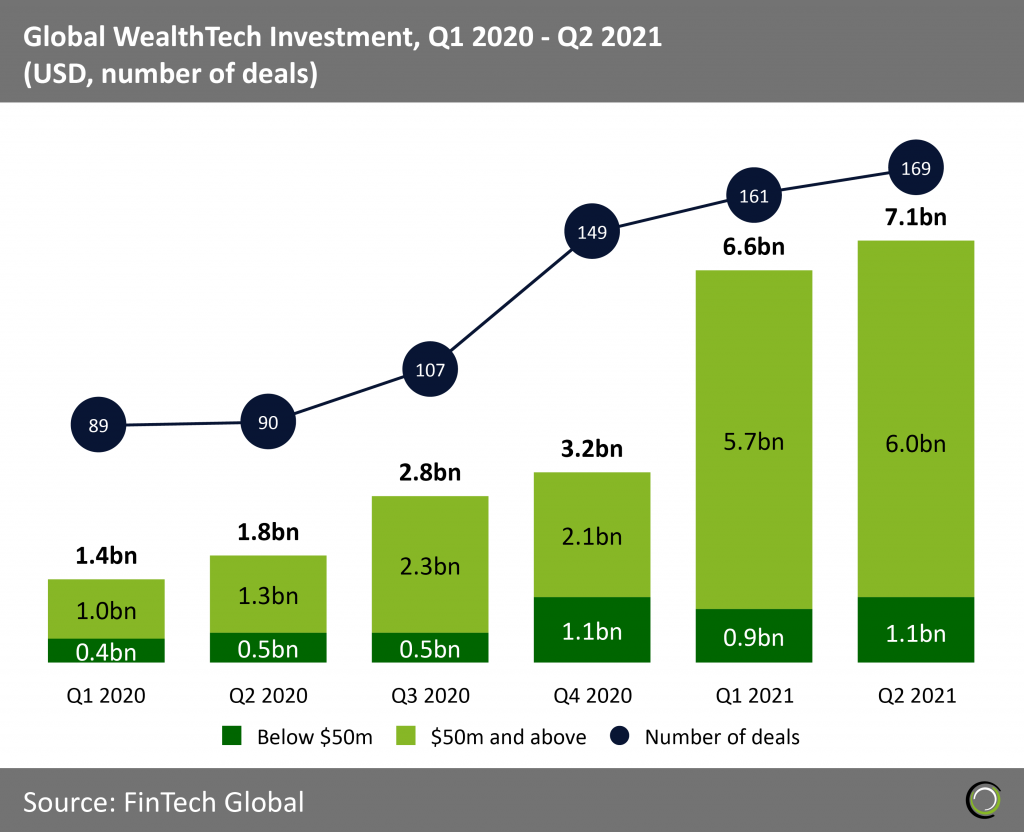

H1 2021 surpasses entirety of 2020 funding by $4.4bn, boosted by large deals over $50m

- Global WealthTech investment increased from 2017 to H1 2021 at a CAGR of 26.6%. Assuming H2 2021 performs at least half as well as H1, deal activity will have increased by an average of 15.5% year over year, continuing the positive trend upwards.

- Funding from deals under $50m has grown consistently at a CAGR of 16% during the period 2017-2020. This growth can largely be attributed to the increased deal activity, as the average funding per deal was $7.7m, $9.2m, $8.4m, and $8.4m for each respective year. With the exception of 2017, funding per deal has remained relatively stable over the four-year period, showing that deal activity has been driving overall growth in that deals bracket.

- Funding from deals $50m and above went up by $5bn in H1 2021 compared to 2020, driving a massive spike in total funding. Out of 2021’s total funding, 25% came from two $1bn+ deals from Robinhood, a retail trading company that offers anyone with a smartphone the ability to invest commission free via an app.

Deals above $50m fuel growth in 2021, signaling strong Covid-19 recovery

- WealthTech investment growth in the past six quarters is highlighted by a drastic jump in deals $50m and above. The funding from deals $50m and above in the first quarter of 2021 is nearly triple that of Q4’s total. This was followed by strong Q2 2021’s funding from deals $50m and above which exceeded that of Q1 by $300m, again showing continued growth in the segment.

