Little has been said about Tom Blomfield and his colleagues’ departure from Starling Bank to launch Monzo in 2015, but a new book may shine some light on the events.

Starling Bank CEO and founder Anne Boden is releasing an autobiography on November 5 called Banking On It, where she claims to reveal what really happened when the Monzo founders broke from her startup. Although, not everyone seems to agree about the events.

The book is being serialised in The Sunday Times. In the first excerpt, Boden describes how Blomfield, Gary Dolman and Jason Bates orchestrated a “coup” before splitting to form Monzo, where they served as CEO, CFO and co-founder. Bates later went on to form FinTech startup 11:FS. Blomfield announced he’d stepped aside to become Monzo’s president earlier in July.

Boden claims that the split happened during a challenging funding round when Blomfield announced that he would up sticks and launched his own funding efforts, an initiative designed to oust Boden and take control of the business.

Boden describes the events as “nothing less than a coup”, writing how Blomfield, Dolman and Bates had approached Eileen Burbidge and Stefan Glaenzer at Passion Capital and inked a deal behind her back.

“Tom made it clear that he was not able to work with me. It was all such a shock. Somehow Tom had taken my place — Passion Capital was in and I was out,” Boden writes.

The “coup” proved unsuccessful in part because the Blomfield and his teammates had pushed for Boden to take responsibility for all of the fledging startup’s debts, which at the time included more than £1m owed to KPMG and PwC, according to Boden.

This, claims Boden, was what led to Blomfield and the others departing to form Monzo. Their departure left Starling Bank staff-less, seemingly uninvestable and heavily indebted.

“This was Starling’s near-death experience. At the time, I had no way of knowing if it was one stage further than that. Whichever way I looked at it, I was effectively back at square one,” writes Boden.

Although there may be some contention about Boden’s version of the split.

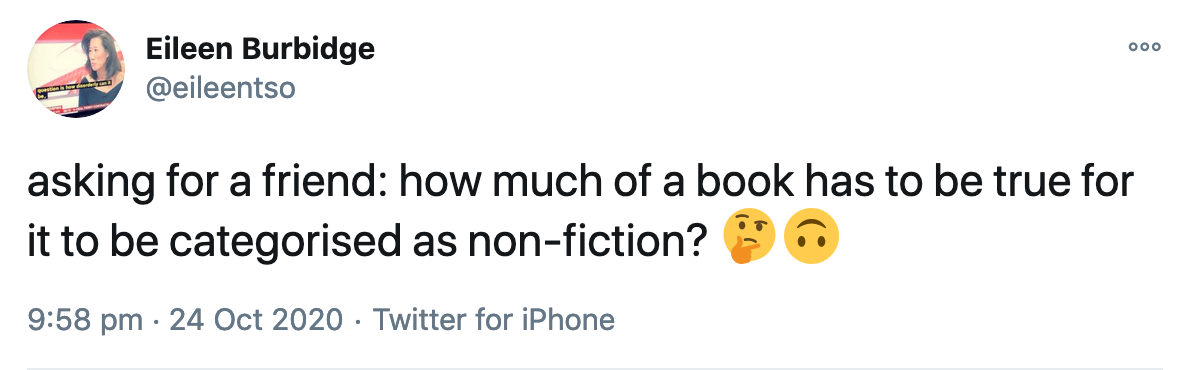

Burbridge tweeted on Saturday October 24, “[Asking] for a friend: how much of a book has to be true for it to be categorised as non-fiction?”

“The whole thing,” suggested Julian Martinez, marketing and technical writer at blockchain company Quantstamp.

“The whole thing,” suggested Julian Martinez, marketing and technical writer at blockchain company Quantstamp.

“[Interesting] (that had been my assumption but think we’re both been proven naive),” Burbridge replied.

However, the Monzo team’s split from Starling Bank is not the only part of the neobank’s journey that has been kept secret over the years.

Another story that has been little talked about is the deal announced in 2017 between TransferWise and Starling Bank. Back then, the transfer company and the neobank had said that they’d collaborate to give Starling’s customers access to TransferWise’s services in the bank’s app. While the partnership was supposed to go live in the summer of 2018, it never materialised.

