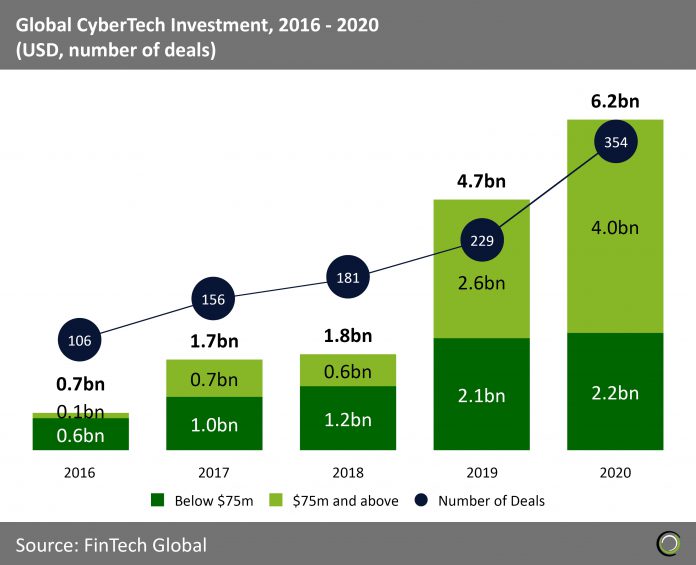

CyberTech companies raised $6.2bn across 354 transactions in 2020

- The global CyberTech industry experienced tremendous growth between 2016 and 2019 as investors poured money into companies battling the increased threat of cyber attacks and data leaks in financial services. Total funding grew at a CAGR of 91.6% from nearly $666.1m to nearly $4.7bn at the end of last year.

- Increased share of total funding came from deals over $75m which made up 55.3% of the total capital invested in the sector in 2019. However, funding and deal numbers also grew for transactions under that threshold. This demonstrates that the sector experienced healthy growth not just fueled by larger cheques to scale-ups.

- The pandemic and the ensuing shift to remote work opened financial institutions to new and increased threats as home setups became easy targets for cyber criminals. As a result investors upped their stakes in the sector as established companies looked to develop solutions and seize market share by addressing the new cyber challenges. Both total funding and deal activity set new records last year driven by increased share of capital coming from deals over $75m which reached 64.5% in 2020.

The fourth quarter of 2020 saw the highest number of large CyberTech deals

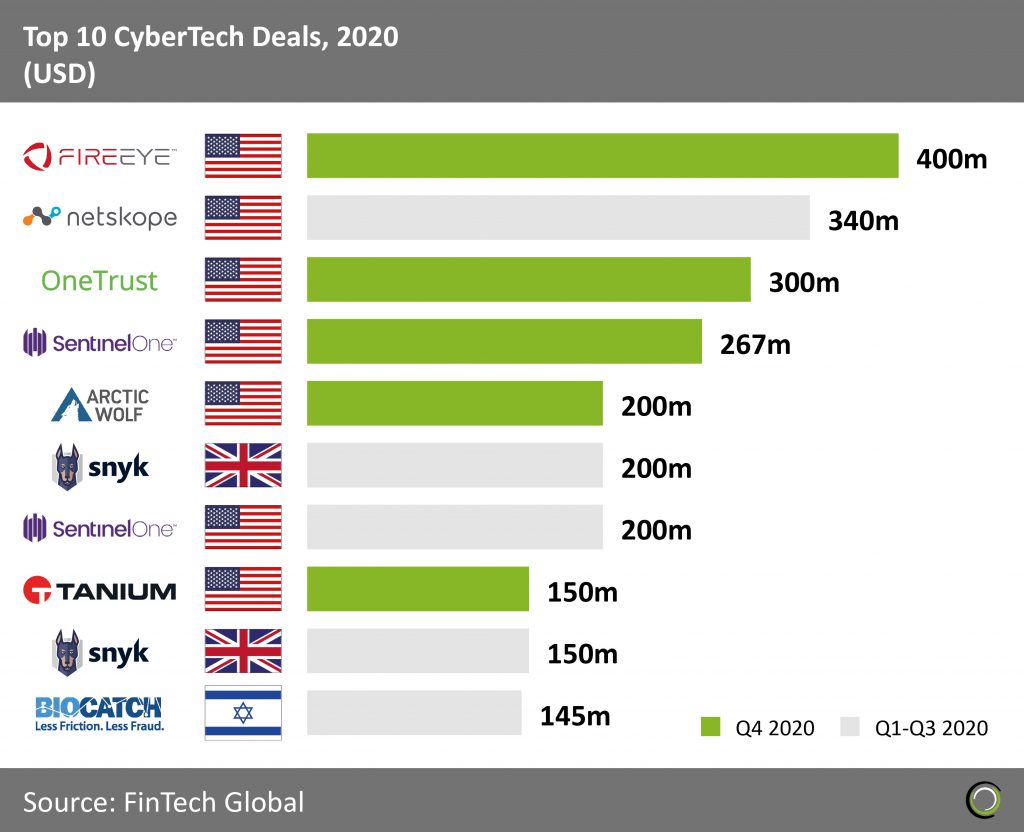

The top ten CyberTech deals in 2020 raised in aggregate nearly $2.4bn, making up 38.2% of the total funding in the sector for the year. Deals that took place in Q4 make up half of the list, including three of the top four transactions for the year.

The top ten CyberTech deals in 2020 raised in aggregate nearly $2.4bn, making up 38.2% of the total funding in the sector for the year. Deals that took place in Q4 make up half of the list, including three of the top four transactions for the year.- US companies continue to dominate the CyberTech sector, capturing seven out of the top ten deals. FireEye, an intelligence-led security company that helps organisations combat online threats, led the way by announcing a $400m investment from Blackstone Tactical Opportunities and ClearSky. FireEye said it would use the investment for the development of its cloud, platform and managed services. This capital injection also supported the cybersecurity company’s recent acquisition of Respond Software, a digital security investigation automation company.

- Snyk, which completed the largest fundraise in 2020 outside of the US, announced a $200m investment led by Addition. The company which builds security into the application development process will use the funding to keep providing “very busy development teams with security intelligence, automated workflows, and visibility that will help mitigate their risks faster and more easily.”

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2021 FinTech Global

The top ten CyberTech deals in 2020 raised in aggregate nearly $2.4bn, making up 38.2% of the total funding in the sector for the year. Deals that took place in Q4 make up half of the list, including three of the top four transactions for the year.

The top ten CyberTech deals in 2020 raised in aggregate nearly $2.4bn, making up 38.2% of the total funding in the sector for the year. Deals that took place in Q4 make up half of the list, including three of the top four transactions for the year.