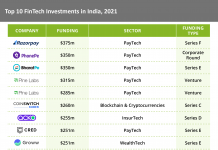

India-based FinTech startup CRED has been the newest entrée into the unicorn club after a $215m round takes its valuation to $2.2bn.

The Series D round was led by Falcon Edge Capital along, with existing investors Coatue Management and Insight Partners. Other investors DST Global, RTP Global, Tiger Global, Greenoaks Capital, Dragoneer Investment Group and Sofina also participated in this round.

Its latest round comes just a few months after the company raised $81m at a valuation of $806m in January this year.

Cred, which bought back employee stock options worth $1.2m during its Series C round, will use this capital for ESOP buybacks with a cumulative value of $5m following this funding round.

Launched in 2018 by Kunal Shah, CRED aims to help users pay credit card bills easily and earn rewards. It has since expanded to lending through Cred Cash and enabled online commerce and brand discovery through its ‘Store’ and ‘Discover’ platforms.

The company also introduced Cred Pay to help with easy checkouts on its in-app e-commerce platform. Currently, it has close to 1,800 brands on its ‘Store’ platform and boasts of over six million users, it claimed.

Commenting on the FinTech’s new round, Shah said, “While valuation is a milestone that many celebrate, we view it as a responsibility and an opportunity to create member value. We’ve grown rapidly over the past 2.5 years, with 35% of premium credit cardholders. As the credit card category continues to grow rapidly in India, our opportunity is to imagine new use-cases, empower Cred members to use credit responsibly and reward them for good financial behaviour.”

This is not Shah’s first entrepreneurial project. Having earlier founded digital wallet Freecharge, he sold it to Snapdeal for over $400m in 2015.

Shah added, “For monetisation products such as lending and commerce, we have seen good traction. And the cohort Cred has chosen is slightly easier to monetise. In the long run, we are focused on the revenue scale and profit collection that we can show.”

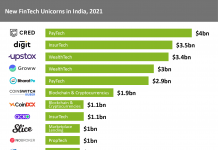

The entry of CRED into the unicorn club makes it the sixth Indian startup to do so this year. Before CRED, Digit Insurance, InnovAccer, Infra.market, Five Star Finance and Meesho too earned the horn in 2021.

Copyright © 2021 FinTech Global