London-based AI-driven InsurTech Sprout.ai bagged £8m in Series A funding led by Octopus Ventures.

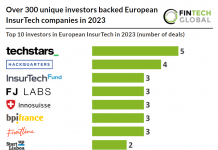

The investment round also saw existing investors including Amadeus Capital Partners, Techstars and Playfair Capital take part.

Sprout.ai will use the investment to recruit top talent into its product, operations, delivery and technical teams as well as grow its enterprise sales and partner networks. It will also use the investment in R&D with an increased focus on Natural Language Processing (NLP) and Optical Character Recognition (OCR).

Founded in 2018, Sprout.ai is a claims automation solution that leverages Contextual AI with the aim to revolutionise the insurance claims experience for insurers and consumers alike.

Its automation solution reads, contextualises and actions insurance claims, significantly improving speed and accuracy in decision-making with the goal of reducing the time taken to process individual claims from 30 days to 24 hours.

This time-saving process has helped the company attract attention from a number of large insurers across the world, including Zurich. Its head of claims digital experience Will Paskins said, “At Zurich, we are constantly looking for innovative ways to enhance a customer’s experience when a claim occurs. When a claim occurs, customers expect fast, clear, and transparent handling of their claims, and by partnering with Sprout we are able to provide them with market-leading technology.”

“Sprout.ai’s passion for improving customer outcomes and endless innovation makes them a partner we are proud to be associated with, and we look forward to working with them as they scale.”

Furthermore, the company claims its document processing has been developed specifically for the insurance sector to deal with raw document variations, such as handwritten doctors’ notes. Consequently, the InsurTech witnessed a massive escalation in demands for its solution since the start of the Covid-19 pandemic, it said.

Commenting on the round, Sprout.ai CEO Niels Thoné said: “Sprout.ai’s mission is to revolutionise customer service within global claims automation. Our innovative and industry-leading AI claims the engine is poised to solve the current market inefficiencies, allowing insurers to focus on customers in their moments of need. This funding will allow us to keep scaling to meet that demand.”

Highlighting the importance of providing faster insurance claims, early-stage investor at Octopus Ventures Nick Sando said: “We are often at our most vulnerable when we submit insurance claims and it doesn’t help when we then have to wait another month for it to be processed. Sprout.ai empowers insurers to process claims in a fraction of the time, creating much better outcomes for customers when they need it most. This is clearly good news for insurers too. Not only should they have much happier customers, but it also has the potential to create huge efficiencies, significantly reducing their operational expenses.

“Sprout.ai is tackling a big problem in an enormous global market and the technology that Niels and his team have built is the best we’ve ever seen in this space.”

Formerly known as BlockClaim, Sprout.ai rebranded in June last year after receiving $2.5m seed funding.

Copyright © 2021 FinTech Global