Data management platform AutoRek has named Omnio as its latest digital banking and payments client.

Through the deal, AutoRek will provide Omnio with its core reconciliation solution, including internal and external reconciliations between Omnio’s payment processors, bank accounts and ledger system.

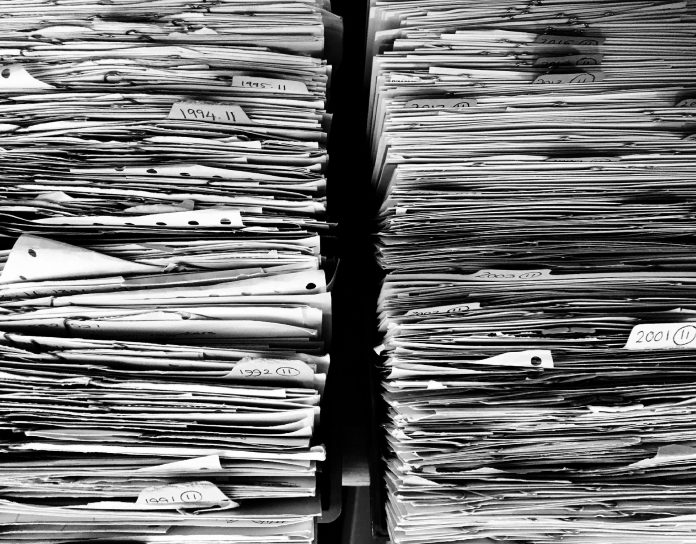

This will replace Omnio’s existing manual processes on Excel with an end-to-end automation solution, which AutoRek claims will boost efficiency and control. The tools will enable automated reporting and real-time management of information to help businesses to improve their daily operations.

Omnio develops financial services infrastructure, which combines banking and customer engagement into a single platform.

Omnio head of reconciliations and settlements Laurence Sproston said, “We approached AutoRek to provide us with a solution to help automate our reconciliation processes. Our main goal in pursuing this partnership is to save time, costs and ensure operational resilience as we move forward to a new way of working.

“The AutoRek team adopts a collaborative approach for implementation and have provided us with an automated solution ensuring our regulatory, data integrity, workflow and management information needs are met.”

AutoRek banking and payments lead Nick Botha said, “We are delighted to be working with the Omnio team. Following the turbulent year defined by COVID-19 and with the constant changes taking place in the digital banking and payments world, we are extremely proud that Omnio have selected the AutoRek solution to be the glue between their internal and external systems.”

The RegTech company recently secured a funding round from private equity firm Scottish Equity Partners (SEP).

Copyright © 2021 FinTech Global