Challenger banks often boast about their ability to revolutionise what they describe as an old timey banking sector, but do customers really buy their spiel?

That is one of the things banking software company Temenos looked into in its latest report. The research is based on an analysis of over ten million online conversations in public forums about personal finance. The goal of the research was to find out what customers really thought about neobanks and traditional banks.

Overall, the researchers found that challenger banks are strongly associated with financial empowerment, but also twice as likely to be associated with security and privacy concerns when compared to traditional lenders. Roughly 13.7% of conversations about digital banks included associations with concerns about safety, security or privacy, compared with only 6.7% of those concerns being flagged in conversations about traditional banks.

The report also found that discussions about investment had increased in the past five years, with 14.4% of neobank conversations including associations with financial empowerment capabilities such as tracking and budgeting, compared with just 2% of conversations that discuss traditional banks.

On the other hand, traditional banks still benefit from trust, reliability and a wider range of services. A quarter of conversations about traditional banks were related to credit cards or reward programmes, compared to just 2.4% of those involving neobanks.

“Innovators are those who understand the ‘brutal realities’ of customers’ daily lives. We never ask customers, ‘what would you like us to build?’ because they are experts at talking about their problems and experience, not product development,” said Jason Bates, co-founder of app-based banks Monzo and Starling, as well as 11:FS, a FinTech consultancy, when commenting in the report.

“Our approach to creating new digital services is to talk to customers about the issues in their daily life and then look at how you can deliver against that.”

The report comes at an exciting time for challenger banks with many new entrants coming to market and raising big funding rounds as well as more incumbent digital players have achieved massive valuations in recent months.

For instance, UK neobank Revolut could for some time arguably claim to share the title of being Europe’s most valuable privately-owned FinTech company after having picked up a $5.5bn valuation on the back of a $500m funding round earlier this year. Although, since then Klarna has pulled away by achieving a $10.65bn valuation.

Although, Revolut’s co-founder and CEO Nikolay Storonsky was recently named the UK’s first tech billionaire, so the neobank seemingly still hold some sway in the market.

Elsewhere, Anne Boden, founder and CEO Starling Bank, has published her autobiography. One particularly publicised part in her work was regarding her version of how the Monzo founding team broke from her startup to launch their own. As we reported when an excerpt of the book was published, not everyone agrees that things transpired like Boden said they did.

One of them was Eileen Burbridge at Passion Capital who was named as one of the people behind what Boden described as a failed coup. She tweeted on Saturday October 24, “[Asking] for a friend: how much of a book has to be true for it to be categorised as non-fiction?”

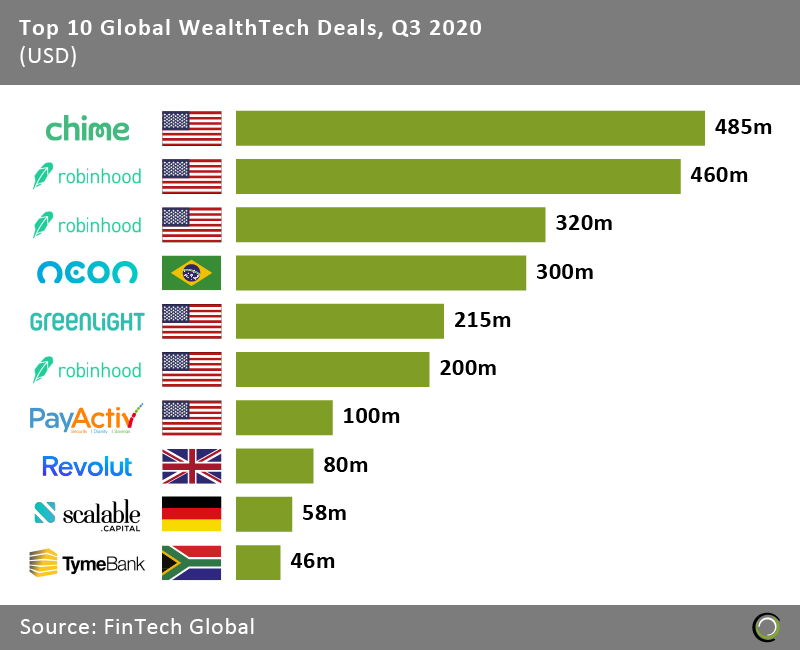

Still, challenger banks have been a key driver behind the growth of the WealthTech space. Indeed, as we reported in our recent research, neobanks have been behind several of the top ten rounds recorded in the sector in 2020.

Although, it is important to recognise that everything is not just unicorns and rainbows in the industry. In fact, an argument can be made that the huge losses suffered by leading challenger banks such as Monzo, Revolut and Starling have deterred investors from being as bullish as they could’ve have been this year.

Although, it is important to recognise that everything is not just unicorns and rainbows in the industry. In fact, an argument can be made that the huge losses suffered by leading challenger banks such as Monzo, Revolut and Starling have deterred investors from being as bullish as they could’ve have been this year.

Indeed, those losses and the raging pandemic could have been behind the fact that the global WealthTech funding had a slow start to 2020. Only $3.3bn was invested in the first six months of 2020, representing a 41% decline compared to the capital raised in the preceding two quarters.

The WealthTech sector did bounce back slightly in the third quarter of 2020, raising $2.8bn across 111 rounds. That was an increase from the the $1.9bn raised in the second quarter. Even though the recovery represented a 12-month high, it is still some ways below the $3.4bn collected in the third quarter in 2019.

Copyright © 2020 FinTech Global