- The Covid-19 pandemic accelerated the shift towards the digital age, thus promoting people to become more open to using technology-based alternatives to everyday tasks including work, shopping, and many more. As lockdowns progressed, middle-class families and young professionals used their extra disposable income from not going out and traveling to take advantage of stock market volatility.

- Thus, Retail Investing/Trading apps gained popularity as they enabled regular people, not just licensed brokers, to trade on a daily basis. The subsector accounted for $5.2bn of the $11.7bn raised from deals $50m and above in H1 2021, the most of any other WealthTech sector.

- Deal count went up in each quarter from Q1 2020 to Q2 2021, with the largest jump of 42 deals occurring from Q3 to Q4 2020. Consistently positive deal volume demonstrates a healthy growth in the WealthTech space and shows that total funding is not solely being driven by massive deals that skew that data.

- The rise in deal activity under $50m from Q3 to Q4 2020 is congruent with an increase of funding from $0.5bn to $1.1bn. Funding from deals under $50m in H1 2021 has remained relatively stable since Q4 2020, averaging $1bn.

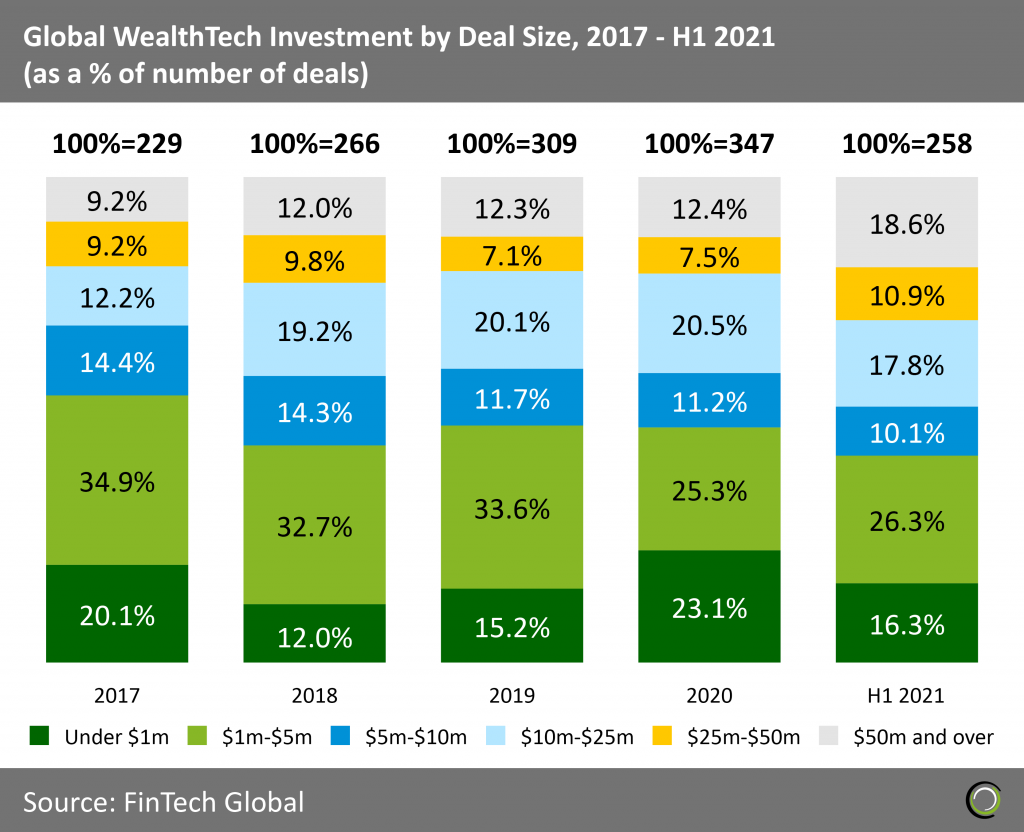

The share of deals $25m and above jumps in 2021, signaling companies are moving into later stages of funding

The share of deals $25m and above reached an all-time high in H1 2021, nearly 10 percentage points (pp) greater than that of 2020. Furthermore, the share of deals $50m and over in 2021 gained 6.4pp over 2020’s share, marking a new record. Companies that investors previously funded when they were in earlier stages are now maturing. Thus, these companies demand more funding and attention than smaller companies if investors want to continue to support their growth.

