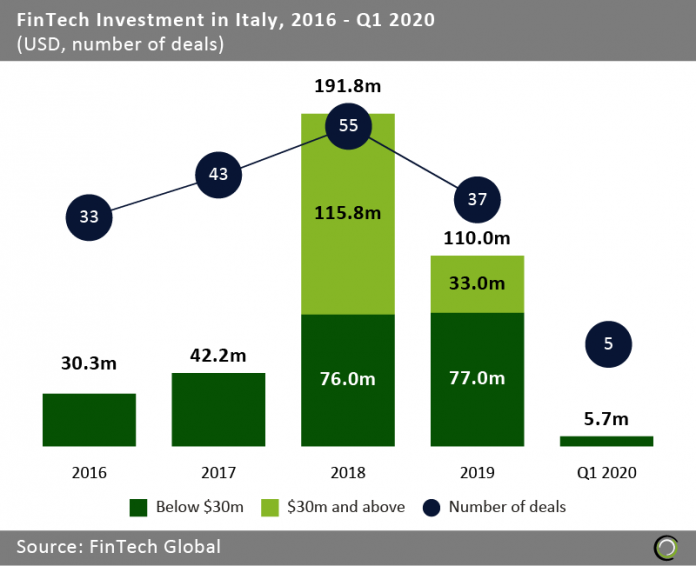

The news comes after investment into Italy’s FinTech sector basically collapsed in the first quarter of 2020. The implosion came as a result of the initial spread of Covid-19, resulting in the sector only closing five deals between January and March this year, according to FinTech Global’s research.

The drop followed from a period of growth between 2016 and 2018 when the number of deals rose from 33 to 55 and the total amount raised jumped from $30.3m to $191.8m. However, the number of deals declined to 37 ones in 2019 when the total amount injected into the nation’s FinTech ventures closed at $110m. The five deals recorded in the first quarter of this year closed at $5.7m.

Copyright © 2020 FinTech Global