With the InsurTech sector continuing to hit record investment levels, FinTech Global has named the 100 most innovative InsurTech companies in its fourth annual list.

The InsurTech100 2021 is a ranking of the world’s most innovative technology solution providers that address the digital transformation challenges within insurance.

More than 1,400 companies, which was compiled by FinTech Global, were assessed and voted on by a panel of analysts and experts. Finalists were picked based on their innovative use of technology to solve a significant industry problem or generate efficiency improvements across the insurance value chain.

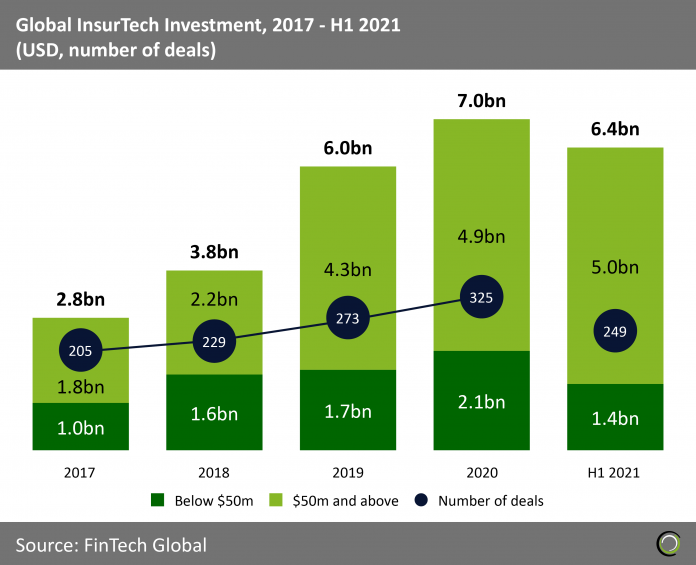

This year’s list comes at a time where investment into the InsurTech sector hits new heights. Despite the fears caused by the pandemic in 2020, demand for InsurTech companies was not impacted. The sector witnessed a new record level of funding, with a total of $7bn invested through 325 deals, according to data from FinTech Global.

The growth has not dwindled in 2021, as a new record is expected to be reached by the end of the year. In just six months, a total of $6.4bn has been invested through 249 transactions.

The growth has not dwindled in 2021, as a new record is expected to be reached by the end of the year. In just six months, a total of $6.4bn has been invested through 249 transactions.

With the pandemic forcing more people online, InsurTech companies were able to capitalise on the interest. The global InsurTech market is now expected to grow at a CAGR of 34.4% and be worth $119.4bn by 2027, according to data from Valuates Reports, a market research company.

FinTech Global director Richard Sachar said, “Consumers and businesses increasingly expect insurance cover to be offered via a range of digital and offline channels, and insurers that fail to keep up with the latest technologies and innovation will be less competitive and lose market share over time.

“The InsurTech100 list helps senior decision-makers in the industry filter through all the vendors in the market by highlighting the leading companies in sectors such as underwriting, pricing, IoT devices, distribution and data & analytics.”

With such fierce competition in the market, the InsurTech100 hopes to highlight those leading the space.

Many of the companies to have featured in this year’s list have recently hit the headlines. Among them is Earnix, an AI-powered pricing and product personalisation platform for insurance and banking, which entered the unicorn club in February. The InsurTech company reached the $1bn valuation after it closed a $75m growth funding round, which was led by Insight Partners.

This is not the only big story from the company this year. The InsurTech recently acquired AI telematics provider Driveway Software’s assets to scale up its Usage-Based Insurance (UBI) and Behavior-Based Insurance (BBI) solutions.

Another one of the InsurTech100 to have featured in the news a lot lately is Life.io, a returning member of the list. Life.io is a provider of customer engagement technology that helps insurers accelerate the development of their end- to-end digital client experience. The InsurTech company recently helped Barbadian financial and insurance business Sagicor launch a digital engagement platform for clients. Similarly, Life.io supplied American insurance company Pacific Life with tools to implement end-to-end customer origination, engagement and service experience.

Greater Than, which also returns in this year’s list, has also had a busy year. It offers real-time data analytics that predicts driver-related accidents and CO2 emissions helping motor insurance and mobility decrease fatalities and carbonisation. In February, it completed a $16m share issue to long-term shareholder Cuarto, a subsidiary in the Nidoco group. It also extended a deal with Zurich and Onto to improve auto insurance and improve road safety.

Partnerships are becoming a common sight within the InsurTech sector. InsurTech100 member Majesco is no stranger to them. It has signed countless deals over the past year, including one with global health service company Cigna. The deal sees it help the company implement digital services to meet the needs of customers. Majesco is a leading SaaS software provider for P&C and L&A insurance markets to modernize, optimize and innovate their businesses at speed and scale.

Insuritas, which offers embedded P&C insurance agency solutions for financial services providers in the US, has also signed several agreements this year. It recently helped Martha’s Vineyard Bank launch an insurance agency for its customers, and empowered UNIFY Financial Credit Union to offer insurance brokerage services.

Not only were partnerships common with the InsurTech100 finalists, but so were funding rounds. Several companies listed in this year’s report have closed fresh equity rounds. Ushur, an AI-powered Customer Experience Automation™ platform, raised $5m in its Series B earlier this year. Relay Platform, which claims to be the first agnostic quote-bind-issue platform for brokers and underwriters, received $5.2m in seed funding, and ThingCo, a next-generation telematics product developer serving both B2C and B2B insurance markets, collected $4.2m in equity.

Qumata, which helps Life & Health insurers streamline their underwriting process, allowing applicants to avoid lengthy questionnaires by sharing their digital data, also raised capital this year. Alongside the close of the $10m Series A, was a rebranding from its former name HealthyHealth.

Some of the other companies to make this year’s InsurTech100 list are: AdvantageGo, a provider of commercial (re)insurance management solutions; AkinovA, a neutral digital marketplace to transfer and trade insurance risks; CelsiusPro, which helps mitigate effects of adverse weather, climate change and natural catastrophes; Companjon, a flexible add-on insurance provider; EIP, a plug & play digital marketplace for subscription insurance; iPipeline, a content-based digital solutions for life insurance; and NeuralMetrics, an AI-driven customer lifecycle solution developer.

Other notable mentions are Pinpoint, which offers leverages behavioural economics to improve carriers’ ability to predict key insurance outcomes; Quantiphi, which helps insurers with data transformations and custom AI solutions; Sure, an SaaS infrastructure and robust APIs service for embedded insurance; and Wakam a digital B2B insurer that builds solutions for all types of distributors.

The full InsurTech100 list, which can be downloaded for free, can be found at www.TheInsurTech100.com

Copyright © 2021 FinTech Global