The share of deals $25m and above reached an all-time high in H1 2021, nearly 10 percentage points (pp) greater than that of 2020. Furthermore, the share of deals $50m and over in 2021 gained 6.4pp over 2020’s share, marking a new record. Companies that investors previously funded when they were in earlier stages are now maturing. Thus, these companies demand more funding and attention than smaller companies if investors want to continue to support their growth. - The share of deals under $1m in 2021 has dropped from 23.1% to 16.3% in H1 2021, providing further evidence that investors have turned their attention more towards maturing companies they invested in earlier years.

- Covid-19 has rapidly accelerated the adoption rate for FinTech companies that would not have otherwise been utilized in five to ten years’ time. The market for FinTech investment has shifted towards larger companies capable of disrupting the current landscape through the use of innovative technologies. As a result of this paradigm shift, H1 2021 consisted of 28 mega-deals over $100m, shifting the focus away from smaller investments.

- Although the share of deal activity among deals under $50m has dropped in H1 2021 compared to prior years, total funding has remained consistent. In Q4 2020, Q1 2021, and Q2 2021, average funding per deal totaled $10.5m, $9.1m, and $9.9m, respectively. Despite H1 2021 seeing a drop compared to Q4 2020, the average funding per deal remains consistently high.

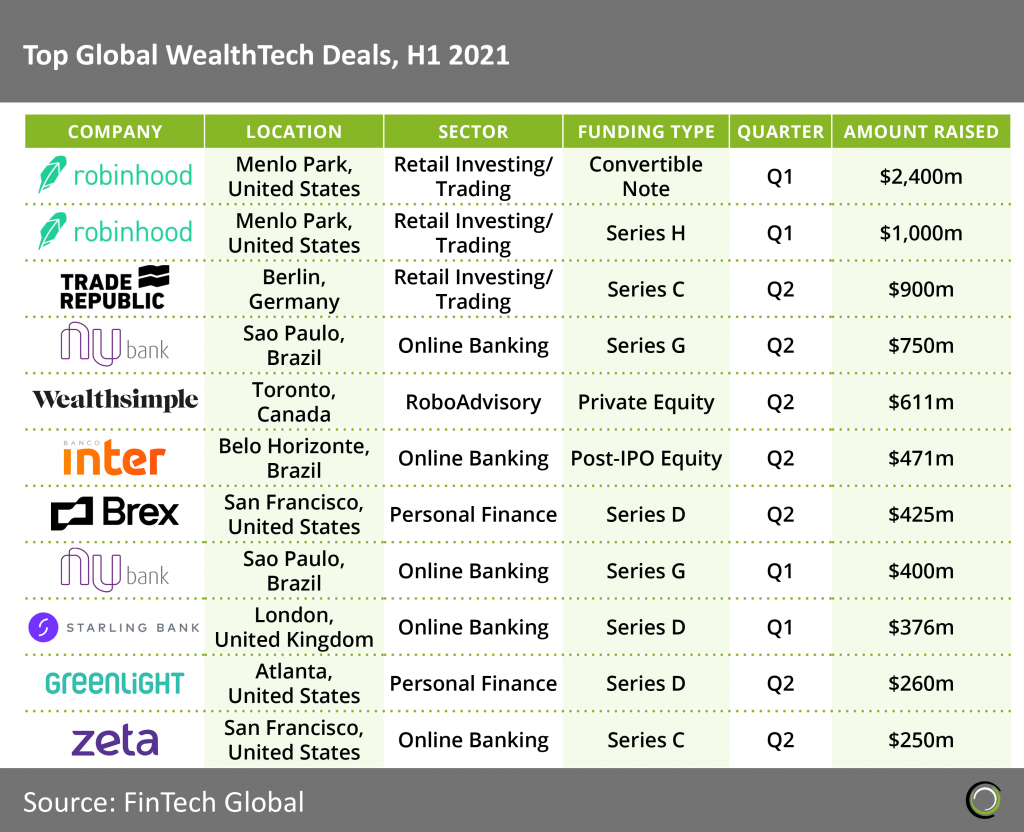

Robinhood’s $3.4bn raised in Q1 2021 Leads 2021’s Top Global Deals

As mentioned previously Robinhood completed the largest deal in H1 2021, raising $2.4bn from a convertible note. The funds raised was largely a result of the “meme stock” frenzy in which amateur investors flocked to pump GameStop and AMC among others in a short squeeze. The initial $1bn came when Robinhood needed to raise money in response to the rising demand for cash because of the trading spree, subsequently raising the additional $2.4bn from shareholders days later.

