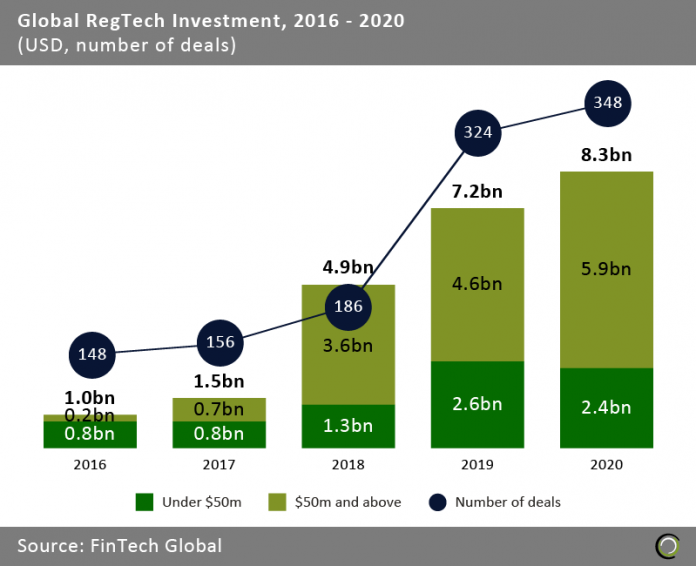

RegTech companies set new records in both funding and the number of investment deals in 2020.

RegTech companies raised $8.3bn across 348 deals in 2020, beating the previous high of $7.2bn set in 2019

- Total investment in the RegTech sector rocketed from 2016 to 2019, growing at a compound annual growth rate (CAGR) of 93.1%, as investors increasingly backed companies looking to solve and bring efficiency to outdated compliance processes as well as take advantage of the new complex regulations coming into effect such as MiFID II and GDPR. The rise in total funding in 2019 was mainly driven by large deals over $50m which made up 63.9% of the total funding for the year.

- RegTech funding was set to decline after the first three quarters of last year saw a 3.4% drop in total funding compared to the same period in 2019 along with a 4.3% decrease in deal activity. However, the sector ended the year strongly and recorded $3.1bn worth of capital invested across 122 transaction in Q4, which was a five-quarter high for both funding and deal activity.

- As a result, 2020 set new annual funding and deal activity records beating 2019’s numbers by 13.9% and 7.4%, respectively. Investors are optimistic about this year’s prospects with permanent shift to increased digital operations and better economic outlook on the back of the positive vaccine news. However, the record investment was heavily fuelled by transactions over $50m and the proportion of funding coming from deals under that threshold fell by 7.2 percentage points.

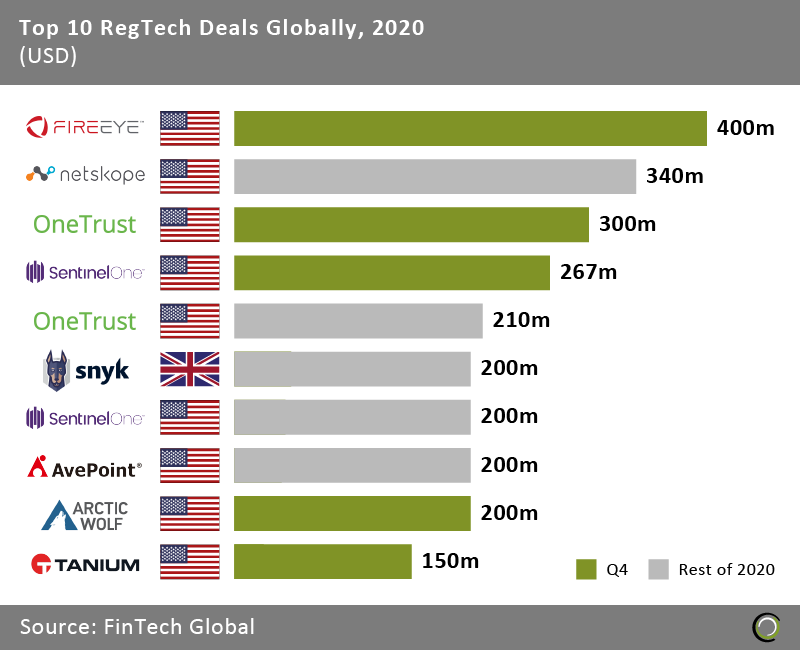

The fourth quarter of 2020 saw the highest number of large RegTech deals

- The top ten RegTech deals in 2020 raised in aggregate nearly $2.5bn, making up 30.1% of the total funding in the sector for the year. Deals that took place in Q4 make up half of the list, including three of the top four transactions for the year. All companies on the list offer solutions within cybersecurity or data security as safeguarding digital operations has become the top challenge globally amid the pandemic.

- US companies continue to dominate the RegTech sector, capturing nine out of the top ten deals. FireEye, an intelligence-led security company that helps organisations combat online threats, led the way by announcing a $400m investment from Blackstone Tactical Opportunities and ClearSky. FireEye said it would use the investment for the development of its cloud, platform and managed services. This capital injection also supported the cybersecurity company’s recent acquisition of Respond Software, a digital security investigation automation company.

- Snyk, the only company within the top ten deals in 2020 outside of the US, announced a $200m investment led by Addition. The company which builds security into the application development process will use the funding to keep providing “very busy development teams with security intelligence, automated workflows, and visibility that will help mitigate their risks faster and more easily. â€

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2021 FinTech Global