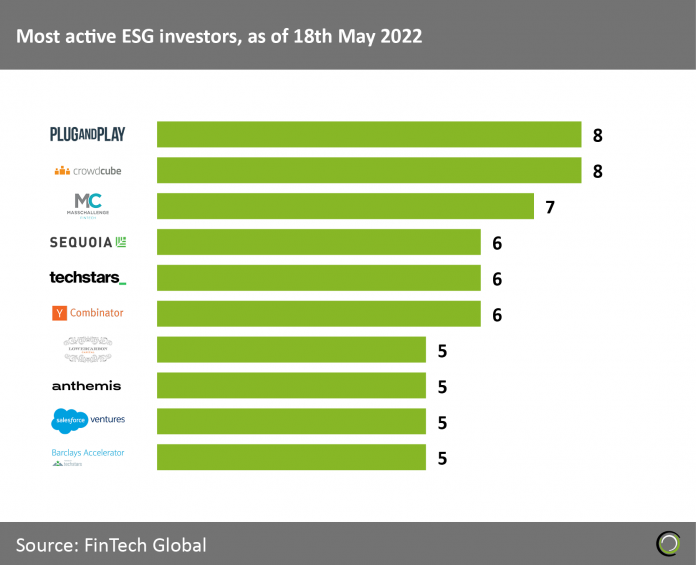

- Plug and Play Tech Center, an early stage investor, accelerator, and corporate innovation platform, and Crowdcube, an investment crowdfunding platform, were the most active ESG investors, each investing in eight ESG companies as of 18th May 2022. Plug and Play Tech Center have identified three sustainability accelerator focus areas and these include plastics, carbon neutrality and fashion. Crowdcube saw the amount invested on their platform in cleantech and sustainability-focused businesses more than quadruple from 2018 to 2021, with over ?34 million raised in 2021.

- Notably Lowercarbon Capital funds research and invests in technologies to reduce CO2 and were seventh on the list with five ESG investments. Lowercarbon Capital raised $800m in August 2021 and states that the Earth has warmed by 1.2 ?C directly from greenhouse gasses but there have been critical advances in carbon reducing technologies that have only just become capable of massive scale. This coupled with directives from governments all around the world towards net-zero creates a very attractive return on investment for Lowercarbon.

- VC activity in the ESG sector has strong growth across all major regions, with North America and Europe investment activity more than doubling in 2021 while Asia grew 61.5% YoY in 2021. Mastercard also issued a report which stated that venture funds deployed approximately 2.5 times more equity into ESG-related FinTechs in 2020 relative to what they invested in 2019 (from $700m to $1.8bn).

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global.??2022 FinTech Global