As mentioned previously Robinhood completed the largest deal in H1 2021, raising $2.4bn from a convertible note. The funds raised was largely a result of the “meme stock” frenzy in which amateur investors flocked to pump GameStop and AMC among others in a short squeeze. The initial $1bn came when Robinhood needed to raise money in response to the rising demand for cash because of the trading spree, subsequently raising the additional $2.4bn from shareholders days later. - Five of the top 11 deals in H1 2021 were raised by digital banks. Millennials have driven the demand for online banking as a service. Many studies show that much of the generation expresses a distrust for the banking system. In addition, both Gen Z and millennials are known for being impatient generations overall. The ease of online banking offers a much more appealing alternative as opposed to waiting in line to meet with an advisor at a traditional bank.

- The largest deal in Online Banking came from Nubank, the largest digital bank in the world by number of customers. The Brazilian company raised $400m in Q1 followed by another $750m in Q2, $500m of which coming from Warren Buffet’s conglomerate Berkshire Hathaway. The funding will be put towards international expansion and acquisitions, specifically focusing on the Mexican online banking market.

- Seven of the top 11 deals so far this year occurred in Q2, signaling that 2021 has positive momentum going forward. Q1’s growth was mainly fueled by the two deals from Robinhood, but the higher abundance of deals in Q2 shows promise that H2 2021 could continue this upward trend

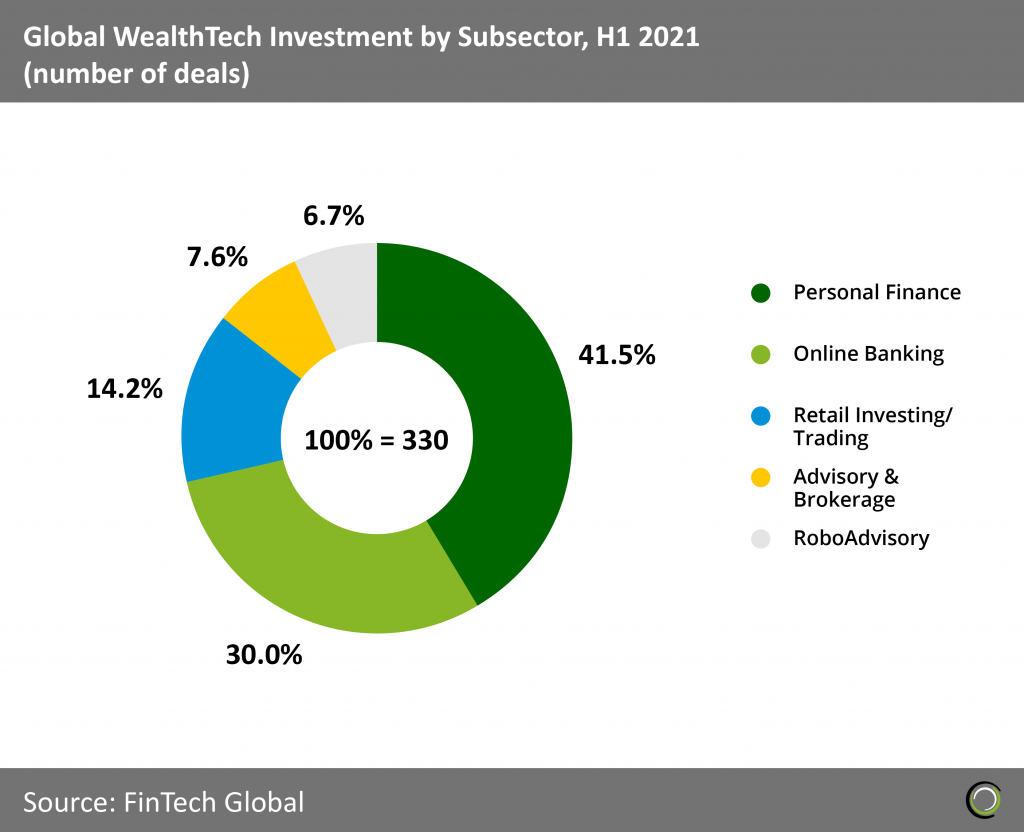

Personal Finance and Online Banking Subsectors comprise majority of total deal activity as younger generations pursue financial literacy

The Personal Finance and Online Banking sub-sectors make up 71.5% of WealthTech deal activity in H1 2021. This majority share of activity can partially be attributed to the younger generations’ push towards gaining financial literacy.

