Swedish InsurTech company Insurello has received a SEK 150m ($17.5m) investment, after it moves past the milestone of SEK 200m ($23.3m) in paid insurance compensation.

Nordstjernan Growth, a Swedish investment firm, served as the lead investor. Previous Insurello backers Schibsted and Inventure also joined the round.

The capital injection will help the company to continue its expansion efforts into new verticals and markets. This expansion will also be supported by acquisitions.

Founded in 2016, Insurello helps consumers find the best insurance cover for them.

Insurello has made a start on its international expansion. It launched in Denmark late last year and in Q2 2021, it entered France.

Schibsted head of financial services and venture Dan Ouchterlony said, “We have been backing Insurello for two years now where the company has constantly continued to prove its strength, both through results and that very many people get the help they deserve through Insurello’s service. Marcus and his team also show how fintech combined with an attractive offer is a real winner. Therefore, we continue to invest and look forward to contributing to the continued development.”

Since the company was founded, it has handled over 200,000 cases and received over $23.3m in compensation for its customers.

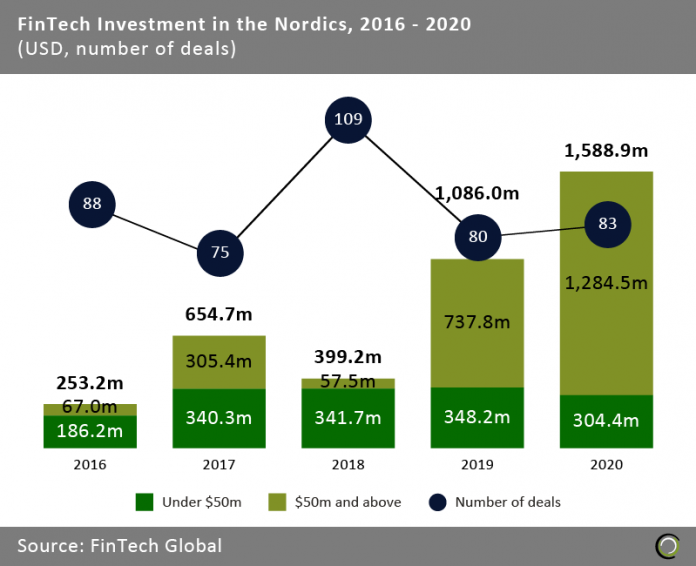

There has been a lot of appetite for Swedish FinTech over recent years. A total of $1.5bn was invested into Swedish FinTech companies in 2020, across 83 deals, FinTech Global’s data shows. Despite the pandemic placing question marks over the financial market, FinTech’s in the country excelled.

Speaking on the future of the country’s FinTech sector, Armando Coppola, partner and head of FinTech at Nordic startup investor Wellstreet, said it was time for its companies to expand internationally.

Copyright © 2021 FinTech Global

Copyright © 2021 FinTech Global