UK and France-based neobank startup Automata has has bagged £1.35m in its ongoing Series A round.

The round takes the total amount raised by the FinTech to £1.8m. The round was raised through an equity token offering, according to BusinessCloud.

Gael Itier launched the startup in 2017. It is the the umbrella company behind wealth-centred challenger bank akt.io.

“Savings have become a thing of the past, a sacrifice with close to zero returns,” Itier said. “People need their money to grow and that’s not going to happen with a savings account that can’t even keep up with inflation. Investing has become mandatory for everyone wanting to secure their financial future.

“We’re making current accounts obsolete by enabling you to pay with money that’s always invested and working for you, and by doing so, money as we know it will never be the same again.”

The news comes at a peculiar time for neobanks. For instance, Revolut’s CEO and co-founder Nik Storonsky has just been named the UK’s first tech billionaire and Starling Bank’s founder Anne Boden has recently shared her version of the split between herself and the Monzo founding team.

But there is plenty of other types of drama in this space. About the same time as those two top executives are grabbing their headlines, leading challenger banks such as Monzo, Revolut and Starling have reported massive losses in recent months.

With that and the Covid-19 pandemic still raging across the world, it is easy to see why investors are not as interested in the WealthTech industry as they used to be.

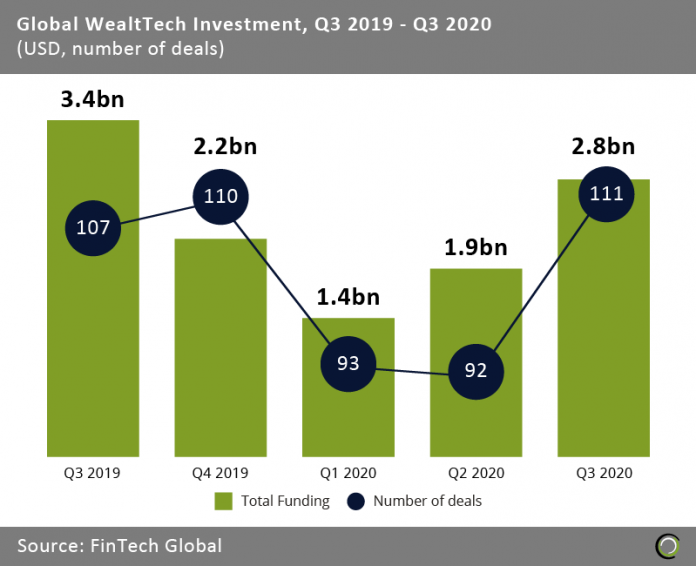

Only $3.3bn was invested in H1 2020, a 41% decline compared to the capital raised in the preceding two quarters, according to FinTech Global’s research.

Although, WealthTech could be turning the trend, having raised $2.8bn in the third quarter of 2020 across 111 transactions, representing a five-quarter high for deal activity.

Copyright © 2020 FinTech GLobal

Copyright © 2020 FinTech GLobal