Eventually, Boden told TechCrunch that she believed the challenger bank’s customers would be better served by it providing a payment solution itself.

In May this year, the non-existent deal led to a few chuckles when one business owner wondered on Twitter if anyone had any idea of how to transfer huge sums via a Starling account to suppliers.

This gave Kristo Käärmann, co-founder and CEO of TransferWise, the opportunity to reply by telling the challenger bank that it could “build TransferWise into the Starling app. Similar what Monzo, N26 and many others have done. It’s pretty easy.”

This prompted TechCrunch reporter Steve O’Hear to tweet, “FinTech trolling is a thing.”

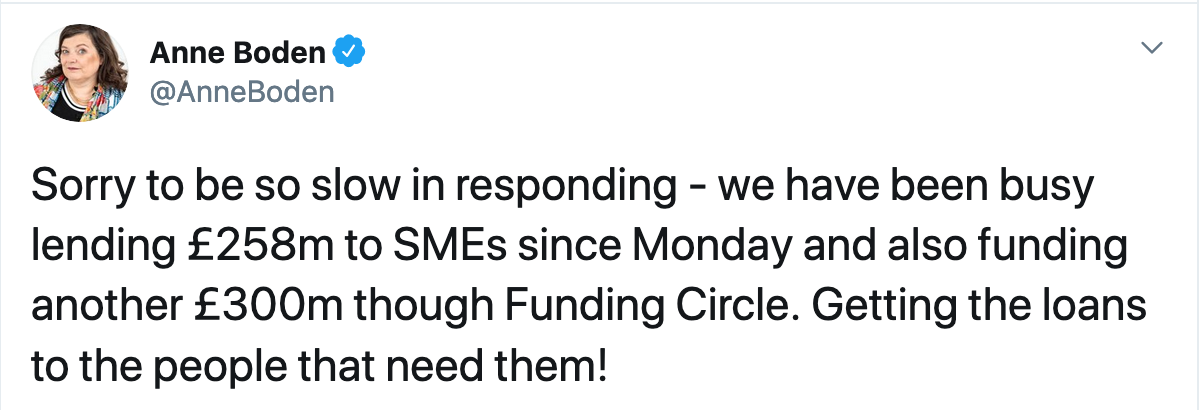

Boden replied, “Sorry to be so slow in responding – we have been busy lending £258m to SMEs since Monday and also funding another £300m [through] Funding Circle. Getting the loans to the people that need them!”

The tweet was a nod to the Bounce Back loans the digital bank had been accredited to be a lender for by the British Business Bank. The loans were designed to help small companies cope with the Covid-19 pandemic.

The tweet was a nod to the Bounce Back loans the digital bank had been accredited to be a lender for by the British Business Bank. The loans were designed to help small companies cope with the Covid-19 pandemic.

Conversely, being able to provide that funding has put the bank in a seemingly better position than Monzo.

As we have reported earlier, Starling Bank and Monzo have both reported that they have doubled their losses over the past year, raising questions of how much trouble the UK challenger bank sector is really in, especially since their rival Revolut had tripled its losses.

Starling Bank’s losses jumped from £26.9m to £53.6m in the last year while its revenues rose from £750,000 to £14.2m. The company also increased its run rate to £80m. It claimed to be on track to break even by the end of the year. And this bullishness was partly due to the aforementioned Bounce Back Loans.

Boden wrote in an open letter that the bank started preparing to help small business when the crisis started to earlier this spring. “So when the lockdown started and small business owners needed emergency help, we were able to swing into action and have committed more than £1bn of lending under the government-backed Coronavirus Business Interruption Loan Scheme and the Bounce Back Loan Scheme to support them,” Boden wrote.

Comparatively, Monzo has been said to be in worse shape than its competitors. While it raised a £60m round in June, that capital injection saw it slash its valuation from the $2bn that it achieved in 2019 after a £113m round to from the company at $1.24bn, representing a 40% drop.

Monzo’a annual post-tax losses jumped from the £47.1m recorded last year to £113.8m in 2020. Reasons for this increased lost are placed on the bank’s expansion efforts, which saw it enter the US, hire more staff and increase marketing. The loss comes despite the bank tripling its revenues, rising from £19.7m to £67.2m.

Copyright © 2020 FinTech Global