Stock trading app Freetrade $69m in a Series B round and has reached a post-money valuation of $366m.

Led by Left Lane Capital, a growth equity firm focused on consumer internet and technology businesses, the round also saw participation from The Growth Fund of L Catterton, a global consumer-focused private equity firm, and LSE-listed VC Draper Esprit.

The company aims to use the funding to accelerate its growth in international markets and allow the team to scale its product.

Having already attracted 600,000 users in the UK, the firm generated £1bn in quarterly trade volume.

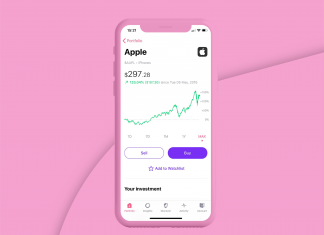

The way the app works is, after signing up, users can buy and sell shares as well as buy fractional shares for companies with expensive shares, such as Alphabet.

Freetrade enables users to access US and UK stocks as well as ETFs. Like its competitor Robinhood, the company doesn’t charge any trading commission for basic orders but only a 0.45% foreign exchange fee on transactions in foreign currencies. In addition to free investment accounts, Freetrade offers individual savings accounts, a UK-specific feature that encourages long-term investments as taxes on capital gains goes down over time.

Freetrade is betting heavily on subscription revenue combined with a freemium approach. Whether its consumers seeking to buy a few shares or those who want to convert part of their savings into stocks and ETFs, the firm aims to cater to all through its free accounts or its Freetrade Plus subscription.

Commenting on the funding round, Freetrade founder and CEO Adam Dodds said, “This is a transformational investment that will supercharge our mission to get everyone investing. It’s painful to see millions of investors across Europe stuck paying high fees and bogged down by complex terms and conditions.

“The costs of offering essential services like share dealing are simply not justifiable and erode valuable returns. Everyone already invests their time and their money on a daily basis, but there is so much more that millions can be doing to get the most out of their money. We are committed to helping everyone to achieve better financial outcomes.”

Highlighting the importance of making stock trading more mainstream, L Catterton partner Michael Mitterlehner said, “As the financial technology industry grows and evolves, Freetrade has differentiated itself as a trusted, commission-free platform that makes the stock market accessible to everyone. Since 2018, Freetrade has amassed a broad and loyal following, and we’re delighted to support the Company’s continued expansion.”

Before this round, Freetrade raised £7.1m in May last year through a public crowdfunding round where 8,500 retail investors took part.

Recently, TrueLayer announced a collaboration with Freetrade in a bid to deliver an enhanced investing experience using open banking. TrueLayer’s Open Banking Data and Payment APIs enabled Freetrade’s customers to connect their primary bank account to its app, thus providing securing funding via Payments Initiation.

Indeed, investment platforms can have a large impact on public markets. Most recently, the GameStop saga saw retail investors take on Wall Street hedge funds.

Copyright © 2021 FinTech Global