Covid-19 has become a part of normal life, and insurance has changed in more ways than just having a remote workforce.

The pandemic has been around for long enough, that like Brexit, it would be weird not to see it mentioned in the news. It is easy to forget just how big of a shockwave it has been to the way we live and how industries work. Insurance is one of the industries to have changed greatly since the start of the year.

InsurTech companies were pegged to do well out of the pandemic, due to insurance firms being lumbered with outdated legacy systems being forced to adapt to the new remote way of life. The amount of capital being raised by these insurance technology companies show that things are going well for them.

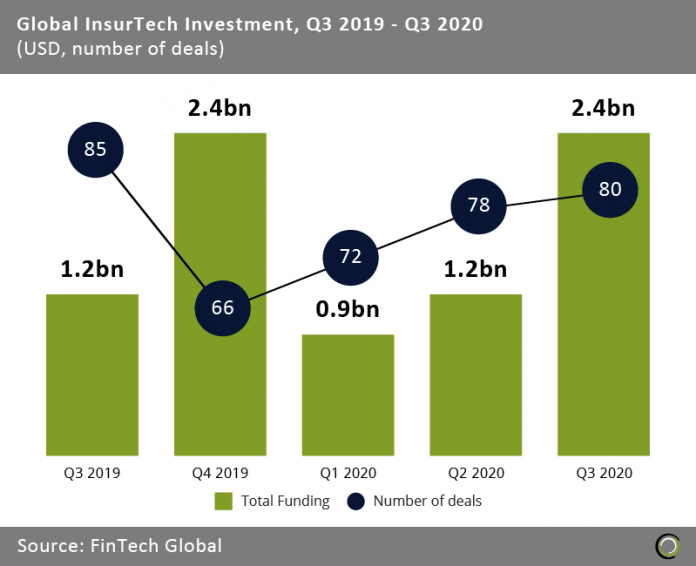

Understandably, the global InsurTech investment in the first quarter of 2020 had dropped down to $0.9bn – falling from $2.4bn raised in Q4 2019. As investors began to better assess the impact of the coronavirus on insurance, funding has slowly been rising. Data shows investment volume in Q3 2020 has recovered to $2.4bn, which matched the five-quarter high seen at the end of last year. Funding in the final quarter of the year was driven by a number of big ticket investments, including a $500m Series E by Bright Health and a $500m equity round from Ki Insurance.

Signs the market is ripe for InsurTechs are supported by the successful initial public offerings of Lemonade and Root Insurance.

Signs the market is ripe for InsurTechs are supported by the successful initial public offerings of Lemonade and Root Insurance.

There is clearly a lot of potential and opportunity out there for InsurTechs and this has been fostered by Covid-19. It has not just meant insurance firms have had to let their staff work from home, it has changed how consumers want to access insurance and the types of products they want.

Yuval Zimerman, the director of marketing and global partnerships at traveller and doctor connection platform Air Doctor stated that when the lockdown began the travel insurance space was put on red alert. People were no longer allowed to go away on holiday and people were cancelling their trips away. When boarders began to reopen there was still a lot of fear placed on travel. People were scared of an increased chance of catching the virus whilst on a plane and people were left confused about the safe lists, which could change overnight. Despite this, a survey from Air Doctor found that people were not as opposed to travelling as expected.

He added, “This desire to travel has combined with worries about the consequences to create demand for new and enhanced travel insurance products to ease their concerns and provide peace of mind. In particular, travellers are looking for insurers to offer them better options if they do get sick while abroad – they want face-to-face appointments (not just telemedicine), and they prefer access to GPs and private clinics rather than being unnecessarily sent to hospital by their insurer.”

This sense of forced innovation to create new products and opportunities is one of the common themes to come from the coronavirus pandemic. Yuval offered another example by which many insurers have explored initiatives that can benefit them and their customers immediately and over long term. He added, “Increasing availability of paperless onboarding and claims processing is a key example – while it has been driven by the immediate needs of the current situation, there is no reason why measures adopted now can’t become the norm, creating greater efficiencies for insurers and a better experience for customers.”

These changes are likely to stay for good. Tough times call for innovation and while the world might return to pre-Covid-19 ways, improved customer experiences or more flexible insurance will likely stay for good.

It is not just the travel insurance industry that has witnessed new opportunities. Changes have been felt across the entire insurance space. One of the most notable is the auto insurance space. Samuel Falmagne, CEO at AI-powered pricing software developer AKUR8, explained that the pandemic meant less traffic, fewer miles driven and a reduction in claims. It also caused a decrease in purchasing power, which led to insurance policy holders to reduce their insurance coverage to minimum legal requirements. This decrease has also seen many launch value redistribution or discount campaigns to demonstrate solidarity, and fuel acquisition and retention. Once the lockdown had begun to ease, there was actually a surge in car sales as people avoided public transport, but this also meant an increase of unexperienced drivers on the roads.

Falmagne said, “Although some of these changes were triggered by lockdown situations, they are likely to last, not only because lockdown situations are not yet a thing of the past, but also because some of the changes they generated will become permanent in what we now call the ‘new normal’.” To that extent, he explained that insurers will need to invest into data analytics and AI to ensure they are able to maximise their growth in this space.

One of the big impacts insurers have seen during this pandemic is that adjustment of their risk models to be almost real-time. This has been caused due to the fact traditional risk evaluation, which is based on mastered variables stable over time, have been impacted heavily from the pandemic. Falmagne explained that all age groups and genders have had their risk of claims decrease, but not due to the same factor, hindering the models. “Traffic halt in cities, as well as moves from urban to rural areas had the same disruptive effect on the traditional use of the zip code variable by auto insurers.”

To keep up with these changes, firms have needed to use AI-based automation tools, to ensure lengthy risk processes can be accelerated to be more up-to-date. Insurers were already experimenting with these types of services and digital tools, but the pandemic has just sped this up.

“So far, technology in the insurance value chain has been applied to the bricks closer to the customer (chatbots, underwriting, claims management, quoting etc.), but core parts of insurers’ processes, such as pricing, were left out as most insurers could live with relatively slow time to market. So it’s exciting to see AI start to play a role there because the potential for adopters is huge.”

The effects of the coronavirus are likely to be around forever. The move towards more technology-powered systems was already happening and the pandemic has only accelerated this fact. This means, insurance firms have had to boost their digitalisation strategies and they will not be getting rid of these changes when the coronavirus incident is finished.

Adrien Cohen, co-founder and president of accident and disaster recovery Tractable, said, “You’ll see a sector that’s undergone accelerated change. Companies that adapt well to the changed circumstances created by Covid-19 – by offering a more flexible customer experience, or more efficient processes – will have flourished, while those that stick to the same way of doing things will decline as customers vote with their feet.

“That doesn’t mean the incumbents will fall – some of the most innovative insurers in the world are also the biggest – but it’s all about agility, and using technology efficiently to help you meet policyholders’ changing needs and circumstances. “

Copyright © 2020 FinTech Global