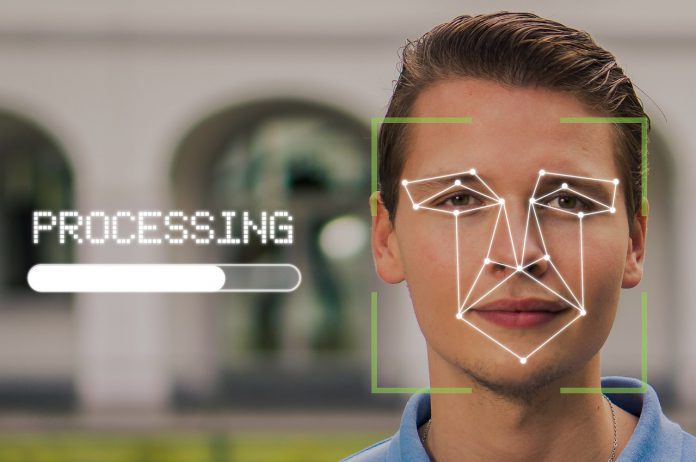

A study from Juniper Research has discovered the number of users of software-based facial recognition to secure payments will exceed 1.4bn people globally by 2025.

The study identified the introduction of Apple’s FaceID as a key growth accelerator for the wider facial recognition market. In 2020, the number of people using facial recognition for digital payments stood at 671m. Based on this number, the use of facial recognition for this purpose would grow 120% over five years.

Juniper’s research also found fingerprint sensors will feature on 93% of biometrically equipped smartphones by 2025. Hardware-based facial recognition software, however, is only expected to feature of 17% on biometrically equipped smartphones by 2025.

Furthermore, the use of voice recognition for payments is expected to increase from 111m users in 2020 to over 704m in 2025. The report highlighted that currently voice recognition is mostly used in banking and will struggle to grow beyond this due to ‘robustness’ concerns. On this matter, Juniper recommends vendors adopt a ‘multi-method biometric strategy’ encompassing facial recognition, voice, fingerprints and behavioural indications in order to ensure a secure payment environment.

The research study also recommended facial recognition vendors implement strong and rapidly evolving AI-based verification checks to confirm the validity of user identity. This is to combat risking losing user trust in the chance of a spoofing attempt of the authentication method.

Juniper associate analyst Susan Morrow said, “Hardware-based facial recognition is growing, but the ability to carry out facial recognition via software is limiting its adoption rate,” Research co-author Susan Morrow explains. “As the need for a secure mobile authentication environment grows, smartphone vendors will need to increasingly turn to more robust hardware-based systems to keep pace with fraudsters’ evolving tactics.”

Estonian identity verification firm Veriff recently introduced Face Match, an AI-powered feature that authenticates a person online with the aim to mitigate fraud and identity theft.

The company’s facial biometric technology matches the person’s face to an identity document that is already previously verified by the firm, therefore, creating an easy online method to verify identities digitally.

Copyright © 2021 FinTech Global