The Personal Finance and Online Banking sub-sectors make up 71.5% of WealthTech deal activity in H1 2021. This majority share of activity can partially be attributed to the younger generations’ push towards gaining financial literacy. - TikTok, a social media app in which users share videos and other content, has popularized the idea of becoming financially literate among its majority Millennial and Gen Z user base. Given TikTok’s rise in popularity since the onset of 2020, more investors and users alike have been drawn towards personal finance companies that are either advertised on the app or recommended on the platform through word of mouth.

- As a result of the Covid-19 pandemic, the stock market crashed, lockdowns were enforced globally, and many workers were either laid off or furloughed if not moved to a remote format. A study from UCLA shows that up to 52% of college workers had their jobs ended, with many more fresh graduates struggling to find opportunities to work. Subsequently, people flocked to personal finance apps to help better manage the financial burden of Covid-19 and start thinking about their financial future.

- The FinTech’s’ ease of use swayed younger generations to adopt these products and quickly utilize them daily, thus prompting investors to actively seek out more WealthTech investment opportunities.

- The combination of online banking making up five of the top 11 deals in H1 2021 and comprising 30% of all WealthTech investment by deal activity demonstrates that online banks are becoming more of the status quo as opposed to an “alternative means” to banking. The abundance of many small banks in addition to larger neo-banks coming into fruition shows that online banking is on the rise as the notion of digital banking on one’s phone continues to become more mainstream.

- Retail Investing/Trading comprised only 14.2% of all total deal activity. Despite companies such as Robinhood and Trade Republic driving massive investment at the top through mega deals, the sub-sector was not able to make up even half of the deal activity compared to its next closest category of online banking.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2021 FinTech Global

The share of deals $25m and above reached an all-time high in H1 2021, nearly 10 percentage points (pp) greater than that of 2020. Furthermore, the share of deals $50m and over in 2021 gained 6.4pp over 2020’s share, marking a new record. Companies that investors previously funded when they were in earlier stages are now maturing. Thus, these companies demand more funding and attention than smaller companies if investors want to continue to support their growth.

The share of deals $25m and above reached an all-time high in H1 2021, nearly 10 percentage points (pp) greater than that of 2020. Furthermore, the share of deals $50m and over in 2021 gained 6.4pp over 2020’s share, marking a new record. Companies that investors previously funded when they were in earlier stages are now maturing. Thus, these companies demand more funding and attention than smaller companies if investors want to continue to support their growth. As mentioned previously Robinhood completed the largest deal in H1 2021, raising $2.4bn from a convertible note. The funds raised was largely a result of the “meme stock” frenzy in which amateur investors flocked to pump GameStop and AMC among others in a short squeeze. The initial $1bn came when Robinhood needed to raise money in response to the rising demand for cash because of the trading spree, subsequently raising the additional $2.4bn from shareholders days later.

As mentioned previously Robinhood completed the largest deal in H1 2021, raising $2.4bn from a convertible note. The funds raised was largely a result of the “meme stock” frenzy in which amateur investors flocked to pump GameStop and AMC among others in a short squeeze. The initial $1bn came when Robinhood needed to raise money in response to the rising demand for cash because of the trading spree, subsequently raising the additional $2.4bn from shareholders days later. The Personal Finance and Online Banking sub-sectors make up 71.5% of WealthTech deal activity in H1 2021. This majority share of activity can partially be attributed to the younger generations’ push towards gaining financial literacy.

The Personal Finance and Online Banking sub-sectors make up 71.5% of WealthTech deal activity in H1 2021. This majority share of activity can partially be attributed to the younger generations’ push towards gaining financial literacy.